ING’s latest CEE economic views and forecasts

As Covid-19 spreads across Europe causing more and more countries to take extraordinary measures, Central and Eastern Europe is no exception. Following some big market and central bank moves, our CEE specialists have updated our forecasts for growth and policy rates

Tricky months ahead

After updating our short-term outlook for major developed economies, we turn our attention to the CEE countries.

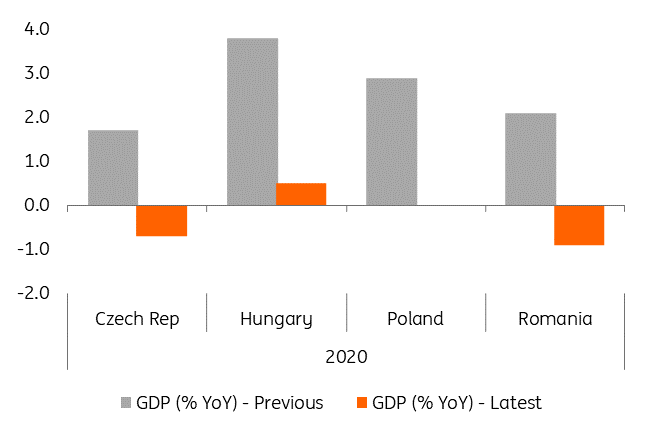

We collectively downgrade the 2020 GDP outlook on the back of coronavirus fears. However, the reaction function will differ a bit. We see a lagged effect of falling foreign demand and supply chain disruptions combined with a stockpiling in 1Q20. This results in 2Q being the bottom in the CEE when it comes to GDP levels. Second-round effects in production, limited business and household spending will drag down both investment and consumption. When fear decreases in the second half of the year, we see on average 60% recovery of cumulated GDP drops from the first half of 2020. Nonetheless, both the Czech Republic and Romania should show negative GDP for full 2020.

A mix of a supply and a demand-side shock combined with weaker FX results in diverse outcomes when it comes to the inflation outlook, but in general, it seems that central banks in the region don’t need to consider high inflation as a barrier when taking steps. And they are taking steps. Central banks are preparing or have been already decided about emergency measures (rate cuts in the Czech Republic, QE and rate cuts in Poland) to improve the liquidity situation and provide stability in the banking sector. What could be the next step varies from country to country. The National Bank of Hungary may also embark on QE, the National Bank of Romania is to focus on liquidity measures while the Czech National Bank is set to cut rates further. The National Bank of Poland is likely done with cuts. The fiscal policy is also a mixed bag with some countries facing mounting problems like Romania, while others can easily afford a 4% of GDP fiscal deficit like Poland.

The upcoming monetary easing coupled with the challenging environment for emerging market FX and risks assets should keep CEE currencies under pressure in coming months. The tightly managed RON should continue to be the winner in falling markets while CZK volatility will remain extra elevated given the positioning-related moves in the currency and the risk of CNB FX interventions (which we expect to have a smoothing effect only). We also look for more HUF and PLN weakness in coming weeks and months.

This update might be just the first in line as more data is released and more measures will take place to prevent the spread of the virus and more packages are coming to counterbalance the economic and social impacts of the shock.

For our views on CEE countries, see below.

The preview was written by Peter Virovacz and Petr Krpata

Czech Republic

- Growth: The Czech economy falling into recession has become our baseline scenario as Covid-19 measures not only affect domestic but also foreign demand significantly. The Czech economy itself could cope with domestic restrictive measures due to sufficient fiscal space (4th lowest total debt-to-GDP in the EU – around 32% of GDP). However, foreign demand might become a bottleneck for a quick recovery in 2H20 though it is too early to estimate the full effect.

- Inflation: While a few weeks back inflation was pencilled in go above 3% this year, the significant decline in oil prices brought a turnaround, subtracting broadly 0.6 percentage points from YoY inflation this year. We will very likely see disinflation pressures due to the weakening economy, though weaker CZK and some supply constraints go in the opposite direction. All in all, we expect headline CPI to decelerate towards 2.5% this year.

- CNB: The Czech National Bank delivered a 50bp emergency rate on Monday and is very likely to continue lowering borrowing costs to mitigate the coronavirus shock. This means that the main 2-week repo rate is likely to fall significantly in the forthcoming months (towards 0.50%) with the CNB likely delivering rate cuts (25bp or more) in each of the three forthcoming monetary meetings (with a non-negligible risk of another emergency rate cut or a cut being larger than 50bp). This scenario is to a large extent priced in by the market.

- EUR/CZK: The upcoming rate cuts (which will take away the yield advantage – the main koruna anchor) and challenging global environment for EM FX will keep the still overbought CZK under pressure. Due to the risk of a disorderly sell-off, we expect the CNB to start one-off FX intervention to smooth the koruna volatility. We expect the first interventions to come around the EUR/CZK 28.00 level. Yet this will not be a firm ceiling on EUR/CZK, with FX interventions having a smoothing rather than firming function. This means the EUR/CZK could trade meaningfully above 28.00 should global risk assets remain under pressure.

- Fiscal policy: The government introduced a set of preliminary measures to mitigate short-term negative effects, like tax delays, or providing no interest/fee 2-year loans for the affected SME with a one-year delay in payments. Other measures are in the pipeline (i.e, helping employment by providing full or partial compensation of wages to companies affected by quarantine). More fiscal measures are likely to come. Given the fiscal space available in the Czech economy, more fiscal measures are necessary to counteract adverse developments and support subsequent recovery.

The Czech Republic by Jakub Seidler and Petr Krpata

Hungary

- Growth: Due to the panic buying of non-perishables through February and March, economic activity might remain in the expansion territory in 1Q (0.2% QoQ). However, as the lockdown of the country and forfeiture of social events kicks in fully in the second quarter, we see a 2.5% QoQ drop in GDP. A rebound in the second half should keep the 2020 growth rate in positive territory, as we downgrade our GDP forecast from 3.8% to 0.5%.

- Inflation: We have already updated our CPI outlook based on what is happening in the oil market and the recent shock is having rather a mixed effect on inflation. However, policymakers don’t need to worry about inflation being above the target range for a while. We see CPI at 3.0% and 3.1% YoY in 2020-21, respectively.

- NBH: The Hungarian central bank has already stepped in to provide extra liquidity via the regular FX swaps and announced a new daily facility, a 1-week FX swap tenders to provide forint liquidity. The change in collaterals also frees up HUF2.5tr extra liquidity for the banking sector on demand. The NBH also suggested commercial banks suspend collecting loan payments from SMEs. Looking ahead, the next move by the NBH could be expanding its bond-buying programme and scrap the related sterilization measure, engaging in a proper quantitative easing.

- EUR/HUF: While the forint ceased to be the CEE underperformer (and in times of stress did better than CZK and PLN) due to the still short positioning and the prior NBH tightening, we look for more EUR/HUF upside as (a) the external environment is to remain tricky, (b) the NBH will likely provide further liquidity measures, causing a drop in implied yields and Bubor (in turn following the easing trend of other CEE central banks). This should be modestly HUF negative, sending EUR/HUF to 352 in the coming months. But as the NBH extraordinary measures will be phased out and the recovery starts, HUF can go back to 340 levels in early 2021.

- Fiscal policy: The Hungarian government is still working behind the scenes to come up with a fiscal package. In theory, the room for such an easing could be around 2-3% of GDP, but that would mean significantly higher net issuance, maybe including REPHUNs.

Hungary by Peter Virovacz and Petr Krpata

Poland

- Growth: We estimate the coronavirus outbreak should lower 2020 GDP growth by 3pp, from 2.9% YoY we expected before the outbreak to around 0% YoY. We see the following channels the outbreak affects GDP: shutdown of the services sector, lower propensity to spend by households and very weak investment demand. We also assume supply disruptions. We expect the pandemic will last 1-1.5 months. The bulk of the hit on the Polish GDP is likely to happen in late March and early April. We see a technical recession with negative GDP QoQ in 1-2Q20.

- Inflation: As of March, CPI should subside. If the crude price remains at the US$35/bbl level, Polish inflation should be lower by 0.7pp compared with our previous forecasts. CPI should move back to 3.5-3.6% YoY in April and average 3.5% YoY in 2020. The Covid-19 may cause some short-term rise of prices, but the disinflationary impact should prevail, especially in the case of oil prices. Some necessity prices (like dry food) may become more expensive, but their weight in CPI is just 8%.

- NBP: The MPC cut rates (main by 50bp) and introduced Polish QE and TLTRO, which will enable a large-scale fiscal response to the coronavirus. Also, the NBP concludes that repo operations increase banks’ liquidity. The first operation was conducted yesterday (with a maturity of four days and worth PLN7.5bn). The NBP also created a Polish version of a QE programme to stabilise the T-bonds secondary market, but the size and length of buying was not specified. It may be either adjusted to current market conditions or set after the fiscal programme is released. QE opens the door for the ministry of finance to announce a large anti-crisis policy package. We see limited space for further rate cuts. Expect the MPC to ease via QE and TLTRO in coming months.

- EUR/PLN: The NBP monetary easing is PLN negative, €/PLN will very likely to top 4.50. Still, the Polish situation is still better compared to CEE counterparts – rates are higher, and the current account showed a high surplus. Also, foreign investors were underweighted in POLGBs. The NBP is very likely to intervene above 4.50. The NBP’s FX interventions will be rather focused on lowering volatility than defending levels. The domestic economy is relatively well suited for the crisis, €/PLN should move back to 4.30 in 2H20.

- Fiscal: We expect the 2020 net borrowing needs to increase from PLN15bn to PLN75bn due to the epidemic outbreak (c.3% of GDP). The government won’t cash PLN18bn from OFE pension funds. On top of that will be the cost of the fiscal impulse, which the government will announce on 17 March. The size of the fiscal package should reach 1-2% of GDP, but it might be partially funded by a redirection of EU funds. We expect the deficit to reach 3.6-4.5% of GDP in 2020.

Poland by Rafal Benecki and Piotr Polawski

Romania

- Growth: While no later than last week we were still relatively optimistic, the avalanche of growth revisions and the signals we get from the real economy brings us to the point where we are calling for a GDP contraction in 2020. Except for a temporary boost in retail sales activity due to the fear factor (even here it will be interesting to see how much booming food sales make up for the falling non-food sales), there is simply nothing good we can expect from the next couple of months. Hence, we expect a flat 1Q20 vs 4Q19, a terrible 2Q20 and a gradual rebound afterwards, leading to 2020 GDP growth of -0.9%.

- Inflation: Here the story is relatively straight forward - lower oil prices, lower (negative) growth and lower demand (eventually the flip-side of the current sales boom will be visible in 2Q) will lower inflation. We revise CPI slightly, both the year-end and annual average to 2.5% from 2.8%.

- NBR: We believe that monetary policy will remain FX-focused. To the extent the currency can be managed without major problems, we envisage the central bank doing a little bit of everything: leaving the EUR/RON to shift higher earlier in the year rather than later, leaving some carefully monitored surplus liquidity in the market or alternatively provide liquidity through repo operations, further cuts in minimum reserve requirements and even one or two 25bp key rate cut(s) if the economic downturn deepens and only after other CEE central banks have done it. Above all, however, we believe that the NBR will work with the banks and the MinFin to support lending schemes for the businesses most severely impacted.

- EUR/RON: We maintain our 4.85 year-end forecast but see increased chances of going higher than this level during 2Q20. We believe that other CEE currencies underperformance will provide some comfort to the NBR for leaving the EUR/RON as high as 4.86 in the second quarter, followed by a quasi-stagnation and a return to 4.85 by the year-end.

- Fiscal policy: The combination of lower growth, lower revenues and higher (or at best constant) spending will – in our view – push the budget deficit above 5.0% of GDP, even in a scenario where the 40% pension hike is postponed, which is our base case now. We estimate the budget deficit sensitivity to GDP slowdown to be close to 0.4pp for every one percentage point of lost GDP.

Romania by Valentin Tataru

Downgrading CEE growth

Our latest economic forecasts

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article