Key events in developed markets next week

Bank of England expected to hold whilst US data puts the Fed on course for a June rate hike, but what else is going on in developed markets next week?

Federal Reserve: On course for June

The positive write-up on the US economy within the Federal Reserve’s FOMC statement coupled with firm inflation readings that have been posted over the past month (look for another rise in CPI this week) all point to a June interest rate rise.

Another strong April jobs report, seeing unemployment fall to a new 18-year low and wages remaining on a gradual upward trend should reinforce those market expectations, which currently give it a 90% chance of happening. It would also offer support to our own forecasts of two additional hikes after the June move. The commentary from Federal Reserve officials suggests a growing sense that tighter monetary policy is required and we expect this message to continue given several regional Fed President and Governors are slated to speak.

Bank of England set to buy itself time as consumer worries mount

Market expectations for a May rate hike have collapsed since Governor Carney sounded the alarm a couple of weeks ago. It now looks likely that the Bank will hold fire next week as concerns about the consumer reach a new level. By some measures, retailers have faced the worst quarter since the financial crisis, as the real income squeeze toxically combined with higher business rates and minimum wage rises. Worryingly, consumer credit has also since collapsed, as banks seek to reduce loan availability.

Whilst this might prove to be a blip, we suspect the Bank’s preference is to buy time to see how things play out. But barring a further deterioration in retail space, we suspect the BoE’s preference is still for tighter policy as wage growth continues to show signs of life. We think an August rate hike is still likely – after all, the window to tighten policy could close fairly rapidly over the summer, as Brexit talks head for a noisy conclusion later in the year.

Attention on German industrial data after a disappointing first two months

Hard economic data in the first two months of the year were a disappointment in Germany. Therefore, the entire batch of industrial data for March should get more attention than usually. Even though slightly distorted by the Easter break, industrial production should rebound significantly. If not, “Berlin, we got a problem” could quickly become a real possibility for Germany’s economic outlook.

Inflation in focus for Scandinavia

In Scandinavia, the week’s key data will be Norwegian and Swedish inflation figures on Wednesday. While Easter effects will muddy the waters somewhat, we’re looking for solid headline figures (2.3% and 1.7% respectively) as energy price increases feed through. But core inflation in both Norway and Sweden is likely to remain some way below 2%.

Also worth watching is the Riksbank minutes released on Tuesday morning. The central bank’s dovish stance combined with weak data has led to a marked depreciation in SEK since February, so further clues on policy-makers views could be important for the currency market.

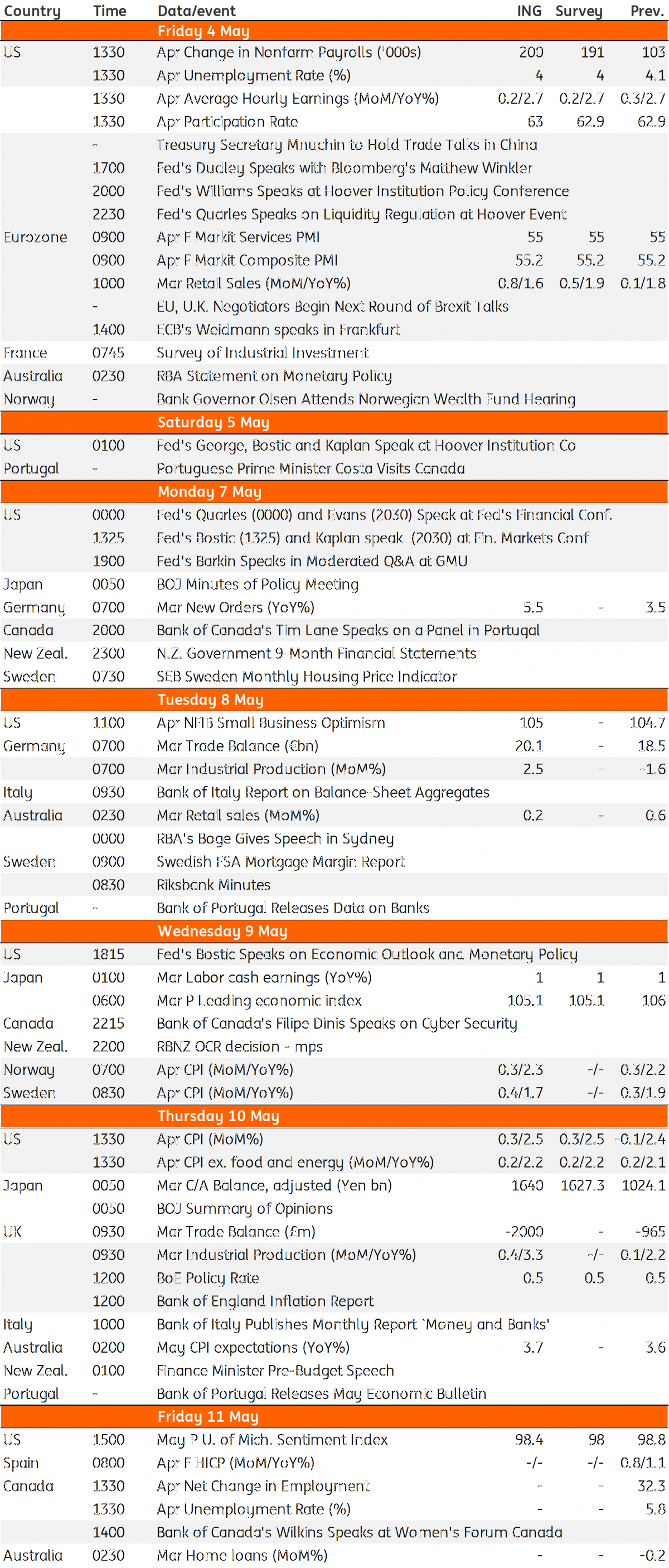

Developed Markets Economic Calendar

Download

Download article3 May 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more