Eurozone: Inflation worries increase

After a strong third quarter, eurozone growth is likely to decelerate on the back of supply chain troubles, high energy prices and a pick-up in Covid-19 infections. Inflation continues to surprise on the upside, likely pushing the European Central Bank to take away some of the monetary stimulus next year

As good as it gets

With 2.2% quarter-on-quarter growth in 3Q, the eurozone recovery proved stronger than expected. The catch-up in the services sector, in particular, was the main driver of the robust growth figure. However, this is as good as it gets. Growth is bound to decelerate from the fourth quarter onwards, not only because we’re now getting close to the pre-pandemic GDP level, but also because headwinds are becoming stronger. The supply chain troubles continue to rattle the manufacturing sector, with car manufacturers especially producing much less than they want to. On top of that, we see high energy prices sapping consumption, even though the strong labour market remains supportive. Finally, Covid-19 infections are picking up again. Admittedly, the high vaccination rate limits the burden on the health care system, but services consumption tends to suffer when the fear of getting infected increases.

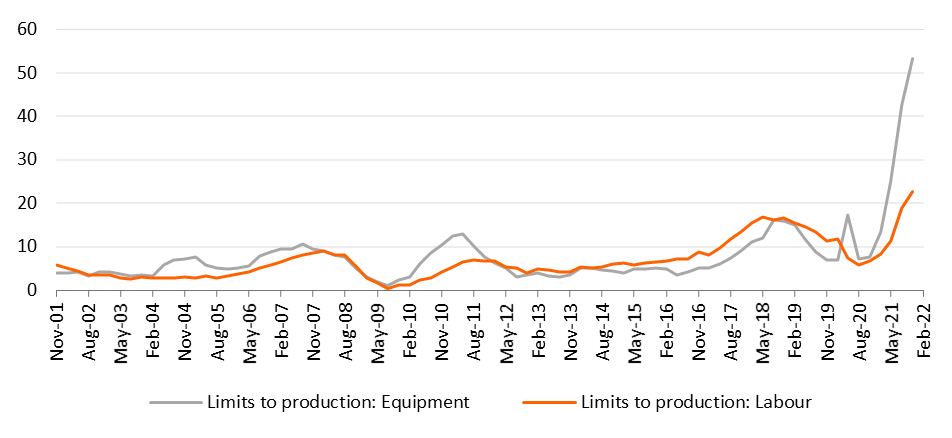

Growing supply constraints are hampering manufacturing production

But there is still some growth momentum

As such, 4Q might see much weaker growth. That said, we certainly don’t expect the recovery to falter again. Order book positions were close to historic highs in October, while hiring intentions remain very strong and consumers’ perceptions of the labour market are increasingly buoyant. All of this means that even if growth turns out to be a bit weaker in the coming months – some catch-up seems likely in the course of 2022. We stand by our GDP growth estimates of 5.1% for 2021 and 3.9% for 2022.

Inflation forecasts revised higher (again!)

We expect inflation to fall in 2022, but remain above 2% until the second half of the year

The inflation story is getting more difficult to navigate for the ECB. The flash Harmonised Index of Consumer Prices (HICP) inflation estimate for October, came out at 4.1%. True, energy prices remain the main culprit, but core inflation also climbed to 2.1%. We agree with the ECB that there are still a lot of factors that might prove to be temporary. Higher services price inflation, which pushed up core inflation, is to a large extent due to its weak base a year ago. Likewise, the German VAT increase has added around 0.6 percentage points to eurozone inflation, an effect that will disappear in January 2022. That said, even though we don’t believe oil and natural gas prices will continue to increase at the same pace in 2022 (we are actually forecasting a decline), the upward inflation impact might last a bit longer. The same holds true for goods price inflation, which has been pushed upwards by high commodity prices and shortages. And in an environment of tightening labour markets, wage agreements are likely to be a bit more generous, though the impact on inflation is unlikely to be felt before 2023 at the earliest. Summing it all up, we expect inflation to fall in 2022, but remain above 2% until the second half of the year. We have therefore revised our inflation forecast up yet again to 2.4% for 2021, 2% for 2022 and 1.8% for 2023. Thereafter, we might see a slight upward trend.

Long-term market inflation expectations are back at 2%

Taking away monetary stimulus

It is interesting to note that the 5 year 5 year forward inflation swap, the measure that was for Mario Draghi one of the warning signals that quantitative easing was needed in 2015, is now back around 2%. At the press conference after the monetary meeting, ECB President Christine Lagarde acknowledged that “market and survey-based measures of longer-term inflation expectations have moved closer to two per cent”. It, therefore, seems logical that the ECB will start to take away some of the stimulus: we expect a gradual decrease of bond purchases after the end of the Pandemic Emergency Purchase Programme in March 2022. A first rate hike will now happen, in our view, in the third quarter of 2023 (for more details see our article on the ECB).

Download

Download article

5 November 2021

ING Monthly: Curve surfing This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more