Japan: The pause that refreshes

The 1Q18 slowdown was likely only a pause, nothing more, and we anticipate activity strengthening in 2Q18 - barring disasters, such as an all-out trade war

A good-old-fashioned inventory led downturn

In times gone by, when economics still largely worked, central banks maintained a positive interest rate and money printing was considered heretical; there used to be a periodic business cycle.

This was no bad thing. With every period of growth, along with the beneficial effects such as rising wages, and profits, there would also be some negative spillovers, such as an accumulation of unproductive activity, capacity or inventories. Every five to seven years or thereabouts, there would be a mild downturn or recession. Some jobs would be lost, and some firms would go bust. But the liberated capital and labour from this downturn would mostly be re-shuffled into more productive uses to fuel the next up-leg of the business cycle. In much the same way that we sleep at night to rejuvenate, or tides wash away and refresh the waters along our coasts, the negative short-run aspects of recessions were made up for by the post-recession benefits.

Japan seems to be undergoing just such an old-fashioned inventory cycle right now.

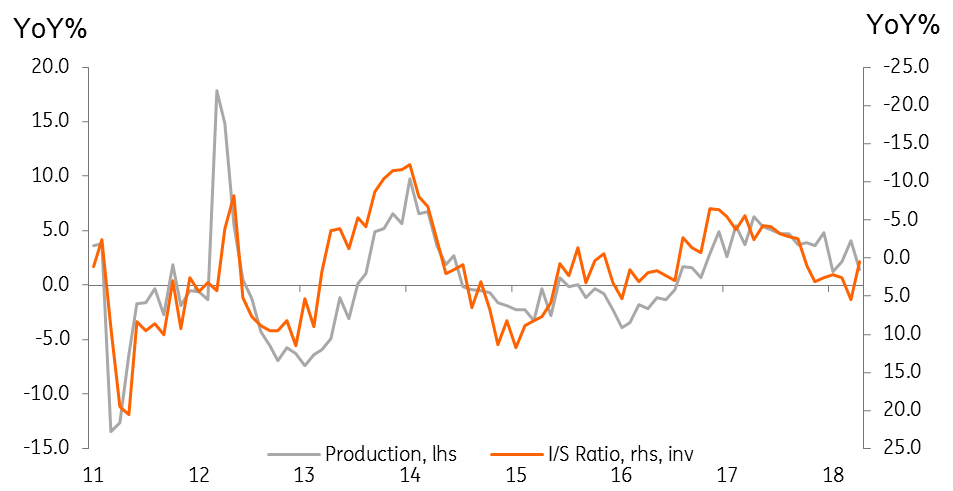

Japan inventory to shipments ratios and production growth

From stagnation to growth

After rising for several months, the year on year growth rate of Japan's inventory to shipments ratio fell last month (inverted in the accompanying charts, so they rise). This fall in the inventory ratio should, if continued, start a process that will enable production to start rising again in the coming months.

What is also clear, however, is that the amplitude of Japan's business cycle is very shallow, so any resultant upturn is unlikely to be very exciting. Production growth should accelerate from zero now to about 5%YoY during the rest of the year, but after that, is likely to fluctuate in a zero to 5% range.

While so many other economic relationships fail to work these days or do so only very weakly, the Japanese relationship between industrial production and GDP growth remains very tight. So a recovery of industrial production into the 0-5% range should lift Japanese growth from its 1Q stagnation back into the 1-2% range, for an average of about 1.0%.

GDP still closely tied to production

Learning to live with 1%

While a GDP growth rate of 1% may not sound very exciting, it is a realistic long-run growth rate for an economy where the population and labour force are now shrinking rapidly. Indeed, at a per capita GDP rate, this is slightly more than 2.0% currently, which sounds about right for an economy as technologically advanced as Japan.

However, even this forecast is not without risks. Top of this list is a collapse in global trade that will work its way back into weaker production growth and thereby weaker GDP growth. While not our central scenario, our outlook on global trade is becoming increasingly pessimistic, thanks largely to the belligerent actions of the Trump administration.

| 1% |

What we should be satisfied with on Japanese GDPGDP per capita growth is about twice as fast |

A change in sentiment at the BoJ? Ask the ECB

The recent weak newsflow has taken the Bank of Japan's tapering off the radar, but it may not stay off for very long:

-

Former BoJ Governor Shirakawa has said that measuring inflation accurately has become difficult, downplaying the undershooting of the inflation target.

- Board member Sakurai has said excessive monetary easing could destabilise the economy and is quoted in the Japan Times as saying: "The BoJ must examine how best to guide monetary policy as needed without any preset idea". Though in other comments, he sounded pretty dovish.

- In another surprise in markets, the BoJ trimmed its usual market purchases of JGBs in the 5-10Y maturity range. Either this marks realisation that the inflation target is unreachable, or unnecessary, or reflects the running out of available assets to buy.

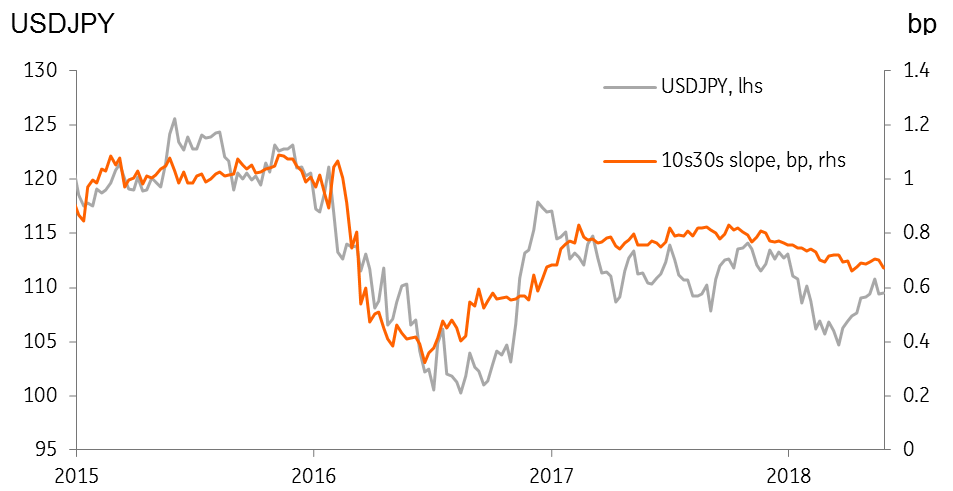

We've seen such surprise moves before, and this last bullet is maybe more tactical than strategic. One thought is that the BoJ will resort to yield curve control, rather than focus explicitly on the 10Y yield, such that a steeper 10s30s slope will result in a weaker currency. If nothing else, this would help muddy the BoJ's targets, making it less obvious that it was missing them (transparency and clarity in central banking is not always a good thing).

Japan: Yield slope and JPY

A more substantive change in BoJ policy could also be assisted as the ECB shifts its stance on QE. As we note in the Eurozone section, it looks as if Eurozone QE is coming to an end after all this year, and that will make the BoJ's job of changing policy that much easier.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

JapanDownload

Download article

8 June 2018

Good MornING Asia - 11 June, 2018 This bundle contains 4 Articles