Key events in developed markets next week

The Fed will continue with 50bp rate hikes throughout this year despite the fall in CPI figures expected next week. However, the lack of activity in the UK may put a dent in the Bank of England's plans

US: Inflation may be past its peak

Consumer price inflation is the key number out of the US next week and it should hopefully show inflation has passed the peak with the year-on-year rate slowing from 8.5% to 8.3%, and core inflation edging down to 6.1% from 6.5%. Lower gasoline prices will be a big help, as will a drop in second-hand car prices as heralded by data from the Mannheim car auctions. However, it will be a long slow descent to get to the 2% target. China’s zero-Covid strategy will continue to pressure supply chains as production and distribution of inputs remain disrupted. Geopolitical tensions add to the problems, while the incredibly tight labour market is also putting upward pressure on wages and labour costs more broadly. In an environment of strong corporate pricing power, these costs are being passed onto customers, meaning inflation will be sticky and slow to fall. As such, the Fed will continue to hike rates swiftly with 50bp rate hikes expected in June, July and September.

Consumer confidence will also be published by the University of Michigan and equity market weakness coupled with anxiety over the rising cost of living looks set to keep sentiment subdued.

UK first quarter bounce to mask weaker performance in March

A strong bounce in UK activity during January should be enough to put in a quarterly growth figure just shy of 1%. But this masks less exciting performance as the quarter went on, and we expect the monthly GDP figure for March to show no growth in economic activity overall. Retail sales fell for the second consecutive month, while health output probably fell again ahead of the end of free Covid testing at the end of that month. That latter factor, combined with early signs of the cost of living squeeze, as well as an extra bank holiday, suggest we should brace for a negative second-quarter GDP figure and indeed weak activity for the rest of 2022. Increasing concerns surrounding growth likely means the Bank of England will hike fewer times than markets expect this year. We expect further increases in June and August before the committee presses the pause button.

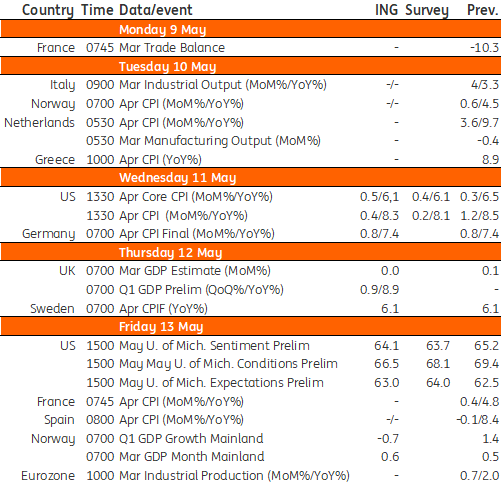

Developed Markets Economic Calendar

Download

Download article6 May 2022

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more