India: First test of RBI’s latest policy inaction

September inflation data today comes as the first test of the RBI's decision a week ago to leave monetary policy on hold. Besides the central bank's inaction, nothing from the government side has worked so far to prop up the rupee, prompting yet another upward revision to our end-year USD/INR forecast to 76.5 from 75.0

| 4.1% |

ING inflation forecast for September |

Inflation to bounce back above 4% in September

Today's release of Indian consumer price inflation data for September will be the first test of the central bank’s (RBI) decision a week ago to leave its interest rate policy on hold. Even though inflation slowed sharply in July and August, that was more of a function of base effects than any underlying price weakness.

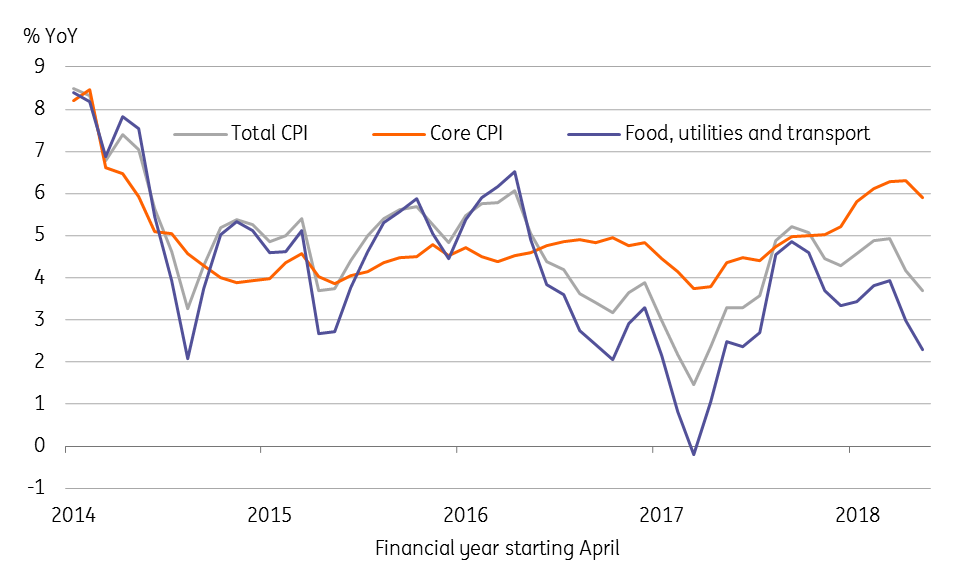

Food, utilities, and transport have been standout drivers of lower CPI inflation in recent months (see figure). But month-on-month increases in these components have been positive since April and likely have been sustained in September, boosting the headline back above 4% from 3.7% in August. The August print was the lowest point in 10 months. Core inflation has been running at around 6%, which is where we expect it to stay.

Consumer price inflation

A reactive rather than proactive central bank

Even as the RBI shifted its policy stance from ‘neutral’ to ‘calibrated tightening’, we believe it grossly underestimated the potential inflationary pressure from higher global crude oil prices, which undoubtedly will be compounded by a historically worse INR exchange rate. Not a proactive policy by a central bank.

And given an underlying policy lag, even if the RBI responds to high inflation in the future with rate hikes (we continue to forecast a 50 basis point rate hike at the December meeting), that’s not going to be timely medicine, while growth will also come under pressure from the global trade war, weak private consumption due to high inflation, and crowding out of private investment from a widening fiscal gap. Also due today, industrial production data for August will provide a sense of GDP growth in 2Q FY2018-19.

And lack of government policy support for rupee

As we noted earlier, the RBI inaction on the rupee has put the ball in the government's court. Yesterday Bloomberg quoted India’s Economic Affairs Secretary Subhash Garg as saying that the economy was strong on most counts – fiscal deficit, inflation in control, reserves fine, exports good -, and that the government has tried to deal with the current account gap with measures on imports. Alas, nothing has worked so far, prompting a further upward revision to our end-year USD/INR forecast to 76.5 from 75.0 (spot 74.1).

Download

Download article

12 October 2018

Good MornING Asia - 12 October 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).