India: A stunning economic performance despite all woes

India’s record GDP growth may open the door for aggressive central bank (RBI) policy rate hikes to prevent the currency (INR) from depreciating and inflation from rising further. However, we believe INR’s troubles are far from over and maintain our view that the currency weakens to the 71.5 level against the USD by end-2018

| 8.2% |

GDP growth in 1QFY19Probably the fastest in the world |

| Higher than expected | |

An astonishing GDP performance in 1QFY19

Conventional wisdom falls apart when an economy with many difficulties – persistently high inflation, lingering adverse effects of twin shocks of cash bans and consumption tax, widening twin-deficits (trade and fiscal), ongoing banking troubles and a battered currency – grows at such an astounding pace.

Contrary to the consensus of a slowdown, India’s GDP growth accelerated to 8.2% year-on-year in 1QFY19 from 7.7% in the previous quarter. This is the fastest rate in more than two years and probably the fastest rate in the world currently. The outcome was far better than the consensus centred on a 7.6% figure, and our 7.0% estimate.

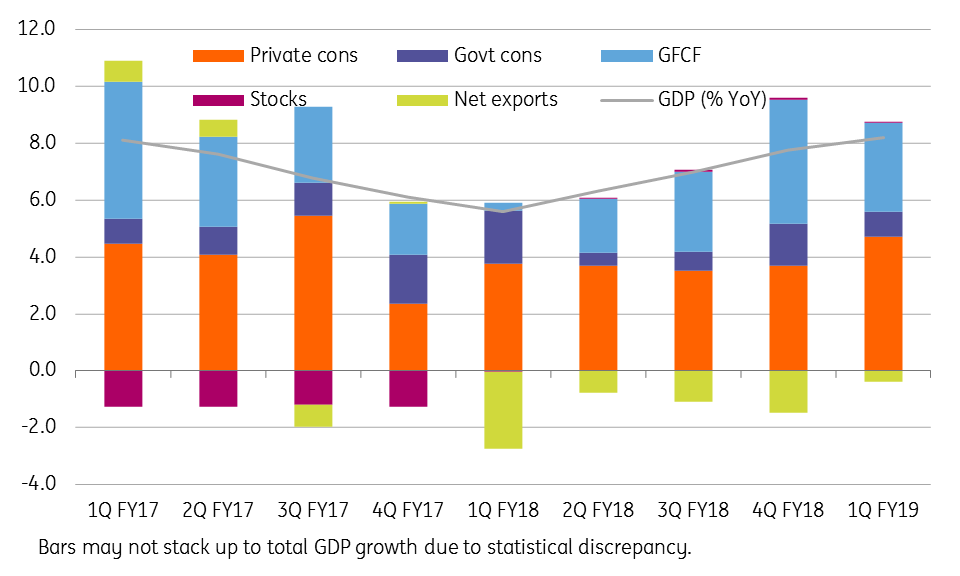

Private consumption was the main driver with an improved contribution of 4.7 percentage points of total GDP growth (up from 3.7ppt in the previous quarter, see figure below). This is the highest contribution since 4QFY17 when de-monetisation hit consumers hard and was at odds with persistently high inflation and complicated consumption tax reforms. The firmer private consumption more than offset the slowdown in government consumption and fixed capital formation. Net exports remained a drag on GDP growth for the fifth straight quarter, though smaller than before. On the industry side, manufacturing powered the GDP.

On the statistical factors, we can give some credit to the low base-year effect in boosting the year-on-year growth; the late-2016 de-monetisation depressed GDP growth to a four-year low of 5.6% in the year-ago quarter. However, the high base-year effect will be at work to depress GDP growth in the remainder of the year. We forecast full-year FY19 growth of 7.2%, below the central bank’s (RBI) 7.4% and the government’s 7.5% forecasts.

Expenditure-side sources of GDP growth

And yet deteriorating public finances

Also released at the same time as GDP data late Friday, the government budget deficit widened to INR1.1tr in July from INR835bn in the previous month. The highest July deficit on record, up 76% from the same month last year, took the cumulative deficit in the first four months of the fiscal year to 87% of the full-year budget target.

The derailed fiscal consolidation last year is unlikely to be back on track this year, justifying the warning by rating agencies of another overshoot of the deficit above the 3.3% of GDP target. And there are more reasons to expect this as looming elections will move the ruling administration to spend more.

What this means for central bank policy, and the INR?

We think two key questions the latest data pose are: Will strong GDP growth help to stimulate foreign investors’ confidence in the Indian economy and halt a free-fall of the INR? And, will this also open the door for more aggressive RBI policy tightening to stem the currency weakness and keep inflation in check? We are skeptical of the first; INR isn’t quite out of trouble from adverse domestic economic factors, let alone external contagion. But we are hopeful about the second.

We maintain our view of the RBI hiking rates again at the next scheduled meeting in early October, possibly a double-up (50 basis point) hike or even an inter-meeting hike if the ongoing external contagion drags the currency for even more depreciation. That said, we continue to see more upside than downside risk to our USD/INR 71.5 end-year forecast. But for today, we can expect some knee-jerk strengthening of the currency, as markets had no chance to respond to the data released after the close of trading on Friday.

Download

Download article

3 September 2018

Good MornING Asia - 3 September 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).