Key events in developed markets next week

The developed markets this coming week are expected to be relatively steady given that the outcome of the trading war is still ambiguous

Fed's guidance to provide calm?

If it wasn’t for the concerns on global trade we would likely see market expectations for US interest rates be significantly higher than they currently are. After all, the US economy looks set to have grown by an annualised 4% in 2Q18 while inflation looks set to breach the 3% level next month. At the same time the US is experiencing its strongest jobs market for around 50 years.

Nonetheless, the uncertainty that protectionist measures creates poses clear risks for investment and hiring in coming quarters, hence the markets’ caution. As such, the tone of the Federal Reserve’s semi-annual monetary policy report to Congress will be of huge importance to gauge the likely path of policy in the second half of the year. We expect it to suggest that the market is probably right to expect two further 25bp rate rises this year. In terms of US data the focus will be retail sales and given the strength in the jobs market and the robust readings for consumer confidence we expect the spending numbers to be strong.

Calming atmosphere in the Eurozone could be clouded by the looming trade war

It will be very calm in the Eurozone and Germany ahead of the upcoming ECB meeting. In light of the recent escalation of the trade war, Eurozone trade numbers should get somewhat more attention than normally.

Cooling UK inflation unlikely to throw BoE off course in August

It’s a big week for UK data, and it kicks off with the jobs report where the key story is likely to be a slowdown in wage growth. Admittedly this is partly down to base effects, but the underlying momentum also seems to have slipped over recent months. This tallies with the slightly more muted earnings outlook in the latest BoE Agents report. There’s also a risk that core CPI slips back to target (although we narrowly think it will stick at 2.1% for now), which also implies inflationary pressures are not getting out of hand at this stage.

None of this is likely to stop a rate hike in August – barring another flare-up in the politics around the time of the meeting. The economic data has been solid enough to support the Bank’s forecasted 2Q rebound. That’s likely to emphasised by robust retail sales figures next week.

But lower inflation is another reason why the Bank is likely to move fairly slowly on rate rises. We expect the Bank to hike rates again in August, but with Brexit likely getting increasingly noisy, we currently don't expect the Bank to hike rates again before May 2019.

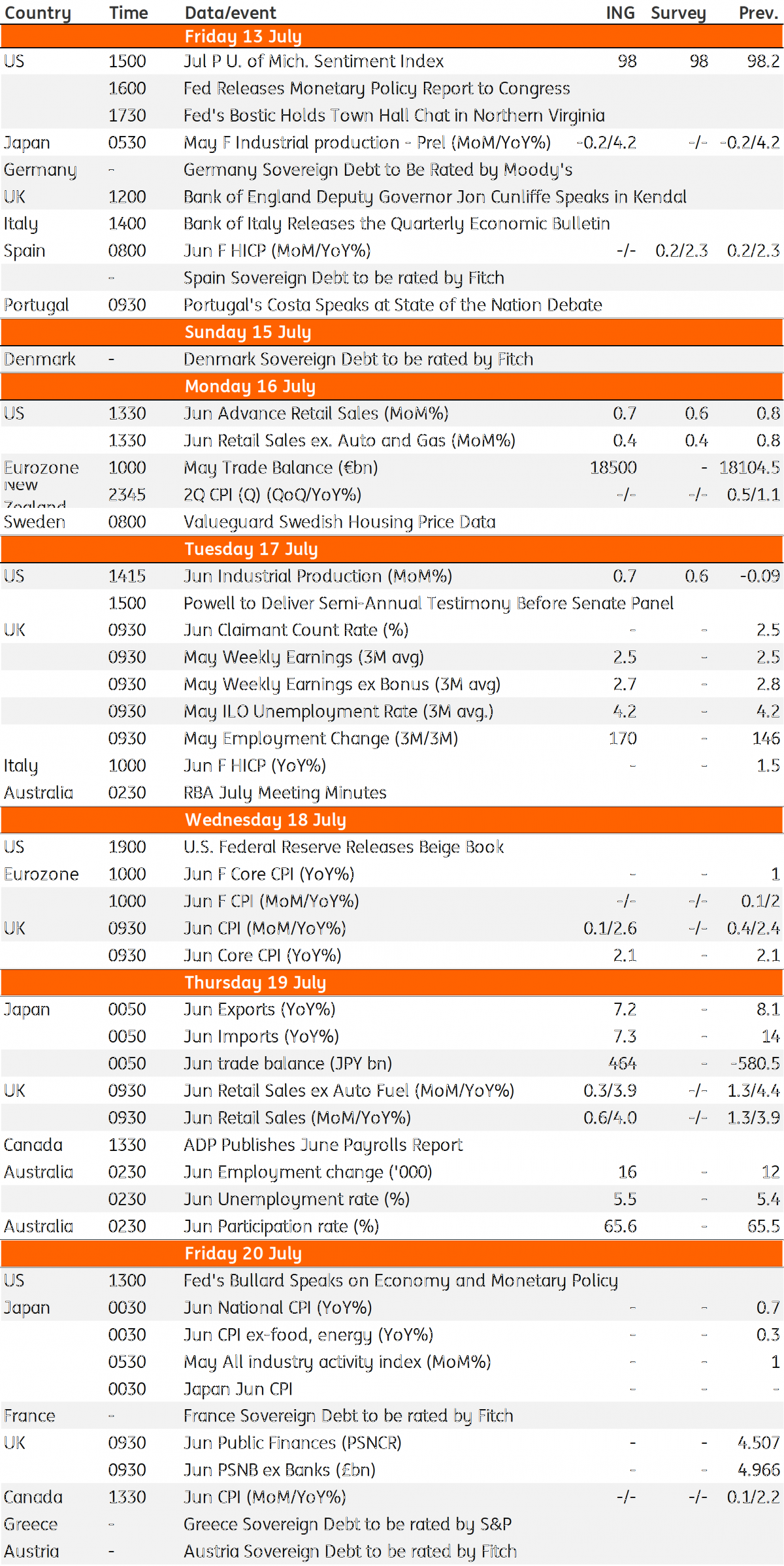

Developed Markets Economic Calendar

Download

Download article13 July 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more