Key events in developed markets next week

Next week is likely to confirm market expectations for US rates are slightly overblown, ongoing Brexit uncertainty will carry on hurting the UK economy and sluggish eurozone industrial production doesn’t look like it is coming out of this phase anytime soon

Focus on trade war as Fed rate cut expectations build

The clock is slowly counting down to the G20 meeting in Japan, where President Trump has said he will make his decision on whether to press ahead with additional tariffs on Chinese goods. Fears of further action have pushed markets to price in over four rate cuts by the end of 2020. While we think these expectations may be slightly overblown, we see risks facing the US economy are clearly building.

For the time being though, the economic fundamentals look fairly solid. Consumer spending is likely to rebound strongly after a more subdued April, given the tight jobs market and mounting wage pressures. Inflation looks set to dip back slightly below target following the modest decline in gasoline pump prices over the past month.

UK leadership contest officially gets underway

The first stage of the Conservative leadership contest will get underway in earnest next week, with the wide field of candidates set to argue their case at a series of hustings events. Reports suggest that the candidates will begin to be whittled down from late next week in a series of votes, with a view to getting down to the final two in a couple of weeks’ time.

All the while, the economy is continuing to take the hit from the ongoing uncertainty. April GDP is likely to be more or less flat, dragged lower by a fall in production (which is slowing as firms grapple with what to do about elevated inventory levels). Similarly, jobs growth is likely to remain fairly sluggish, although recent PMI surveys have hinted that the temporary dip in uncertainty may be helping to unfreeze some hiring decisions. The key thing for the Bank of England though is wage growth. While likely to be a touch lower in next week’s report, it is still close to post-crisis highs. We don’t expect a BoE rate hike this year, but this latter point on cost pressures has led to some hawkish comments from policymakers. This suggests a November move can’t be 100% ruled out just yet.

Eurozone industry - things don't seem to be changing

Eurozone industrial production has been sluggish for quite some time now and it doesn’t look like this will change anytime soon. The downward trend is unlikely to have been broken in April as activity surveys have remained subdued and German production data also came in very negatively.

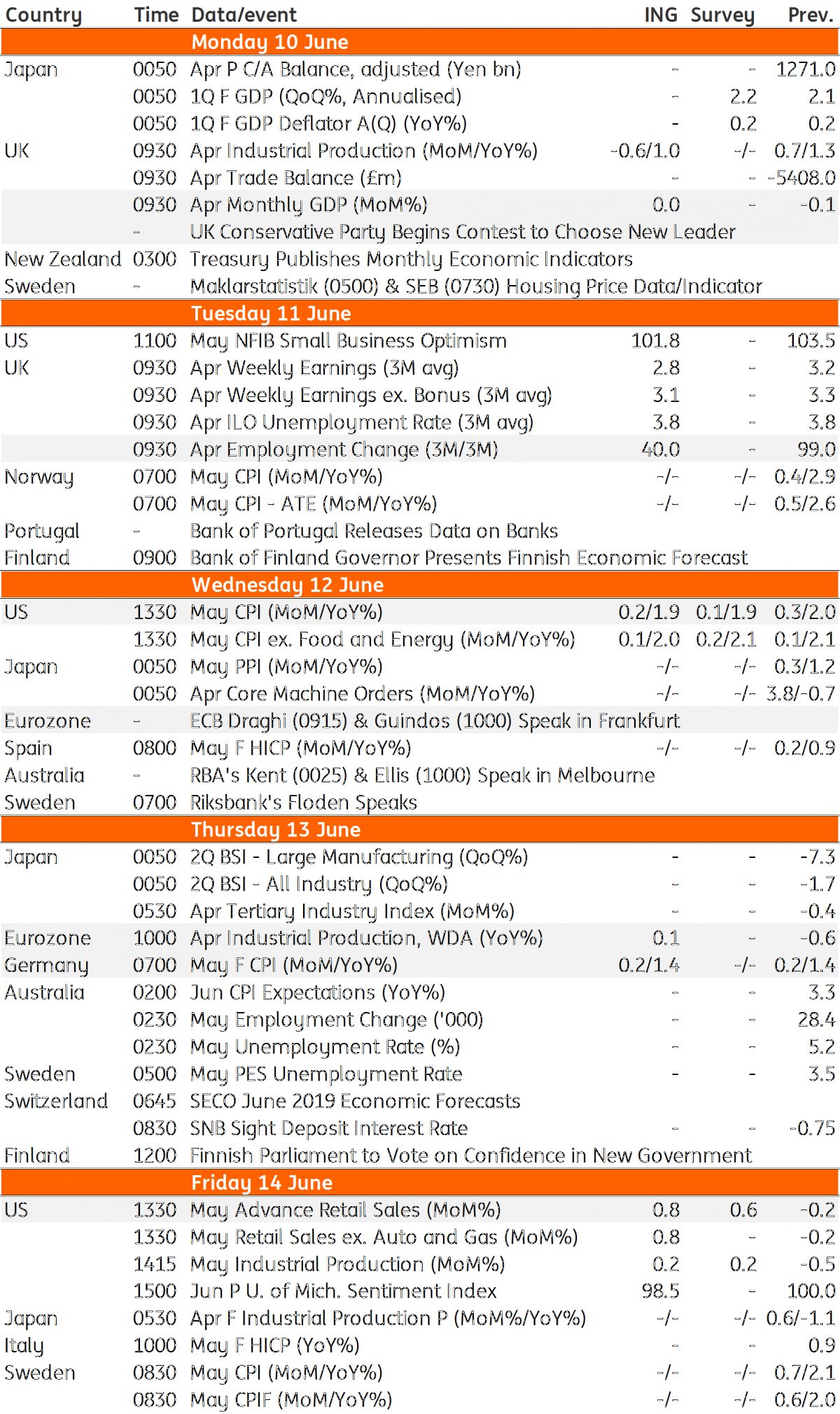

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

7 June 2019

Our view on next week’s key events This bundle contains 3 Articles