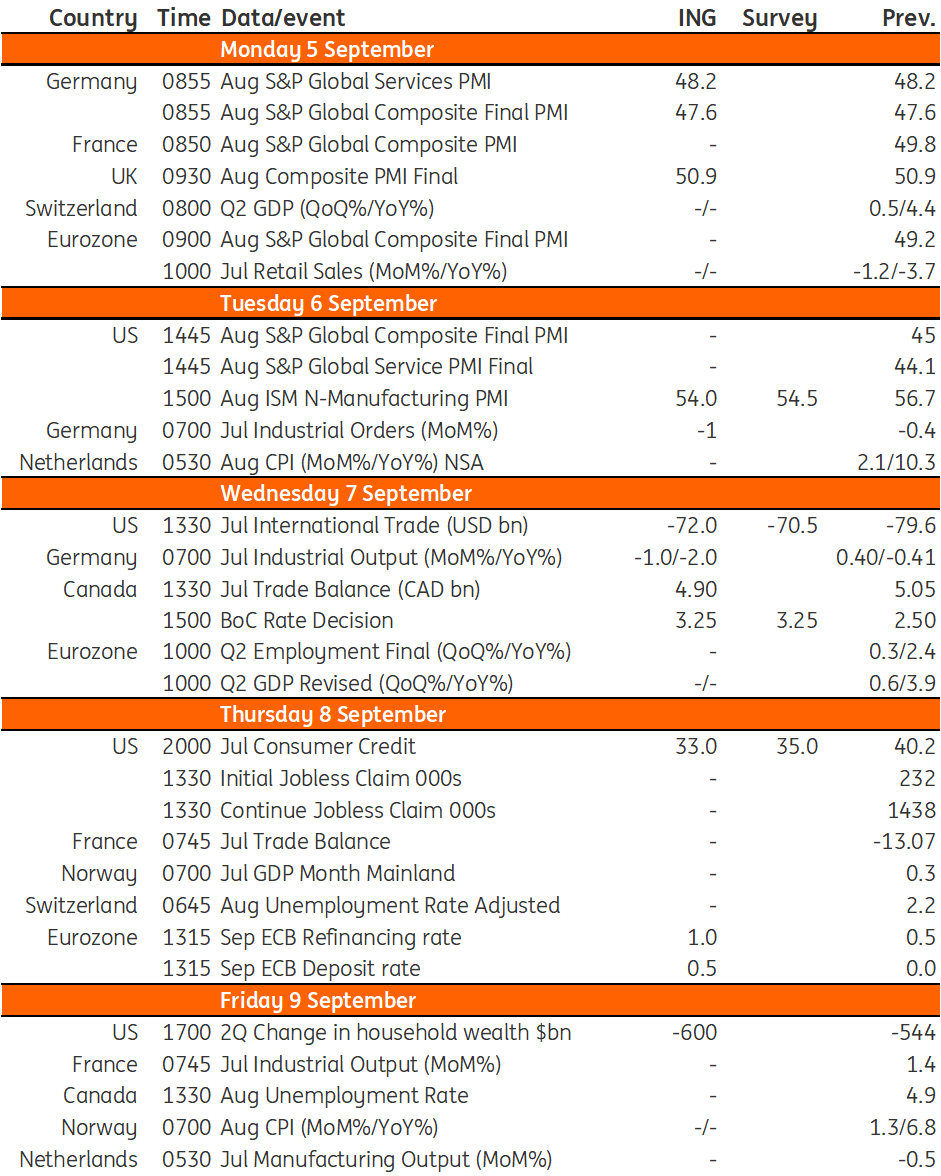

Key events in developed markets next week

Despite headline inflation at a new record high and multiple hawkish comments by European Central Bank members, we are expecting the ECB to ‘only’ hike by 50bp next week. In Canada, with excess demand causing inflation to remain well above target, we expect the Bank of Canada to opt for a 75bp hike on Wednesday

US: Focus next week will be Powell's comments on monetary policy

Markets continue to favour a 75bp rate hike from the Federal Reserve on 21 September despite the economy having been in a technical recession since the first half of the year. With more than three million jobs added since the start of 2022, consumer spending continuing to grow, and inflation running at more than 8%, it is hard to argue this is a “real recession” with the fall in GDP instead down to volatility in trade and inventory data which continues to swing wildly due to ongoing supply chain issues.

Monday is a holiday and the data calendar is light so instead we will be focusing on Federal Reserve Chair Jerome Powell’s comments at a conference on monetary policy next Thursday. With the Fed’s “quiet period” ahead of the 21 September FOMC meeting set to kick in the following weekend, it will be the last opportunity he has to shift market expectations. We expect him to talk up the need to act forcibly to get a grip on inflation. Moreover, with core inflation set to rise from 5.9% to 6.1% on 13 September, we agree that a 75bp hike is the most likely outcome.

UK: New prime minister to face immediate test as energy bills climb

The new UK prime minister will finally be announced on Monday, and Foreign Secretary Liz Truss is widely expected to beat Rishi Sunak to be Boris Johnson’s successor. Markets will be looking at two key areas in the first few days of the new leader.

First, extra government support for households and businesses amid soaring energy costs seems inevitable – the question is what form it will take. Truss has said during her campaign that her preference is for tax cuts, though the sheer scale of the energy bill increase anticipated by early next year suggests this is unlikely to be sufficient. Most households will be paying more than 10% of their income on energy in the 12 months from October, which is when the next big increase in bills kicks in. That suggests blanket support payments (or a price cap of some form), in addition to more targeted measures for low-income households, will be required – as will similar support for smaller businesses. Markets are increasingly assuming this will translate into extra Bank of England rate hikes. We agree with that assessment, even if markets are heavily overestimating the scale of tightening that’s likely to be required.

Second, Brexit is expected to come back to the fore. Truss is pushing for the passage of the Northern Ireland Protocol Bill, which would enable ministers to unilaterally override parts of the deal agreed with the EU in 2019, and has already passed through the House of Commons. Press reports also suggest Truss is considering triggering Article 16, which in theory allows either side to take safeguard measures if elements of the Northern Ireland agreement aren’t perceived to be working. This story is not likely to be a fast-moving one, but ultimately a unilateral move by the UK to overwrite parts of the deal could see Brussels suspend the UK-EU trade deal, which it can do with 9-12 months' notice.

Canada: Bank of Canada expected to hike rates by 75bp next week

Next week will see the Bank of Canada hike rates by 75bp after a 100bp hike in July. Inflation is well above target and the economy is growing strongly, and with the BoC having openly talked of the need to front-load policy tightening we do not expect it to switch back to more modest 50bp incremental changes just yet. Read our full BOC preview

Eurozone: ECB to implement another 50bp hike; 75bp not ruled out

Even if the ECB doves have been very silent in recent weeks, we expect the ECB to ‘only’ hike by 50bp next week. This would be a compromise, keeping the door open for further rate hikes. A 75bp rise looks like one bridge too far for the doves but cannot be excluded. Further down the road, we can see the ECB hiking again at the October meeting but have difficulties seeing the ECB continue hiking when the eurozone economy is hit by a winter recession. Hiking into a recession is one thing, hiking throughout a recession is another. Read our full ECB preview

Key events in developed markets next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

2 September 2022

Our view on next week’s key events This bundle contains 3 Articles