Japan: No bounce

Things in Japan aren't looking as promising as we anticipated, with net trade the biggest scope for disappointment. This isn't too surprising in light of the weak global trade backdrop, though even without a trade war escalation we reckon the picture is still bleak for Japan's trade sector

For some time, we have been running with a more upbeat view on the economy than the Bank of Japan, who we felt were trying to talk the yen down.

But as we approach the release of the fourth quarter GDP release for 2018, we have to admit that things are not looking as good as we had hoped. 3Q18 was a terrible quarter for growth. But there were good reasons for that, namely terrible weather in the shape of Typhoon Jebi, the most powerful storm on earth in 2018.

Typically, when something of this nature happens, storm, flood, earthquake, volcano etc, we see a fairly dramatic drop in growth in that quarter, but then bounce back in subsequent quarters, and the GDP effect is often, thanks to rebuilding and replacement, better than the prevailing pre-crisis trend.

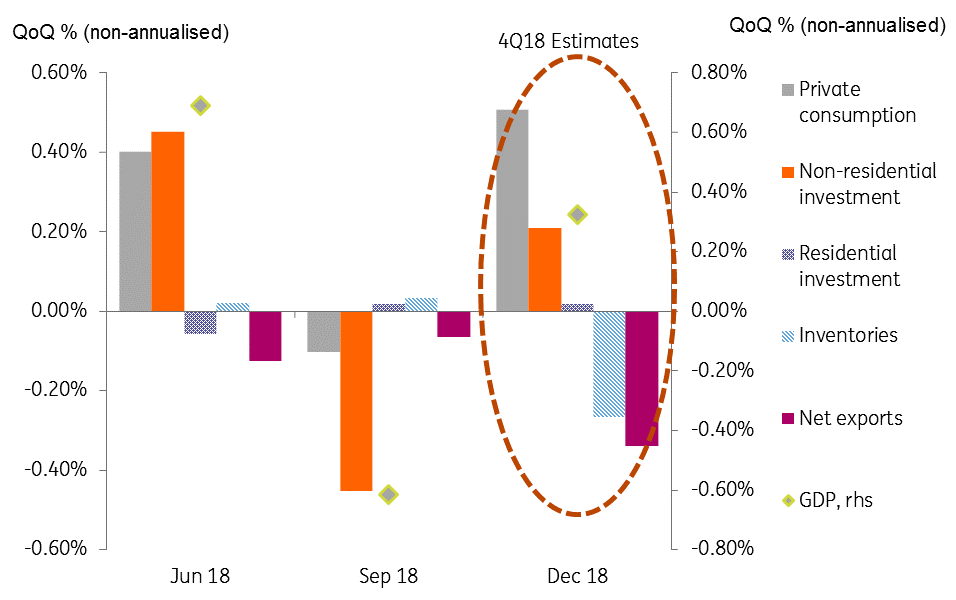

Estimates for 4Q18 GDP

Consumer spending may be the only exception to this. At -0.2% quarter-on-quarter in 3Q18, spending was sharply down from the 0.7% growth that preceded it. 4Q18 will probably deliver something around 1.0% QoQ based on the two months of household spending we have for 4Q18 and some educated guesses about how the December figure will turn out. That puts us about where we would have been in a world without typhoons.

In contrast, non-residential investment fell 2.8% QoQ in 3Q18, but we see it recovering only about half of that in the fourth quarter.

However, it is trade (net trade to be precise), where we see scope for the biggest disappointment. 3Q18 saw exports falling 1.8% QoQ. But imports also fell 1.4% in the third quarter and the net trade impact was negligible.

It looks from the trade data already available as if the 4Q18 export figures didn’t even make back the 3Q loss, whilst imports roared back with more than a 3% gain, leading to almost a 1% loss from the annualised GDP growth figure.

Perhaps it isn’t that surprising to see trade damaging the growth backdrop for Japan given the poor global trade backdrop. The 3-month growth figures for Japan show almost no destination growing faster in terms of absorbing Japanese exports than in the same three months a year ago.

4Q18 vs 4Q17 Export growth by destination

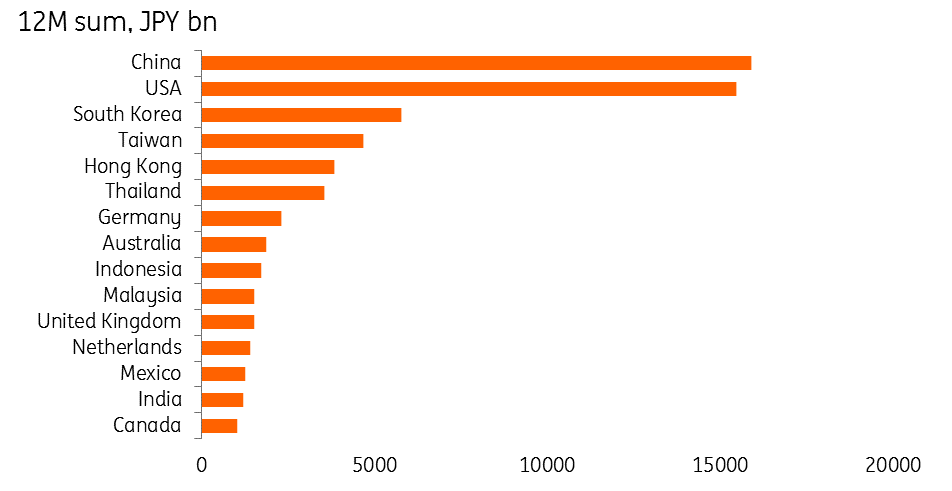

Combining the rate of growth in the chart above with the absolute absorption by country in the chart below, we can see that the slowdown in Chinese absorption is going to be the most important factor for the overall growth total. Moreover, our growth chart flatters the data. If we used the latest year-on-year comparison instead of the 3-month average, it would show that Japan’s export growth to China is now negative.

12M sum of Japanese exports by top destination

Other Asian countries, South Korea and Hong Kong, are not helping, though the picture is likely reciprocated for them by Japan. Even exports growth to the US, Japan’s second largest single country destination, has slowed substantially.

In other words, the picture, even with no escalation in the trade war shows Japan’s trade sector suffering. We know that across Asia, export flows have been hurt by the trade war, and it is not clear that we have yet seen the worst. We are assuming worse to come.

even with no escalation in the trade war Japan's trade sector is suffering

Were we to see the current 10% tariff rates on China replaced with 25% rates, then Japan would likely have serious growth issues to deal with, if not an outright recession. This isn’t our base forecast. A more plausible extension of the current tariffs seems to be a sensible working assumption. Even then, we suspect the consumption tax hike due later this year may be postponed (again) if the economy remains weak and the authorities see a need to support the economy.

Download

Download article8 February 2019

February Economic Update: Stick or twist? This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more