Key events in developed markets next week

How strong will the slowdown of the German economy be? Will the US keep up the positive growth momentum?

US to keep up positive growth momentum

In the US the main data releases to watch will be retail sales and industrial production. With regards the former, bad weather played a part in negative January and February readings, which were always going to struggle after the post hurricane spending splurge seen in 4Q. March saw a rebound and we look for the positive momentum to continue to April as tax cuts and a strong jobs market buoy confidence and spending.

Gasoline station sales will contribute positively due to price rises while autos will be a drag given volume numbers already released – again a payback from the post hurricane surge. Industrial production should also be firm with oil and gas output stimulated by price gains while manufacturing surveys report strong order books, which should keep production firm. As such the strong growth story remains intact and with inflation creeping higher we are sticking to our view of three further rate hikes in 2018.

UK wage growth in focus as Bank of England mulls summer rate rise

We are inclined to think the market reaction to the May Bank of England meeting was a little extreme. The Bank was surprisingly adamant that it believed the first quarter slowdown to be temporary (albeit policymakers appear to be a little more wary about the household story), and it remains confident that wage growth is on the right track. BoE Agents have indicated that business contacts are increasingly having to boost pay, perhaps at the fastest rate since the crisis, and we should get further evidence of this next week. With regular pay growth set to remain at a near-three year high, we think markets may be underestimating the chances of a rate hike this year – and we maintain that August is probably the most likely opportunity.

Economic slowdown in Germany

Tuesday will be the big GDP Day for the entire Eurozone, with the Eurostat release of all first quarter GDP data. While the first estimate for the entire Eurozone already showed a growth slowdown previously, German data is still a black box. All available monthly data points to a slowdown of the German economy, the only question being how strong or mild will it be.

Norwegian GDP and Swedish housing

In Norway, 1Q18 GDP data on Wednesday is the key event next week. We expect 0.5% QoQ growth, slightly weaker than 4Q17. This would be also be a touch below Norges Bank’s forecast of 0.6%, which could increase uncertainty about the central bank’s plan to raise interest rates in September.

In Sweden, house price data for April on Thursday will be closely watched to see whether the housing market continues to stabilize.

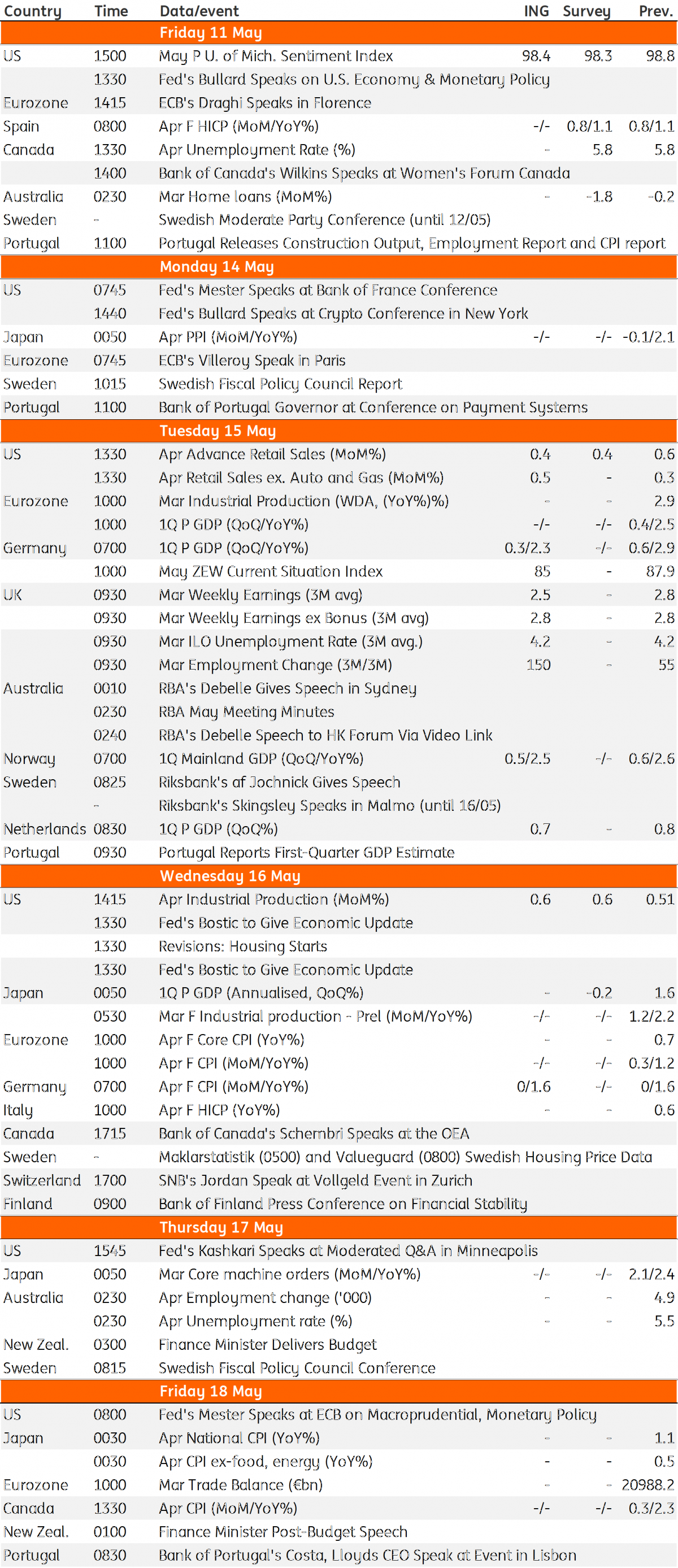

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

10 May 2018

Our view on next week’s key events This bundle contains 3 Articles