Iron Ore: looking better supported after disruptions

It’s been the commodity most commonly associated with oversupply and bearish price calls, but now following a series of supply disruptions and improved Chinese demand, we think iron ore prices will hold up better than expected

Supply disruptions limit the expect surplus

After seemingly set for year of significant oversupply, the seaborne iron ore supply growth from the big 4 (Vale, Rio, BHP, Fortescue) is quickly being offset by disruptions from the smaller exporters in the market: Roy Hill will not ramp up as quickly, Anglo’s Minos Rio will only ship 3MT, Iron ore canada is on strike, and we also expect exports from Sierra Leone, Iran and India to register significant declines (amongst others). Against a 32MT increase in seaborne supply from the big 4, exports from others are expected to fall by 31Mt so that now our 50MT+ seaborne surplus we expected for 2018 looks closer to 10MT (we also raised demand projections). 2019's oversupply looks a more modest as well.

Iron ore seaborne supply-demand balance (Mt)

Chinese Demand: Property looking better but be wary of Chinese steel data

Given positive signals from Chinese residential property, (the largest component of chinese steel demand c.35%), we are raising our expectations for Chinese steel demand growth from flat (as per WSA forecasts) to a modest but still growing 1% for 2018. Despite much enthusiasm around the headline 5% YoY growth in Chinese steel NBS production for 1Q, these official figures are still being skewed by the closure of illegal (and unreported) induction furnaces (IFs). 140Mt of such capacity was closed through 2016-2017. Shanghai Steelhome estimates the remaining unofficial/”ditiaogang” steel amounted to 12Mt last year (68MT in 2016) which is enough to outweigh the increase to date seen in the official NBS figures. In fact, last year's apparent 3% growth in NBS steel production was probably a decline when accounting for the IF closures.

The production shift from scrap consuming furnaces to blast-furnaces has increased iron ore consumption above the milder steel demand rate. This is why we expect Chinese iron ore imports to be almost flat on last year’s. We don’t think it is a bearish call considerable growing scrap consumption (outside of IFs) and given that last year’s 34MT of port stock increase that need not be repeated this year.

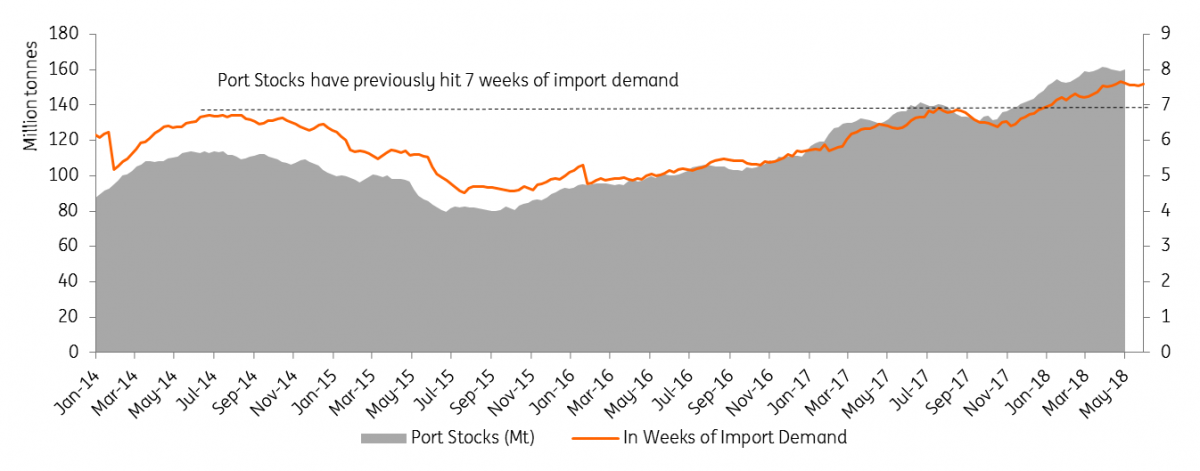

Port stocks in perspective

Regarding Chinas swelling port stocks, we haven’t yet interpreted this to be as bearish a data point as perhaps other commentators have. Our channel checks suggest around half of this stock is lower grade fines which is against a steel user base showing increasing preference for higher grade ores. This has been especially true during the capacity restraints of the winter heating season (November - March) so it was those unwanted lower grade ores which saw total stock figures balloon by 28Mt. Furthermore, growing port inventories in terms of stock cover is a natural extension of both a growing demand base and a considerably more liquid secondary spot market that has been taking place portside rather than seaborne. Against falling domestic mine output and growing demand we calculate the 160Mt of iron ore stocks is only 1 more week of import demand than the highs seen in 2014. The more preferenced the market becomes towards higher grades the less relevant cover is provided by those stocks,

This explanation does of course have its limits, which we have probably reached or at least close to. At some point surging port stocks has to equate to a build-up of iron units that cannot be sold in to the Chinese market. This is why we don’t account for any further port stock build up that would boost Chinas iron ore imports this year. When it comes to the impact of port stocks on prices the relationship is expected to get increasingly seasonal as winter capacity cuts/ sintering controls will boost preferences for higher grades/lumps, reducing the effective stock overhang to only that of relevant grades.

Port stocks do not look as scary vs import demand

Import demand = Iron ore demand - domestic mine production (in import equivalent grade)

Grade preferences: part seasonal, part structural

Since August 2017 the price differential between 58% and 62% iron ore has averaged US$23/mt or 34%, which compares to US$15/mt or 21% the 12 months prior. That grade premium rises and falls with steel mill profitability. Whilst mill profits are still expected to swing over time with downstream conditions (credit, steel inventories, construction activity, etc) they have also set in to a higher new normal. Less overcapacity allows the remaining steel production to extract more value from their selling prices vs the raw materials, in turn boosting purchasing power for the ores, but more generally this incentivises any uncurtailed capacity to produce more with less: aka using higher grading ores. Aggressive permanent capacity cuts (150Mtpa throught 2016 to 2018) render a good degree of this higher profitability, utilisation and ore premiums a new normal whilst the winter heating season curbs are also expected to see a seasonal boost. Expecting a wider 58-62% spread during the heating season therefore brings a new seasonal element to our price forecasts so we now expect a historically weaker 4Q to hold up better in terms of the 62% price. Restrictions on sintering will also need to be watched for swings in lump vs fines pricing.

Iron ore's grade premium follows steel mill profitability

A new normal for higher chinese steel mill utilisation (Mt, %)

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).