Key events in developed markets next week

After four consecutive 75bp hikes, the Federal Reserve will likely look to slow the pace of rate hikes from December. The key US data release next week is month-on-month core CPI, which we expect to be 0.5%. Other releases of note include consumer credit and confidence data, however these are shadowed by the mid-term elections on Tuesday

US: Mid-term elections in focus

Federal Reserve chair Jerome Powell has successfully brought the market on board with the notion that while the central bank will likely look to slow the pace of rate hikes from December after four consecutive 75bp moves, the terminal interest rate will likely end up being higher than what it signalled back in September. Nonetheless, this will depend on the data flow. If inflation and job numbers continue to come in on the strong side it may be that officials end up doing a fifth 75bp. Given this uncertainty, markets are currently pricing around 58bp for the December meeting and 42bp for February, with a final 25bp hike coming at some point in the second quarter.

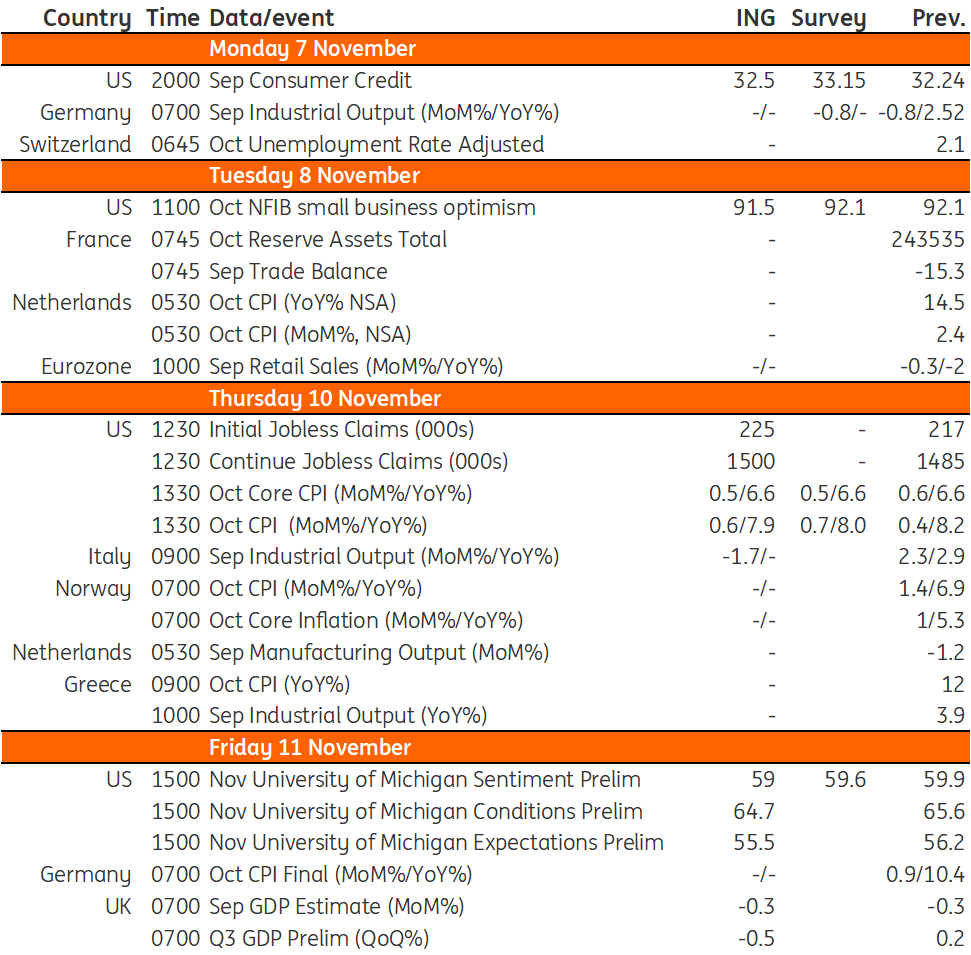

Next week’s data will be important, but not critical in determining the path forward. The key release is the consumer price index with the focus within that being the month-on-month core (ex-food and energy) number. Over the past six months, we have had one 0.7%, four 0.6% and one 0.3% print. We need to see numbers closer to 0.2% to bring the annual rate down toward the 2% target over time. The consensus right now is for 0.5% next week, which is also our prediction. There is a second bite of the cherry ahead of the December FOMC meeting on 14 December given November CPI is published on 13 December. Nonetheless, if we get a downside surprise we could see markets looking to price in a greater chance of a 50bp December hike and possibly a slightly lower terminal rate.

Other data includes consumer credit and consumer confidence along with small business optimism. However, these will be overlooked given the mid-term elections on Tuesday. Opinion polling appears to show momentum is building for Republican party candidates with a majority in both the House and the Senate now looking like the most likely outcome. We have written up a scenario analysis of the possible outcomes, but essentially if the Republicans gain control of Congress, President Joe Biden’s ability to pass legislation will be severely curtailed. Indeed, there is far less probability of any fiscal support for the economy through the recession than if the Democrats retained control of Congress given Republicans will look to block it. Consequently, if the Democrats lose then it is more likely that we will see interest rate cuts in the second half of 2023 to provide the stimulus to help the economy rebound, rather than if they win where fiscal policy would likely do more of the heavy-lifting and interest rates stay higher for longer to offset any inflation impulse.

Key events in developed markets next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

USDownload

Download article

4 November 2022

Our view on next week’s key events This bundle contains 3 Articles