Industrial metals on a roll

Through the equity turmoil, inflation rollercoaster, and collapse in crude, metals have largely held on to their multi-year highs. The macro money in December rebased prices to levels that have now firmly stuck in and we raise our forecasts for the year according to this new normal

Oil-metals correlation is short-lived

In December 2017, a flow of macro money rebased metal prices to new highs as funds allocated to the most liquid contracts:

- Aluminium breached $2,200

- Copper above $7,000

- Oil pushed through $65 on its way to above $70

The common flows into hard assets amid a falling dollar and rebounding inflation had briefly heralded the return of correlation in commodities. Given our bearish call on oil, which proved correct, we had expected copper to follow suit and come down closer to those fundamental levels required for incentivising new supply. Indeed, money was starting to retreat even before the equity sell-off but the whipsaw trading that followed has seen such a dramatic short covering and fresh allocations at the higher levels, that those past flows now look redundant.

Our economists expect more pain for the dollar (1.30 to the EUR by year-end) and US inflation to rise to 3% by the summer which should keep the reflationary theme intact for some time.

December fund inflows drove metals and energy together

In December, metals and oil were positively correlated for the first time since July 2017. In both months, net money manager positioning rose across the complex.

Rethinking copper

Copper quickly shrugged off the sell-off in oil and equities and is holding its ground above $7,000/mt so we are raising our forecasts for Q2 and Q3 as the seasonal tightness and positive economic backdrop should provide support from here. We are below consensus from Q4, however, as there is room to disappoint the bulls counting on high strike losses and tight fundamentals to remain mostly upstream.

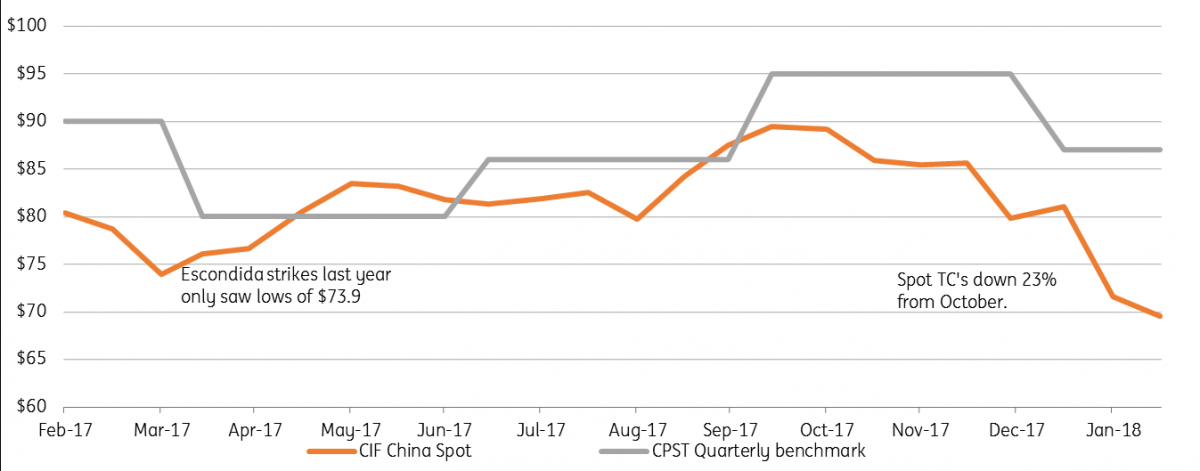

All current signs of tightness in copper markets are in the upstream markets. Premiums, wide contango’s and large exchange stock inflows demonstrate that refined metal is currently ample. Treatment and refining charges have meanwhile slid 23% since October to $69.50/dmt, which is even below the March 2017 lows when both Escondida and Grasberg suffered outages. We think it is the perception of high strike losses rather than current tightness that is driving concentrate bids so low. This is in addition to traders undercutting smelters given the wide contango for financing.

Strikes aside, we do expect the concentrate market to remain tight this year and next but this is in large part due to a major expansion of smelter capacity. Smelter capacity, largely from China, will rise over 5% this year compared to only 2% refined demand growth. Smelter utilisation will be lower because concentrate supplies are too low to feed the higher capacity but the refined output will not so massively underperform demand. By Q4, fund allocations could show fatigue as the tight fundamentals remain mostly upstream, especially if wide contangos continue eating into profits.

When we wrote our 2018 copper outlook, we felt markets relied on higher strike losses to justify prices above $7,000. Reflationary themes and asset rotation have since taken centre stage so now we don’t see as much near-term downside risk as more labour negotiations resolve. We note positive newsflow negotiations at Centinela and Los Pelambres plus Codelco recently settled at Andina. Talks at the mammoth Escondida still seems gridlocked with a splinter union being dismissed by the larger, but we question the appetite for either miner or workers to experience another lengthy strike, and there is still four months to go. Along with Grasberg, we expect these two mines alone to bring a +300kt increase of concentrate supply this year. Conversations regarding the 51% divestment via a Rio stake sale increase the government’s interests in the smooth running of this mine.

Copper TC's running ahead of actual tightness ($/dmt)

Potential Q4 weakness

The higher price environment is economically justified by the need to incentivise new mine supply ahead of large post-2020 deficits. However, we are now actually somewhere above that floor which is closer to $6,800. Indeed, even in February expansions/extensions have been approved at Los Pelambres, Collahuasi and Cobre Panama. Whilst the macro flows have served to rebase prices at higher levels, they do nonetheless look high on this fundamental backdrop.

Mine supply responses majorly lag but scrap has the proven ability to cap gains in the market as material is sold off from yards. Last year saw lower demand growth because a flood of scrap supplies cannibalised demand. Supporting our decision to raise price forecasts is the fact that whilst prices have notched higher and ex-China scrap supply is ample (especially for low-grade qualities), scrap markets are stable. MB reports US #1 and #2 scrap discounts at the end of January are actually at the same level as November. Chinese restrictions have also seen discounts there slide to lows not seen since August.

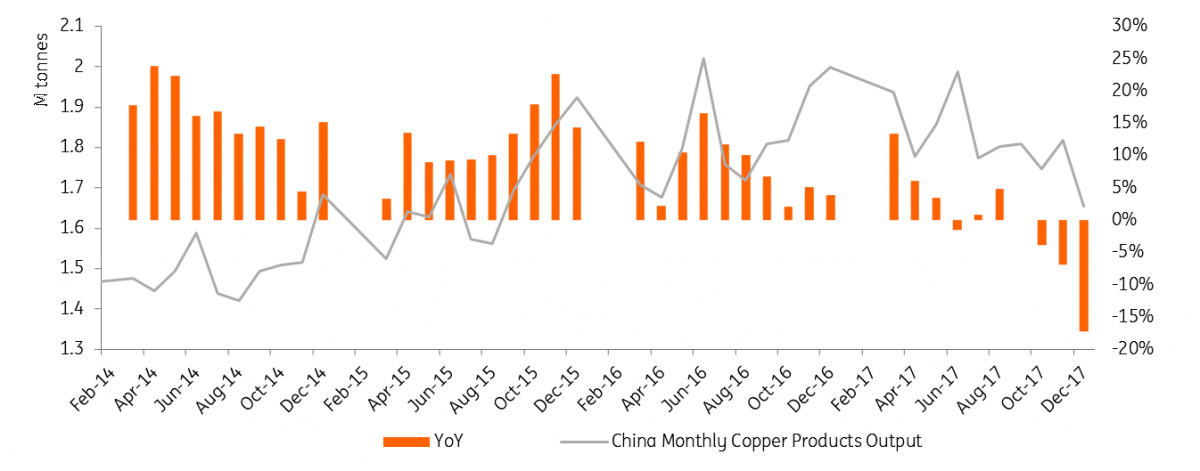

Given the lack of a short-term supply response, good demand prospects from economic growth seem set to push prices above this fundamental floor for sometime though we are cautious that a seasonal pullback in Q4 could see this momentum tested. In Q4 2017, China’s copper products output was down 10% YoY, which suggests the winter curbs on manufacturing and construction are bringing more extreme seasonality into the market. At the same time, the output of cathode surged to meet annual targets. The potential for a cathode stock build and demand lull during this year’s winter months could see expectations rebase once more, especially if the refined deficits have not yet been sufficient to change the key downstream indicators.

China copper products output dips in Q4

Aluminium gets 232 boost

Prior to Friday’s US 232 announcement, aluminium was suffering the most from the equity market sell-off, down 2% through February, but it has recovered back above $2,200 since it was revealed that the US Commerce Department is recommending a wide array of import tariffs. The report has suggested a blanket 7.7% duty across both primary and aluminium products with more severe treatment for China/Russia/Vietnam. President Trump has until mid-April to decide and the stakes are high.

The US premium had briefly looked like its surge had hit a peak. On Thursday the CME forward curve was flat at 13c/lb for the year but Friday’s news saw April 2018 onwards leap to 15c/lb. A 7.7% duty suggests around an 8c/lb increase to the US premium but we do expect a portion of this was already priced in. Freight has been the other driver lately and weekly truckstop data showed Midwest prices were down 13% from their peak but even so premiums had kept rising.

In our 2018 aluminium outlook note, we had suggested the metal might be prone to more liquidation near-term as Chinese exports look to stay high. A deficit ex-China market promises to ultimately drive a tight LME market higher, as we forecast almost 2Mt of annual deficits in each of the next two years. That LME tightness was evident in the Feb-March backwardation, which expired at a massive $50b yesterday with the power to squeeze out any remaining shorts.

Since mid-February, the backwardation has drawn in a hefty 310kt into Asian sheds. We saw similar trends in 2016 and given the very high US premiums, it is likely this material will also be cancelled and sent to the states. As trade taxes loom, prudence would suggest to move the stock sooner rather than later. We have been surprised to not yet see Asian (MJP) premiums stronger, which has aided the flows on to the exchange. High Chinese semi-finished exports including fake coils are depressing the market but as the stock flows east, the premiums should play catch up.

LME Aluminium Cash-3M hits huge backwardation ($/mt)

Iron ore: quality control

China continues to surprise with the rigor of its supply reform of the steel sector. We remain long-term iron ore bears based on oversupply but we are pushing back our forecasts for prices below $60/t because profitable steel margins look set to support higher grade qualities for a while longer.

High margins support near-term but oversupply beckons

Beijing has announced it will bring forward its 2020 goal of cutting 150 million tonnes of capacity. Following 115Mt of cuts through ‘16/17 (plus 120Mt of lower quality steel/induction furnaces) that leaves a target of 35 million tonnes for the year. On our expectation of a mild 0.6% increase in Chinese crude steel production, this would see utilisation rates averaging above 80% for the first time since 2011. This will support healthier mill margins/purchasing power and the incentive to maximise output through higher quality ores. In addition, steel mills in Tangshan have confirmed they will extend the winter cuts in some form beyond March. Full details are pending and they will likely not be as strict as the winter cuts but given over 10% of Chinese production resides in the city, there is room for upside.

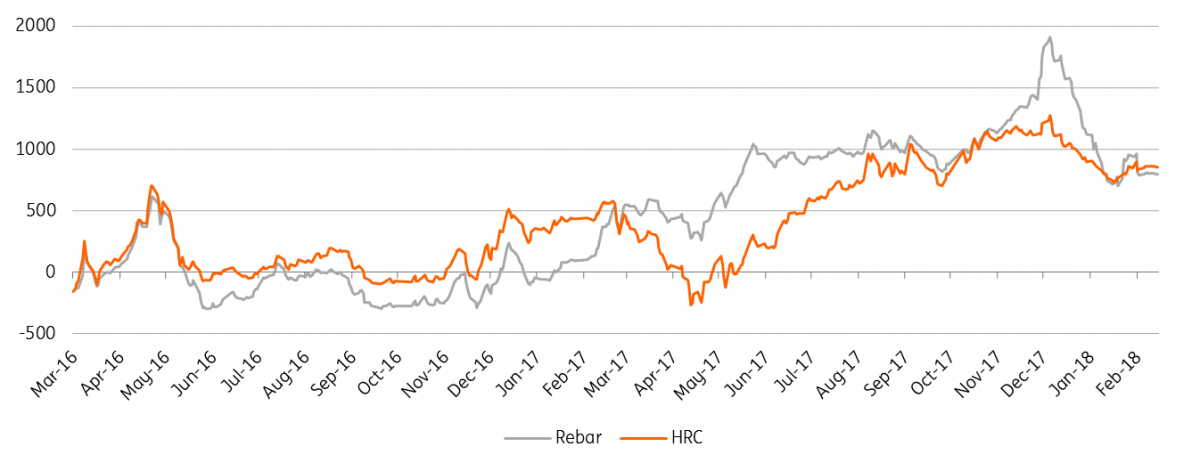

Steel margins have stabilised after sliding slightly through Dec- Mid Jan. At 800 CNY/mt flat rolled margins are in a different world from the minimal to negative rates pre-2017. Rebar profits have more than halved since December but this mostly represents a cooling of the excessive speculation that had inflated SHFE rebar prices. Steel rebar inventories are also seasonally low following the winter cuts but the MTD increase has been a steep 36%. Should stock levels remain low as construction demand picks up into Q2, we could see volatile up-shoots on SHFE like was seen in 2016.

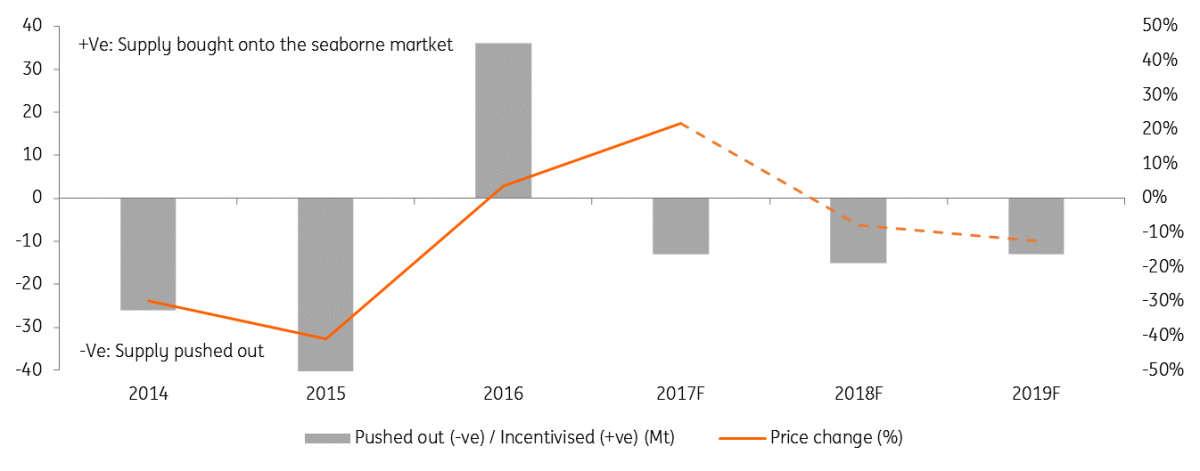

As Chinese mill restocking rolls over after the Lunar New Year, we do expect prices to start to soften but high profits should support the 62% grade prices comfortably above $60/t. Longer term we do revert to our original view that oversupply will pressure prices. China is nearing 'peak steel', which along with higher scrap rates means import demand has practically peaked. On the other hand, the big four will alone add 40Mt next year, 60Mt with Roy Hill. Some 30Mt will therefore need to be displaced from the seaborne market through the next two years. This is already factoring a collapse in Indian exports, which seems more likely following the recent cancellation of mining licenses in Goa.

Chinese steel mill profits stabilise at high levels (CNY/mt)

Iron ore oversupply to push out 30Mt next two years

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).