Japan: Old style

Fourth-quarter growth was a bit of a 'dead-cat' bounce. Consumption is struggling to grow, despite better wage growth and inflation isn't going anywhere. This is spurring some talk of action at the Bank of Japan

As we feared, 4Q18 GDP failed to bounce back as strongly as we had initially hoped. After a 2.6% annualised decline in 3Q18, the 1.4% bounce in 4Q18 was of the distinct ‘dead-cat’ variety. Certainly not the ‘sharp bounce’ one business TV channel reported on the day. And since then, the data hasn’t got much better.

4Q18 GDP failed to bounce back as strongly as we had initially hoped

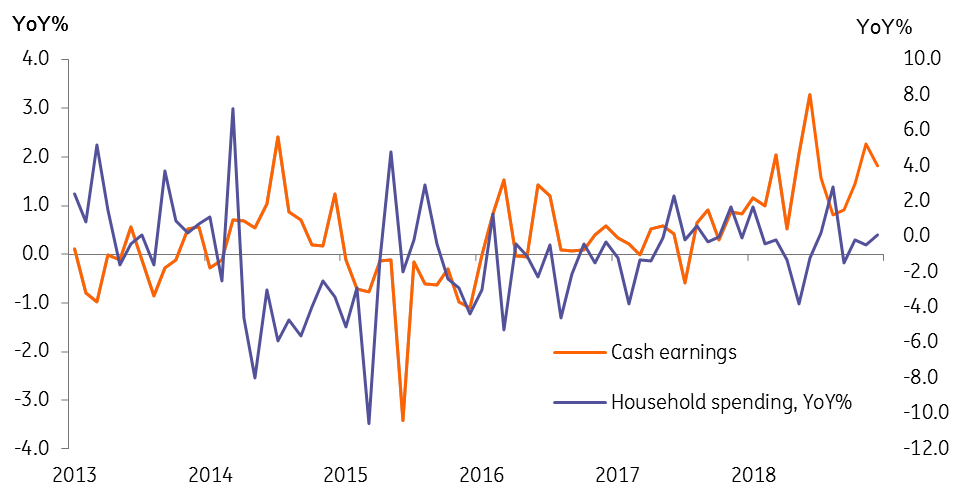

One of the biggest disappointments for Prime Minister Shinzo Abe, we imagine, must be that after convincing businesses to be more generous with wages, which they are now with wage growth honing in on 2.0% year-on-year, household spending still remains virtually flat. The idea that paying people more through scheduled cash earnings and not through one-off bonuses would lead to a smaller percentage being saved, has simply not been borne out by reality.

Cash wages and household spending

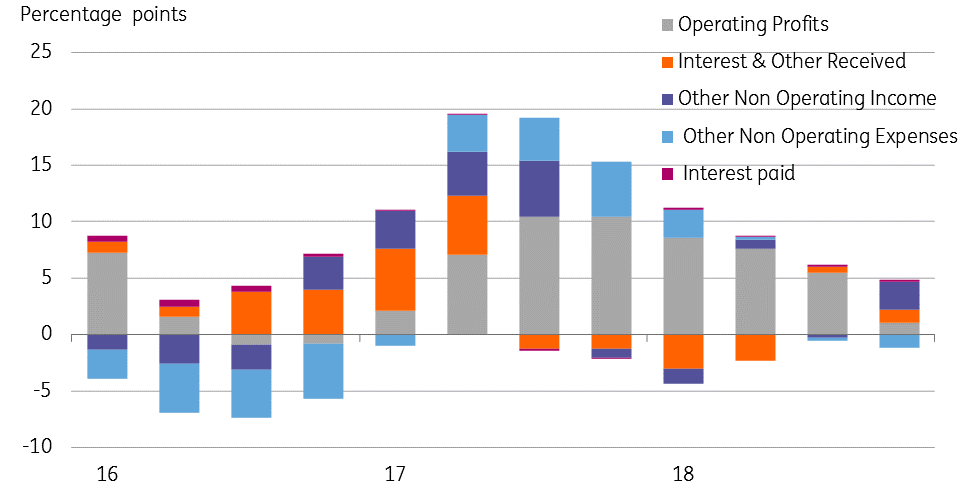

Exports are, like everywhere else in Asia, falling - a combination of trade war effects and the global slump in semiconductor / electronics demand. And corporate profits are weakening – which doesn’t bode well for either continued wages or employment growth, and puts a question mark over recent capital spending figures, which came in a little stronger than expected.

Inflation data, too, has utterly failed to make it any further, and has now drifted back in the direction of zero. This isn’t a big deal as far as the real economy goes. Japan isn’t exhibiting any genuine ‘deflationary trends’, but it’s encouraging the Bank of Japan to talk up remedial policies aimed at pushing inflation in the direction of their 2.0% target.

By now, one would have thought that by having undershot the target for so long with no obvious adverse effects, someone would have understood that the target itself may not be attainable, and might be the wrong level to target.

That sort of thinking doesn’t seem to have permeated into the inner circles of the central bank, though recent commentary from governor Haruhiko Kuroda amongst others, has been to talk up the prospects of policy actions to provide a further boost to the economy. We certainly have come a long way, and in an unfortunate direction since this time last year, when all talk was of taper.

Contribution to profits growth (percent)

Now, forget any change to the negative rate on excess reserves. 10-year bond yields may be targeted below zero, and the asset purchase programme (which we note is virtually stagnant at current levels) could be ramped up. None of which, we believe, will make any meaningful difference.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

March Monthly UpdateDownload

Download article

8 March 2019

March Economic Update: In like a lion, out like a lamb? This bundle contains 9 Articles