Bank of Canada preview: we expect a 75bp hike

While there are signs that activity may be slowing and inflation is peaking, there is a long way to go before inflation gets close to target. With excess demand still a clear concern for the Bank of Canada (BoC), we expect a 75bp hike. A hawkish BoC should ultimately help a CAD recovery, but that should take time to materialise

Mixed data, but inflation backdrop suggests more tightening

The Bank of Canada surprised markets with a 100bp rate hike at the July policy meeting as it sought to “front load the path to higher interest rates”. It suggested that "interest rates will need to rise further" with the central bank "resolute in its commitment to price stability".

Since 13 July, the data has been a little mixed. Second-quarter GDP came in below expectations at 3.3%, but consumer spending rose 6.9% annualised with non-residential investment up 13.9%. It was a 30.5% surge in imports and a 27.6% drop in residential investment that held back growth.

The residential story is obviously a worry while the fact employment has fallen for two consecutive quarters is also a slight concern. However, we see the loss of jobs as a temporary blip and the strength in domestic demand still points to an upward trend in employment activity.

Moreover, the BoC will be concentrating on the strength in consumer demand and the fact inflation remains way above target at 7.6% with core inflation above 5%. Remember that the BoC suggested the economy is experiencing excess demand and has repeatedly warned that elevated inflation expectations heighten the risk that “inflation becomes entrenched in price and wage-setting. If that occurs, the economic cost of restoring price stability will be higher”.

Given this situation, we expect the Bank of Canada to opt for a 75bp interest rate hike next Wednesday. This would leave the policy rate at 3.25%, which is above the “neutral rate”, assumed to be 2-3% by the Bank of Canada. We don’t think it will stop there given a desire to make positive restrictions to ensure inflation gets back to target. We expect a further 75bp of hikes by year-end.

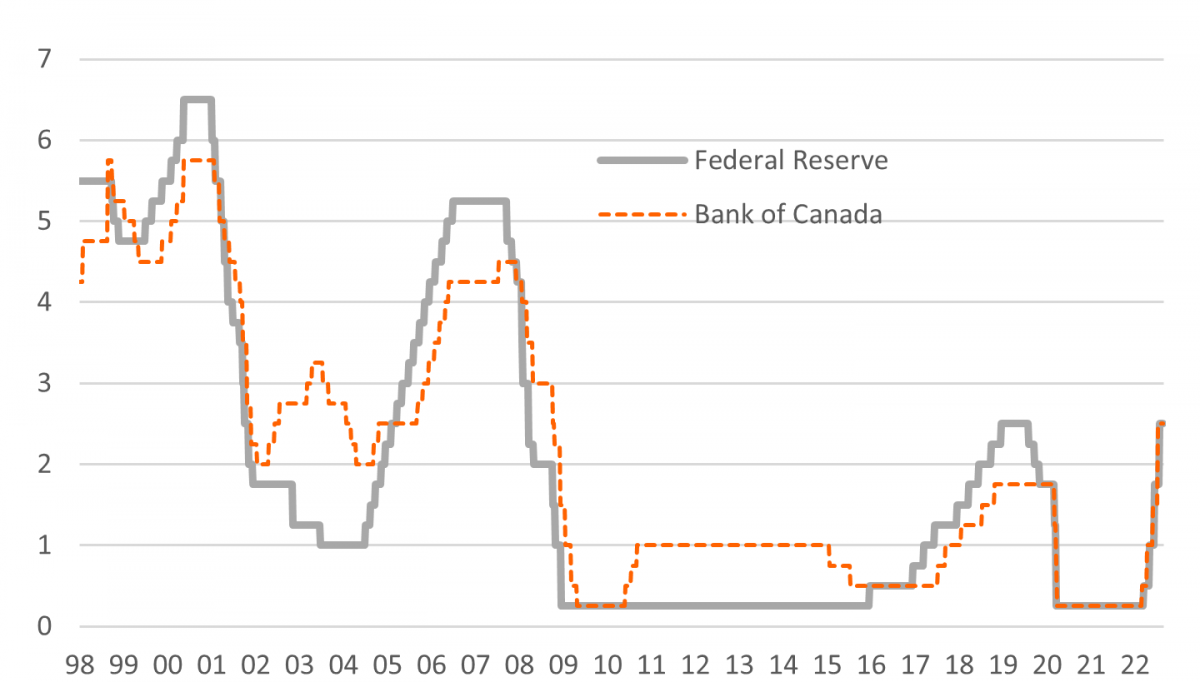

The Fed and BoC have historically moved in tandem

FX: Good news for CAD, but more time is needed to recover

The OIS market shows that a 75bp hike in September by the BoC is fully priced in, which suggests CAD should not directly benefit from the move on the day of the announcement. The market reaction will instead depend on forward-looking language by the BoC.

Market pricing currently implies 50bp of extra tightening by year-end, which is below our expectations for 75bp. Furthermore, a Fed-style protest against any rate cut expectations for 2023 cannot be excluded and would have positive implications for CAD. In other words, there is decent potential for a repricing higher in BoC rate expectations.

We do see a hawkish 75bp hike supporting CAD on the day of the announcement, but most of the benefits of the BoC tightening for the loonie may take time to emerge, and would likely rely on stabilisation in global risk sentiment and some easing in USD strength. This could start to happen towards the end of the year, and still, high energy prices do suggest that a move to 1.25 in early 2023 is a tangible possibility.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more