Japan: What goes up…

Japan is now heading into a period where data will cease to have much meaning. It will be some months before we can see how it has weathered the latest consumption tax hike

Tokyo...do we have a problem?

It’s a bit like when a space shuttle returns to earth, there is a period when communication ceases, and there is a heart-stopping period when you just can’t tell if the crew has made it safely back or not. This is roughly where Japan’s economy is right now.

Retail sales point the way

Japan’s consumption tax hike from 8% to 10% in October is now a reality, and the data is now beginning to show us how this is beginning to affect the economy. So far, all we have is some limited sales data for September - the month before the tax increase came into effect. Next month we will also see consumer prices soar, with inflation perhaps even exceeding 2.0%. This is about the only way Japan can achieve 2% inflation though.

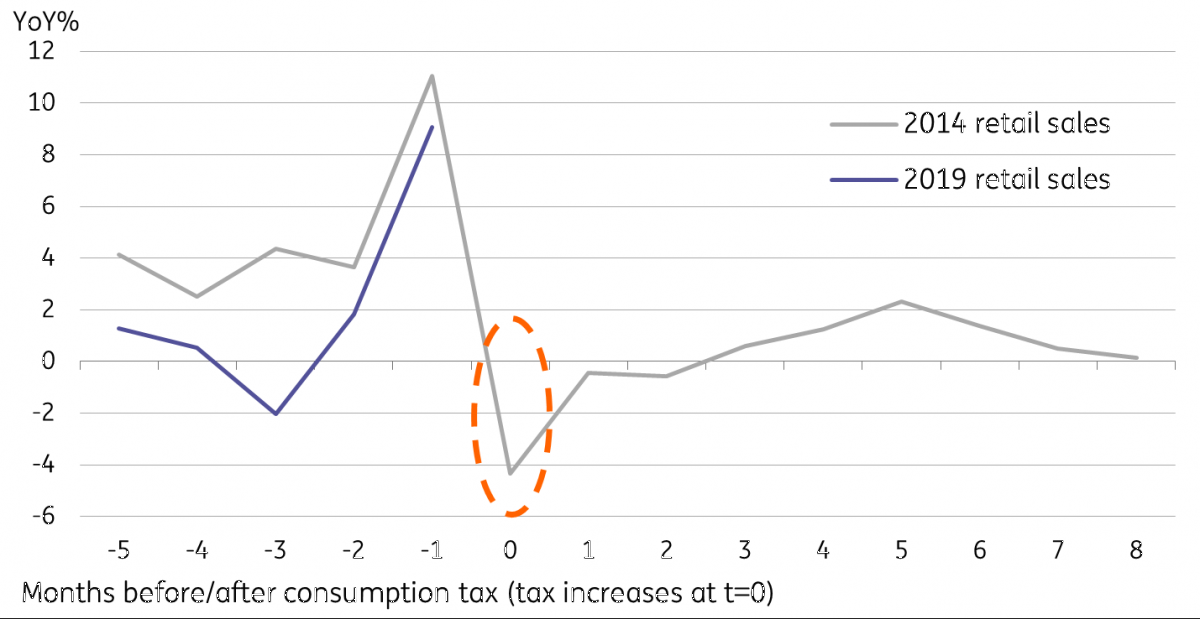

Retail sales in 2014 and now

Cannibalism ahead and after the tax rise

Looking at the behaviour of retail sales now, and when the consumption tax was last raised, back in April 2014, the path is somewhat similar. Though we would note that this time around, the bounce in September, delivering a 9% year on year increase, is coming from a much lower base. To some extent then, not only is some of this September growth likely to be cannibalising what we will see in October when we will probably see sales slump by 4-6%YoY, but it also looks as if it is cannibalising sales ahead of the tax hike too.

Acid test will come by January 2020

The real acid test for how the economy is weathering the consumption tax hike will come from the speed with which the economy recovers. If 2014 is any guide, retail sales will return to growth by January 2020, about three months after the price increase.

Bank of Japan policy changes - seem very unlikely

In the meantime, any thoughts about a change of policy from the Bank of Japan are seriously wide of the mark.

Even if it did look as if the economy had suffered more than a temporary setback from the tax hike, we remain highly doubtful that the Bank of Japan has anything up its sleeve that it can deploy to make things better. Its four options are:

- Expand asset purchases – either in size or scope – though it isn’t even doing what it claims is its current target, so this looks dead in the water.

- Expand the monetary base (but this is essentially the same as above – double-counting, there are really only three options)

- Reduce the policy rate further into negative territory (but how to do this without having to ring-fence most bank reserves to exempt them and not crush banks interest margins is an open and as yet unanswered question).

- Target negative bond yields - they are already negative and hurting Japan’s population of savers.

The next four to eight weeks will provide more information, though we won’t really have much of a clue what is going on here until next year.

Download

Download article8 November 2019

November Economic Update: Trading the positives This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more