Iron ore supply to normalise

Expect further pressure on iron ore prices in 2020. More supplies from Brazil and higher shipments from Australia mean we're expecting a softening to US$75/t by the end of next year

A standout 2019

Iron ore supply should normalise next year after a standout 2019. It was one of the commodity outperformers due to supply disruption and relatively healthy demand. The Vale dam incident at the start of the year, along with a train derailment in Australia, sent iron ore prices soaring. At one point, they went higher than US$120/t, which made the mining operations somewhat profitable. Iron ore prices did soften in the second half of the year as Vale restarted mine operations and increased supply faster than initially estimated. That said, prices are still up around 16% YTD.

New projects could face increased scrutiny

Longer-term, the Vale incident raised regulatory and political risks surrounding iron ore mining, and new projects could face increased scrutiny from both governments and local communities over the coming years. Vale reports that around 48 million tpa of capacity has restarted or has been approved to begin again out of the 90 million tpa of capacity that stopped after the dam incident; the rest of the 42 million tpa capacity will restart by 2021.

Meanwhile, the company continued to ramp up output at the giant S11D mine with production up 28.3% YoY to 54.1 million tonnes over the first three quarters of 2019. It could increase production and reach full capacity of 90 million tpa in 2020. The Samarco mine, closed since 2015 after an incident, has received all approvals to restart operations and production could well resume later next year with around 8-10 million tpa of capacity.

In Australia, ore exports dropped around 1% YoY to 828 million tonnes in 2019, mainly due to disruptions in the first quarter of 2019. They're expected to recover next year on the back of increased production at some new and existing mines. Australia’s Department of Industry, Innovation and Science forecasts Australian iron ore exports to increase more than 4% year-on-year to 862 million tonnes in 2020.

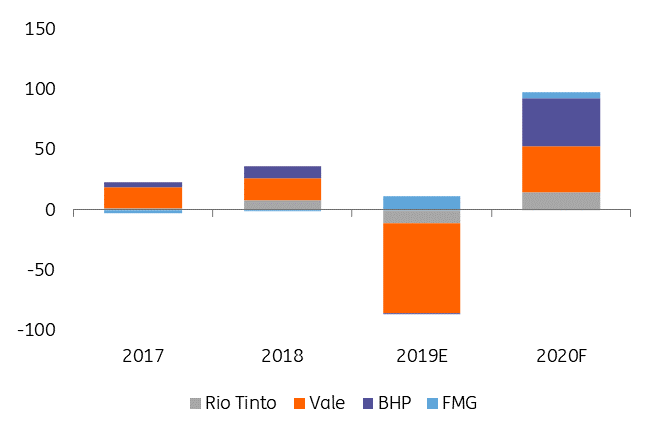

With those forecast restarts now in the pipeline, we expect the ore supply to normalise over 2020. Currently, we anticipate production from the big four to grow by around 9% YoY in the next twelve months. As a result, seaborn supply to China is likely to continue improving. And you can already see that reflected in the total China ports' inventory, which has grown by more than 12% since the lows in June. China's domestic iron ore production is also contributing to the supply side; it's grown fairly strongly, by 6.5% YoY, to 712 million tonnes in the first ten months of the year.

Big four iron ore supply changes (million tonnes)

Demand growth mismatch

Should this supply picture hold, there is a mismatch in the outlook for demand growth next year, which may have trouble competing with the speed of supply growth. Data from the World Steel Association shows that global steel production increased 3.9% YoY to 1,391 million tonnes over the first nine months of 2019, which has kept iron ore demand steady during the year.

However, the outlook for 2020 is not as optimistic with the Association estimating global steel demand to slow down to 1.7% YoY. Chinese demand growth is set to slow from 7.8% in 2019 to just 1% in 2020. That said, over the coming year, we expect a relatively firmer 1H and a softer 2H in Chinese iron ore demand, taking steel demand prospects from infrastructure and the construction sectors into consideration.

Steel production exports are expected to continue their downward trend, and this would eventually feed through to iron ore demand by the mills. China's total steel production exports already fell by around 5% YoY in the first nine months of 2019. That said, we expect average prices to be weaker next year with intra-year prices' formation becoming softer towards US75/t by the end of 2020.

Tags

Iron oreDownload

Download article10 December 2019

ING’s 2020 Commodities Outlook This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more