International trade in 2021: Plenty of challenges, but recovery in sight

World trade will not be far from news headlines in 2021, and despite the new leadership both in the US and soon at the World Trade Organisation, this is no guarantee of international co-operation. But at least it offers some hope for thawing of trade tensions

With a vaccine, trade will rebound but second round effects will drag into 2021

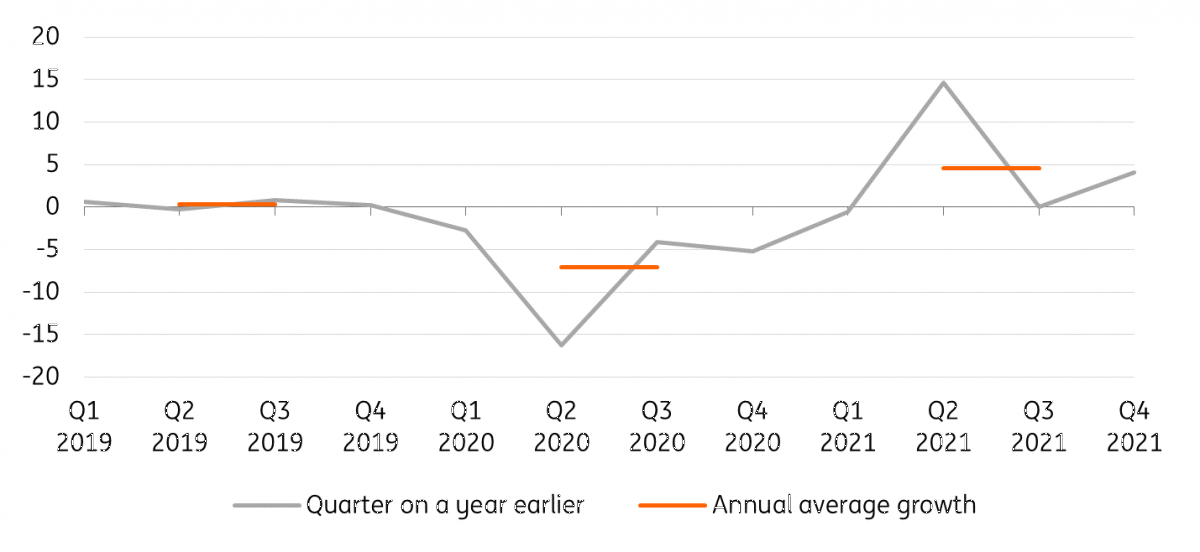

Progress towards a vaccine is a key step towards restoring consumer and investment confidence over the course of 2021, helping trade volumes recover to their pre-pandemic levels from the 16% collapse in 2Q20. But some Covid-related disruptions to transport capacity will take time to unwind, and cause a persistent drag even as demand recovers.

Even though trade will respond quickly as demand recovers, it may take until 2022 to reach pre-pandemic volumes again.

As Covid restrictions ease, trade bounces back

We forecast a 7% fall in goods trade volumes in 2020 followed by growth of around 5% in 2021, to reach pre-pandemic levels in early 2022.

As the recovery progresses, government support packages which have been essential for consumers and businesses alike pose a downside risk to trade volumes, as subsidies create an uneven playing field for exporting firms. If government support is unwound, the dampening effect on trade volumes should be limited.

The costs of diversifying supply and holding larger inventories will limit any grand migration of supply chains in 2021

However, much of the support provided has no formal end-date, and could therefore have unintended effects on trade’s recovery.

Policy responses to the vulnerabilities revealed by Covid-19 may result in countries stockpiling certain goods and even trying to incentivise re-shoring. But supply chain disruptions from lockdown in China proved to be a smaller problem than collapsing demand in export markets, especially thanks to China’s swift reopening. For many firms, increasing supply chain resilience is easier said than done. The costs of diversifying supply and holding larger inventories will limit any grand migration of supply chains in 2021.

Trade war act II will be milder

US trade policy under President-elect Joe Biden looks likely to continue to put pressure on US-China trade relations while de-escalating other disputes.

The tariffs on US-China trade flows are likely to remain in place, though talks may resume. As part of a Biden campaign pledge to “work with our closest allies” on trade, US tariffs on steel and aluminium may be reduced, and the threat of US tariffs on EU cars forgotten.

Alongside continued strained trade relations with the US, and now also Australia, China faces the threat of continued restrictions on its investment abroad. In response, it may redouble its efforts to lower trade costs and build export markets closer to home through its Belt and Road connectivity projects and develop its high-tech manufacturing capacity as part of its ‘Made in China 2025’ strategy, reducing imports in the process.

Challenges right from the start, with high stakes

Thanks to Brexit, we are almost guaranteed to start the new year talking about trade disruption. Even if a trade deal is signed, cancelling the prospective tariff increases on goods between the two countries, new customs checks on the origin of goods and safety standards will delay cargo travelling from the UK to the EU from 1 January 2021.

By early 2021, the new director-general of the WTO should have been appointed, just in time for the world trade system to play its part in the distribution of Covid-19 vaccines. Countries have signed up to the principle of fair allocation, but making this work will be key to a global recovery in 2021, and prospects for multilateral co-operation thereafter. The stakes couldn’t be higher.

Being ‘under new management’ is no guarantee of international co-operation on a vaccine

The incoming WTO director-general has other daunting issues to address too. Various disputes caused by the trade war are working their way through the WTO’s courts, including the US steel and aluminium tariffs, which require the WTO’s appellate body to get back on its feet. There is also a dispute with China about the use of state subsidies, where the US has been joined by the EU and Japan in voicing concerns. Progress on these difficult issues is required to avoid future trade wars.

Cautious optimism on global trade seems warranted

Trade will not be far away from the headlines in 2021, and being ‘under new management’ is no guarantee of international co-operation on a vaccine, or resolving the issues that led to the trade war. World trade will continue to bear the scars of the tit-for-tat trade war, and the effects of subsidies introduced during the pandemic risk dampening the recovery.

But in spite of the challenges and risks, cautious optimism for 2021 is warranted as economies are set to recover and trade policy may be done through talks, rather than tariffs.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 November 2020

Global Macro Outlook 2021: The darkness before the dawn This bundle contains 15 Articles