Industrial Metals: Show me the money!

Fund flows in aluminium and copper have reversed since December and divergent flows have set the stage for divergent prices

Copper and aluminium retreat with flows

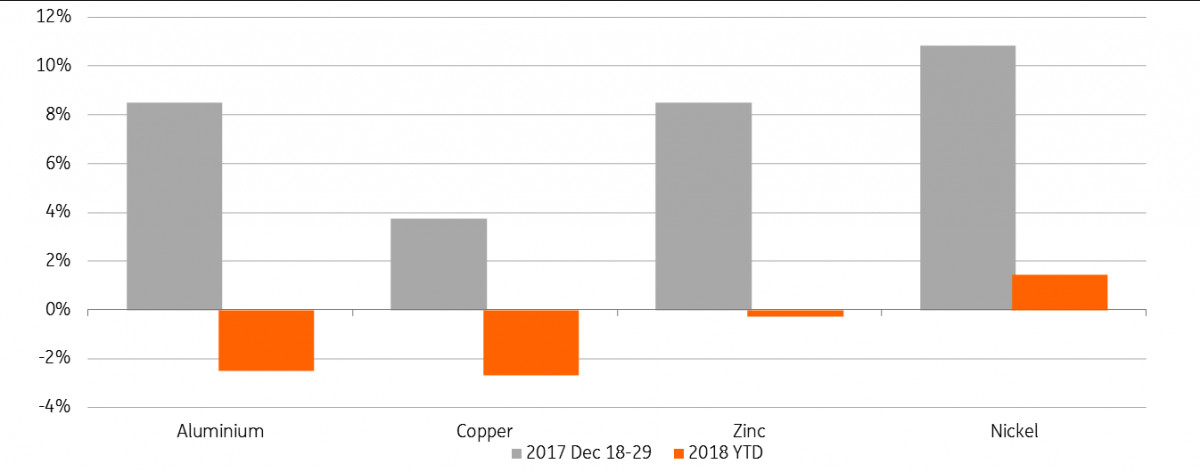

Copper and aluminium both breached significant price barriers of $7,000 and $2,200/mt respectively in December 2017, but through January, and regardless of the falling US dollar and strong Chinese data, both metals have slipped from their highs. The corresponding change in money manager longs and open interest mirrors this asymmetric month-on-month performance. Aluminium open interest had surged 8% through the last two weeks of December, which drove prices up 9% but both prices and positions have slid 2% in January. Copper flows and prices have had the same pattern. In December, copper open interest rose 4% alongside a 5% price rally but a 2.6% slide in positions this year has seen prices come down by 1.9%.

Unless these flows start to turn, more price weakness is likely to follow in the two major metals. Fundamentally, we are more bullish on aluminium at these prices and we also note how tightening spreads (Jan-Feb) offer the opportunity to squeeze out the shorts and give extra yields to the longs. A very wide contango in copper markets, only briefly surpassed once since 2008, however, makes a rolling long copper position all the more costly.

Open interest Reverses for Aluminium, Copper

LME Open interest

Money Manager Longs Retreating in Aluminium and Copper only

Small metals in front

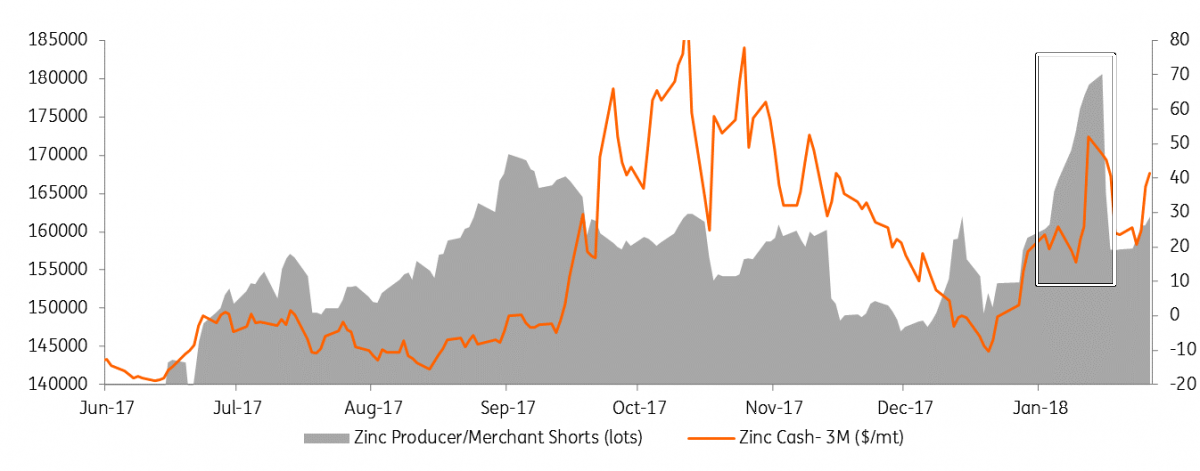

Market leader zinc sees a fairly flat open interest this year but the money manager longs are up 3.6% to the highest since July and following on from the 2.6% increase seen in November. This allocation was boosted by a 13% collapse in the physical shorts as a $52 backwardation peak in the Cash-3M drove these participants to submit to the tightness and liquidate short hedges/stocks in financing.

Nickel’s allocations are far more obvious as LME money manager longs are up a further 10% through January to record highs. The LME's flows are, in turn, augmented by the +15% of Shanghai nickel open interest that included a 30% surge last week. Given the LME length and pace of the SHFE increase, we would be cautious of profit taking sparking quick reversals. As we wrote last week: ''Nickel, beware the Chinese speculator!''

Zinc physical shorts get squeezed out by backwardation

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).