Industrial Metals Monthly: Dim global economic growth clouds metals outlook

Our new monthly report looks at the performance of iron ore, copper, aluminium and other industrial metals, and their outlook for the rest of the year

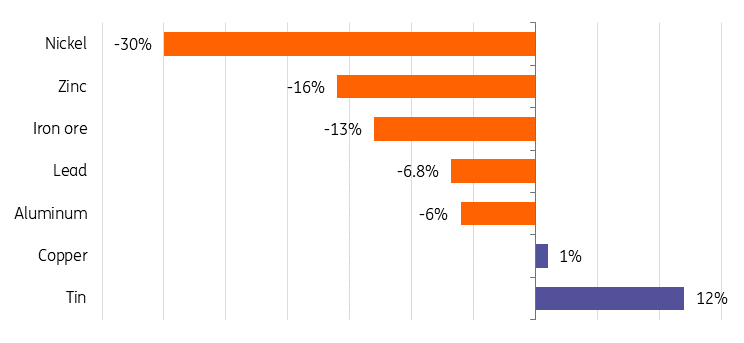

Industrial metals struggle in the first half of the year as China demand disappoints

(year-to-date metals performance)

China’s economic activity loses more steam in July

Prices for industrial metals remained mostly volatile in the first half of the year amid an uneven economic recovery in China.

Beijing has set a cautious growth target of 5% this year, the lowest in decades. In the second quarter, the economy added 6.3% compared with the same period last year, when Shanghai and other big cities were in strict lockdown, but growth was just 0.8% in quarter-on-quarter terms.

Last month’s data releases offered new evidence that China’s overall economic momentum was weak at the start of the second half of the year, but have also raised hopes of more government stimulus measures as the top metal-consuming country slides into deflation. China’s consumer and producer prices both declined in July from a year ago as demand has continued to weaken. The consumer price index dropped by 0.3% last month from a year earlier, while producer prices, which are heavily driven by the cost of commodities and raw materials, fell for a tenth consecutive month, contracting by 4.4% in July from a year earlier. This marks the first time since November 2020 that both consumer and producer prices registered contractions.

Meanwhile, the manufacturing and property sectors, which are crucial for industrial metals demand, are struggling to turn around. Manufacturing activity in China contracted again in July, proving that the economy’s recovery remains under pressure. China’s official manufacturing PMI climbed to 49.3 in July, from 49.0 in June. The sector has been in contraction since April. The Caixin manufacturing PMI fell back into contraction, dropping to 49.2 in July, from 50.5 in June, reflecting flagging demand for Chinese exports. Similarly, China’s property sector continues to struggle. In June, home sales dropped by 18% from a year earlier, while residential construction fell by 10%.

Overall, China’s post-reopening recovery has disappointed so far this year.

Chinese government continues to promise more support, including for the beleaguered property sector, but measures have lacked detail so far. At last month's Political Bureau of the Communist Party of China's Central Committee meeting, the announcement of continued stimulus for China's economy lifted metals prices toward the end of July. However, the optimism quickly subsided as the scale of the stimulus promised was somewhat disappointing and details are yet to emerge of specific policy steps that would benefit industrial metals.

We believe metals will stay under pressure in the second half of the year as the sluggish recovery in China will likely continue to weigh on demand, with most industrial metals remaining dependent on economic stimulus from the world’s biggest consumer of metals. However, if China introduces stimulus measures, in particular for the property sector, this will boost metals demand and support higher prices.

We believe that any improvements in metals prices will depend on the eventual implementation of China’s stimulus measures and actual demand improvement.

China’s recovery is showing fatigue

Weak trade data highlight struggling recovery

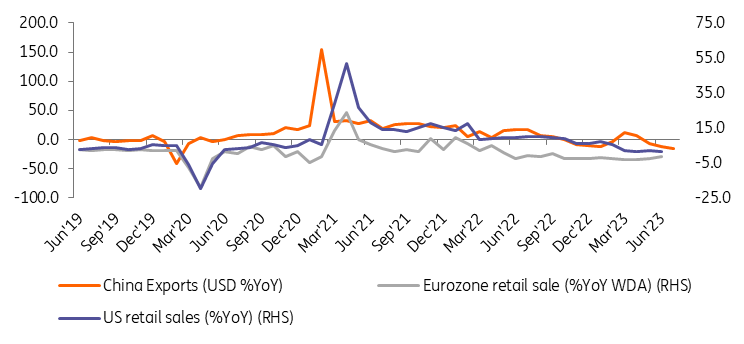

Plunging trade in July fuelled more concerns about China's growth prospects. Exports fell by 14.5% in dollar terms last month from a year earlier, the worst decline since the start of the Covid-19 pandemic in February 2020. Imports contracted by 12.4%, reflecting weak domestic demand, leaving a trade surplus of $80.6bn for the month.

Flagging industrial activity also capped China’s metals imports. Iron ore imports fell by 2.1% in July to 93.5 million tonnes, a three-month low, as steel output declined over the month.

Copper ore imports slide to nine-month low

Imports of unwrought copper and products fell by 3% on a daily basis in July to 451,000 tonnes. They are now down 11% year-to-date. Meanwhile, copper ore imports slid to a nine-month low. The premium paid for refined metal at the port of Yangshan, which acts as a measure of import demand, has been on a downtrend too. It recently stood at $31.50/t, down from its record highs of $152.50/t in October last year.

Weak external demand remains a challenge for China's recovery

Global economic outlook remains dim

World manufacturing PMIs also continued to struggle in July, mostly staying below the expansion level. This ongoing weakness, especially in the US and Europe, continues to be a drag on demand for industrial metals. Although China dictates most of the industrial metals prices, weak external demand also caps gains.

In the US, while economic data releases in July indicated that the consumer price index dipped to its lowest in June since March 2021, the US Federal Reserve proceeded with a 25 basis-point interest rate increase at its July meeting. And at the start of August, Fed policymaker Michelle Bowman said more rises may be needed in the inflation battle after a mixed jobs report, further dampening demand for industrial metals.

Manufacturing PMIs stagnate globally

China property woes depress iron ore prices

Iron ore prices remain volatile, ending the first half of the year 4% lower than at the start of the year. Prices at the SGX hit the lowest level in May since November 2022 at around $89/t. However, renewed optimism over stimulus from China pushed prices higher again in June. Prices remained elevated throughout July and ended the month at around the same level they started the month, above $100/t.

The first week of August saw renewed concerns over China’s stimulus for the steel sector following a proposal from the China Iron Ore & Steel Association to cancel night trading as Beijing looks to ease volatility in industrial metals, with iron ore prices collapsing below $100/t.

Since the start of the year, the National Development and Reform Commission (NDRC) and other authorities have been enhancing the collaborative supervision and regulation of the iron ore market and have cracked down on price gouging, excessive speculation, and illegal activities.

Previously, government interventions to calm the markets have included subduing trading and ordering steel capacity cuts. If we see similar measures used again, this could add further downside pressure to our view.

Adding to iron ore’s headaches are reports of Chinese authorities mulling potential steel production cuts in the second half of the year. The NDRC is reportedly considering setting a crude steel production cut target for 2023.

Chinese steel output has declined over the past month

CISA daily average crude steel output at member companies (10,000 tonnes)

Any steel output cut would add to bearish risks for the iron ore market, while the seaborne supply side is showing signs of strength with major producers reporting robust production numbers and exports from Australia and Brazil remaining elevated.

We believe the outlook for iron ore remains bearish in the short term amid sluggish demand from China’s steel-intensive property sector. The pledges from Beijing to support the economy are underwhelming for now and support for the real estate sector is not likely to translate into large-scale property development that would revitalise steel demand in the country and lift iron ore prices.

We believe prices will remain volatile as the market continues to be responsive to any policy change from Beijing.

Copper warehouse stocks remain historically low

(thousand tonnes)

Like iron ore, copper prices are driven by economic policies from China and other major economies. LME copper prices had a strong start to the year as China's reopening boosted the outlook for demand. Copper was one the biggest winners following China’s reopening amid expectations that China’s support for the property market would kickstart demand for industrial metals. But prices quickly turned as that optimism faded, remaining mostly rangebound since February. Copper prices ended the first half of the year flat from where they started the year.

Since May, prices have mostly been on an upward trend. Copper was lifted in the first half of July by the US dollar dropping to a one-year low on the release of a positive June inflation number and prices remained elevated throughout the month trading mostly above $8,400/t. However, in recent weeks, copper has been struggling for direction amid an uncertain path of US rate hikes and China’s lacklustre economic recovery. LME prices dropped to a one-month low following worse-than-expected July trade data from China.

However, the supply side remains supportive of copper prices – total warehouse stocks at the LME, COMEX and SHFE remain historically low. Refined copper exchange inventories are now at the equivalent of just two-and-a-half days of global consumption. This sets up the market for squeezes and spikes in prices if we see demand improving sooner than expected.

For example, weekly copper stockpiles reported by the SHFE dropped by 15% last week and remain below the seasonal average. These critically low levels of Chinese inventories could be partially explained by weaker supply out of Chile, the biggest producing nation. The country saw its July copper exports come in at the lowest level since January, suggesting that Chilean operations continue to suffer project delays and mine setbacks. Chilean state copper producer Codelco has reduced production guidance to between 1.31 Mt and 1.35 Mt for 2023, from a previous 1.35 Mt and 1.45 Mt. Codelco's production drop has been systematic for the last three years.

We remain cautious about the short term for copper, with sluggish demand from China pointing to lower prices. We believe in the near term, copper prices are likely to continue to be dictated by the pace of China’s economic recovery as well as the Fed’s interest rate hiking path. However, we believe low levels of global visible stocks are likely to prevent prices from significant decreases until copper consumption improves again.

| 2.5 |

global copper stocks as days of consumption |

Aluminium supply side woes ease as Yunnan restarts

July was the first month this year that saw LME aluminium prices closing the month higher than where they started. Prices closed at a similar level to their peak within the month.

However, the fundamental picture for aluminium has not changed. Instead, the July price increase came amid a softer US dollar and hopes of more stimulus from China. The start of August saw LME prices moving lower again.

On the supply side, we expect output to grow fast in China. The power supply in Yunnan improved significantly from May with the arrival of the rainy season. By late July, around 1.1Mt of capacity restarted in Yunnan, and we believe the resumption of Yunnan capacity remains the key headwind for aluminium in the near term. However, if the upcoming dry season has insufficient rain, output could be cut again with a lack of hydropower leading to rising Chinese imports.

China's primary aluminium production (1000 metric tonnes)

In Europe, however, we don’t expect major restarts before 2025, while demand for aluminium remains weak. Europe suspended around 2% of the global total capacity by the end of 2022 as power prices surged. And although power costs have now eased, only one smelter has restarted so far this year. Meanwhile, Norsk Hydro recently said it does not plan to restart the aluminium output it curtailed during the European energy crisis while market conditions remain weak.

Chinese aluminium exports drop on weak global demand

On the demand side, Chinese exports of aluminium products did not improve in July, signalling weak demand for aluminium products globally. China exported 489,700 tonnes of unwrought aluminium and aluminium products, a drop of 24.9% year-on-year and down 0.6% month-on-month. The cumulative export from January to July 2023 is now at 3.29 Mt, which represents a decrease of 20.7% from the same period last year.

In the near term, we believe aluminium prices will remain volatile as the market’s focus will stay on the bigger macro-economic picture with flagging global growth weighing on aluminium demand.

We expect prices to start recovering in the fourth quarter on the improving global economy, which will lead to stronger aluminium demand growth. However, the recovery will be slow as demand will only start improving substantially before next year.

ING Forecasts

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more