Indonesia: Central bank’s “burden-sharing” deal unlikely to stoke inflation

In a bid to limit financing costs for the Covid-19 response, Bank Indonesia (BI) will be buying up bonds in the primary market at discounted rates

Indonesia taps central bank to “ease the burden”

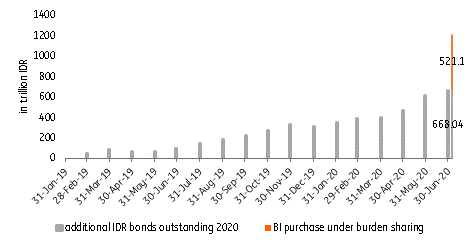

With the government’s response to the ongoing pandemic ballooning to IDR 695.2 trillion, Finance Minister Sri Mulyani Indrawati tapped the central bank to help ease financing costs, with Bank Indonesia (BI) asked to purchase bonds in the primary market at discounted rates. BI had previously received provisional authority from the President to purchase bonds directly from the primary market to help rein in borrowing costs at the height of the risk-off episode in April. The recent “burden-sharing” arrangement between BI and the Ministry of Finance goes a step further, with the central bank buying IDR 397 trillion worth of bonds to fund social spending at BI’s policy rate. BI will also participate in the purchase of a second bond worth IDR 123 trillion, which would fund loans for small and medium-sized enterprises with the central bank also taking on a portion of financing costs. All interest earned would however eventually be returned to the government with the central bank monetising government debt.

Additional outstanding IDR bond issuance 2020

Level of outstanding IDR bonds at end 2019: IDR2,437 trillion

Market players initially spooked by new arrangement

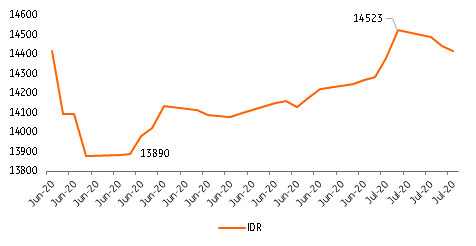

Sentiment soured somewhat on Indonesia in the past week with investors turning increasingly wary about the much-anticipated BI-finance burden-sharing arrangement, with the Indonesian rupiah knocked back by 1.6% in early July ahead of the announcement. Concerns about the new scheme centred on central bank independence with BI’s profitability taking the direct hit from the agreement. Furthermore, the resulting infusion of liquidity from the bond purchases was expected to stoke inflationary pressure and spark IDR depreciation. Authorities moved to allay concerns, assuring investors that the scheme would be in place only for 2020 due to the pandemic and that both the central bank and government would “maintain fiscal and monetary prudence to ensure macroeconomic credibility”.

IDR movement June - 7 July 2020

BI’s bond purchase arrangement not likely to stoke inflation but IDR will come under some pressure

Indonesian authorities have sidestepped concerns about the burden-sharing arrangement setting a precedent for future debt monetisation for now, but investors will be wary if the scheme is extended beyond 2020. The profitability of the central bank will definitely take a hit, but given the circumstances, and with other global central banks unloading unconventional monetary policies, investors will likely give the central bank the benefit of the doubt for now. In the near term, price pressure from the imminent infusion of liquidity will likely be marginal given the depressed state of economic activity, with inflation currently at the lower end of the central bank’s target of 2-4%. Economic growth will contract in 2Q and remain subdued for the balance of the year and consequently, we agree with BI Governor Perry Warjiyo that inflation will likely settle within target in 2020 even with the liquidity infusion from the burden-sharing bond purchases. We do, however, expect the IDR to come under some depreciation pressure in the near term which will likely be offset by a sustained triple intervention by the central bank. A renewed weakening bias for the IDR may mean Governor Wariyo shelves plans for a further rate cut for now.

Download

Download article

9 July 2020

Good MornING Asia - 9 July 2020 This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more