India: Weak growth paves way for bigger rate cut

The Reserve Bank of India’s Governor Shaktikanta Das is determined to ease for as long as it takes, particularly now that weak investment has pushed GDP growth lower. We expect a bigger, 40 basis point rate cut this week (consensus 25bp) and we're cutting our full-year growth forecast

| 4.75% |

ING forecast of RBI repo rateAfter 40bp cut this week |

Stimulus so far failed

Has stimulus failed to revive the Indian economy? It seems so, judging from headline GDP growth, which slipped further to more than a six-year low of 4.5% year-on-year in 3Q19 from 5.0% in 2Q, marking the seventh consecutive quarter of slowing growth.

Fiscal stimulus was evident from a near-doubling of government spending growth (15.6% YoY vs. 8.8% in 2Q) and also from a pick-up in private consumption growth (5.1% vs. 3.1%). Even so, a large part of the fiscal stimulus was pumped in the last quarter itself, and we have yet to see the full impact of that. This left investment as the main drag on GDP growth, subtracting one full percentage point from the GDP total, which tells us that aggressive RBI easing (by 110 basis point rate cuts through August) hasn’t worked either.

On the supply side, there was a slowdown across all key industrial sectors (mining, manufacturing, and utilities) and also as in construction activity. Agriculture and services growth rates, 2.1% and 6.8%, respectively, were little changed from the previous quarter.

Where is stimulus?

More is on the way

At 4.8%, growth in the first half of the current fiscal year (FY2019 started in April) has made the government’s 7% full-year growth forecast utterly unrealistic. The central bank's (Reserve Bank of India, or RBI) forecast of 6.1%, revised in October from 6.9% (and likely to be nudged down again this week), is also far out of reach now. Dismal data, coupled with reduced hope of any recovery in the remainder of the fiscal year, leads us to cut our FY2019 forecast by half a percentage point to 5.1%.

The stimulus tap should remain open and we don't have to wait too long.

The RBI’s Monetary Policy Committee is meeting this week and it will announce the decision on Thursday, 5 December. There is little doubt that it will ease again. And don’t be surprised if it’s another big rate cut, perhaps equal to the 35bp cut at the August meeting, or even more. We think a 40bp cut is probable, taking the repurchase rate to 4.75% and reverse repurchase rate to 4.50%. We don’t anticipate any change to the 4% reserve requirement ratio for banks.

An extended RBI easing cycle

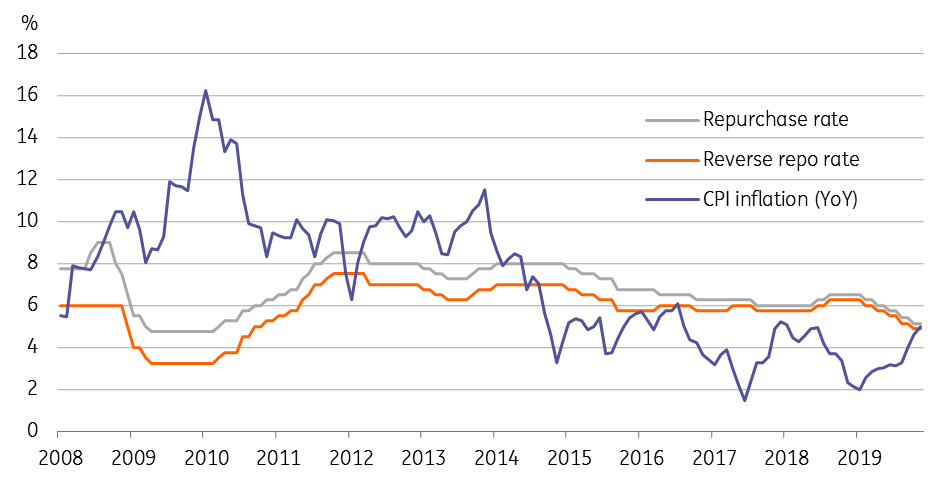

Will that be all the RBI easing in the current cycle? If historic lows in the policy rates are any guide – 4.50% for repo rate and 3.25% for the reverse repo rate at the height of the 2009 global financial crisis – we could see these levels again given the current state of the economy and dull outlook ahead. However, it may take a continued slide in growth over coming quarters, which is not our baseline, as growth will likely get some lift from here, at least from a favourable base.

What about inflation, which has surpassed the RBI’s 4% target (mid-point of 2-6% range) for three months through November? Again, looking back in time, inflation hasn't been a hurdle to RBI easing, even when it was running in double-digits. We think the same is true this time around. Therefore, with growth outweighing inflation as the policy driver, we expect the RBI to extend the easing cycle into 2020 with one more 25bp rate cut in February, possibly marking an end of the current cycle.

Against such a backdrop, the Indian rupee's weakening seems to be far from over. We revise our end-2019 USD/INR forecast to 72.50 from 72.00 and now see the pair re-testing 73.00 by March 2020 (spot 71.72).

Inflation hasn't been a hurdle for RBI easing

Will it help?

The question is, what good will that do for the economy? Besides the cyclical element, we believe structural bottlenecks are reasserting themselves in dragging down growth.

We think the economy needs more than fiscal or monetary stimulus. Accelerated economic and banking sector reforms and strong infrastructure investment are needed to regain the 7-8% growth potential". Absent this, Prime Minister Narendra Modi’s vision of boosting India to be a $5 trillion economy in five years (over his second term) will be something of a pipe dream.

Download

Download article

3 December 2019

Good MornING Asia - 3 December 2019 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).