Key events in developed markets next week

The instability of markets has failed to rattle the rate hike forecasts in developed markets such as the US and the UK. Industrial production and retail sales data will fail to direct markets as they will not reflect the latest war developments

US: Fed will stick to its rate hike path this week

The US Federal Reserve is set to raise interest rates this week with the consensus firmly settled on a 25bp move after Fed Chair Jerome Powell stated that is what he would propose and support. It may not be a unanimous decision with a strong likelihood that two Federal Open Market Committee members will vote for a more aggressive 50bp hike given inflation is already close to 8% and is soon set to test 9% at a time when the economy is growing and creating jobs in significant number. However, the uncertainty created by Russia’s invasion of Ukraine is likely to lead to the majority of the committee backing Powell’s motion. They will also be releasing their updated dot plot diagram of individual projections for interest rates. Currently, the median is for three 25bp rate hikes in total by year-end, but it is likely to end up being much closer to the six hikes markets are fully discounting after this update. However, the Fed is likely to emphasise a need to be “nimble” given the uncertain geopolitical backdrop while acknowledging that the surge in commodity prices not only poses an upside risk for inflation, but also a downside risk for growth.

In terms of the economic data, we will be following retail sales and industrial production. Autos sales fell by around 7% in February so this is quite a big drag that will mean overall positive growth will be difficult to achieve. Nonetheless, even if sales are flat on the month, the total value of retail spending is still going to be 24% higher than in February 2020 when Covid hit. We expect a greater weighting of spending to move towards services in coming quarters, but with household finances looking solid and wages rising this does not mean we expect retail sales to fall. Industrial production will be interesting given the surge in oil and gas prices. Rig counts are rising in response and the government is likely to become increasingly willing to permit drilling, to ease the financial pain for households and businesses.

UK: Bank of England to plough on with rate hikes despite fresh uncertainty

Markets have concluded that the higher energy prices that have resulted from the war in Ukraine will see the Bank of England double-down on its tightening plans. In the short-term investors are probably correct in that we’d expect the Bank to hike rates for the third time next week, and probably again in May. Policymakers have made it abundantly clear that they want to get some pre-emptive tightening done to mitigate against their concerns about higher inflation rates becoming more sustained.

However, we suspect the Bank will opt for another 25bp rate rise this week, rather than a larger 50bp move. While four out of nine policymakers voted for such a move back in February, the remainder of the committee indicated that they worried such a move would simply add further fuel to market interest rate expectations. Markets are once again pricing six rate rises this year, and comments from officials have offered some modest pushback against these expectations.

Our own view is that after a couple more hikes, the committee is likely to pause and put greater emphasis on the deteriorating growth backdrop. After all, such a sharp rise in oil and gas prices is more likely to be medium-term disinflationary, even if it keeps headline inflation rates higher this year.

Eurozone: Data releases won’t paint an accurate picture with ongoing uncertainty

Next week’s eurozone data will be about industry, but only cover January and February. With economic developments so driven by the war in Ukraine at the moment, these production and trade figures will be of little help to give direction to markets. Some information to be taken from them is that industrial production in January likely continued its rise thanks to a German rebound. So manufacturing was showing strength ahead of the war. The trade data out on Friday is nominal and currently dominated by commodity price developments, hardly relevant for the outlook. For direction on the eurozone economy, look to geopolitical and market developments at the moment.

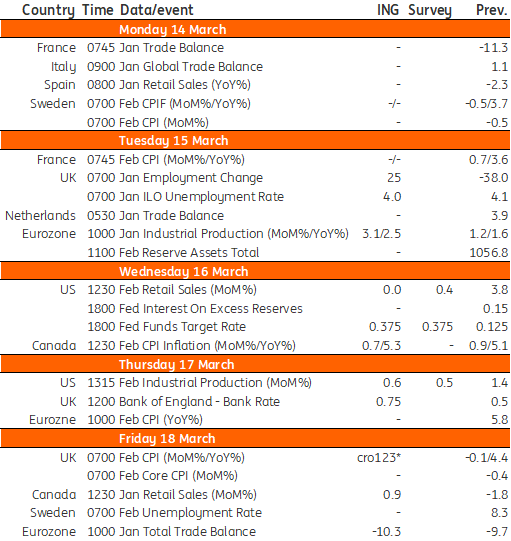

Developed Markets Economic Calendar

Download

Download article11 March 2022

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more