Japan: monthly activity data suggests GDP will rebound in the second quarter

Monthly activity data for June came as a surprise to the market. Better-than-expected industrial production supports a rebound in manufacturing production, while an unexpected decline in retail sales suggests a limited recovery in private consumption, seemingly hurt by high inflation and a resurgence of Covid-19 cases

| 8.9% |

Industrial production%MoM, sa |

| Higher than expected | |

Industrial production surges in June

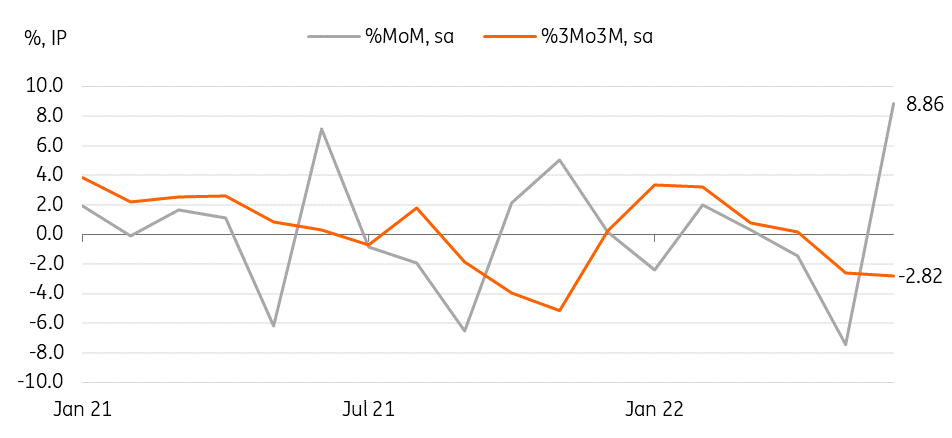

Industrial production (IP) surged 8.9% month-on-month, seasonally-adjusted in June, posting the largest monthly gain in data series history. The stronger-than-expected IP (vs 4.2% market consensus) was mainly due to China’s relaxation of lockdown measures. The main export items such as motor vehicles (14.0%), electrical machinery (7.5%), and electronic parts and devices (11.4%) all firmly rose. Global demand and production are clearly slowing down, particularly in the US and EU, but production in Japan has not fully normalised yet and its catch-up recovery momentum will likely hold if the global supply bottleneck continues to improve.

IP hit a historic high in June thanks to China's lifting of lockdown measures

However, retail sales dropped unexpectedly in June

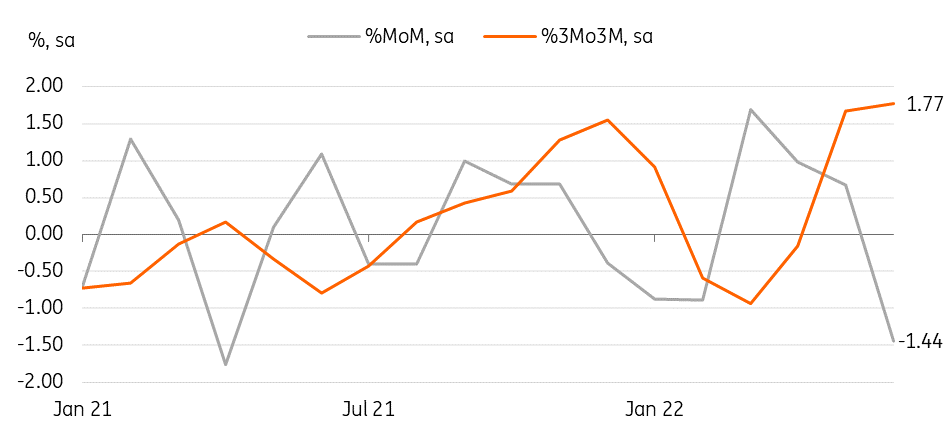

Retail sales declined by -1.4% MoM sa in June (vs 0.2% market consensus), the first drop in four months. Food and apparel sales fell by -0.8% and -6.0% respectively while automobile sales rebounded by 4.0%. A resurgence of Covid-19 cases in Japan has curbed household consumption, even as the auto sector’s supply bottleneck has improved. Despite the sudden monthly decline, sequential growth in three-month over three-month terms still accelerated compared to March, so private consumption should lead the growth in the second quarter. However, growing inflationary pressures and concerns about Covid will weigh on household consumption over the next few months.

Retail sales weakened due to a pick up in Covid cases

Labour market conditions tightened

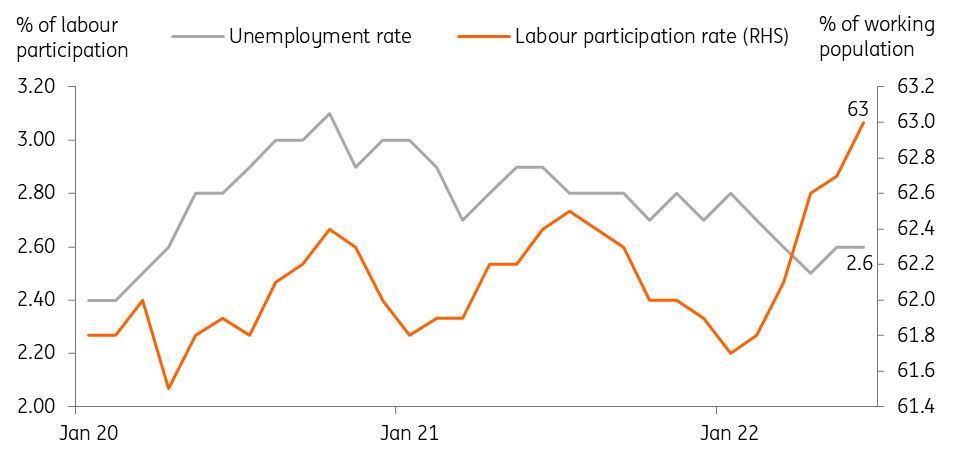

The jobless rate in June was unchanged at 2.6% (vs 2.5% market consensus) while the job-to-application ratio edged up to 1.27 in June (vs 1.25 market consensus), indicating that overall labour conditions remain healthy. But, we do not see signs of meaningful wage growth yet and the recent Covid spike may have some negative impact on the labour market in the coming months.

Labour market continues to tighten in June

Inflation rises mainly due to high commodity prices, but not enough to trigger the Bank of Japan to move

Tokyo CPI accelerated to 2.5% year-on-year in July (vs 2.3% in June), higher than the market consensus of 2.4%, mostly driven by a hike in utility prices. The monthly gain sped up 0.3%MoM sa (vs 0.1% in June) with goods and services up by 0.6% and 0.2% respectively. Inflation will likely stay above the Bank of Japan's target for a while, but cost-push-driven inflation will not change the firm stance of the Bank of Japan’s easing policy.

Revising up the second quarter GDP forecast

Based on the recent data releases, we revise up the second quarter GDP from 0.3% quarter-on-quarter sa to 0.6%, maintaining our view that the economy made a moderate recovery in the second quarter following the first quarter’s contraction of -0.1%.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more