How meaningful will Tuesday’s vote be for GBP?

The FX market thinks tomorrow’s meaningful vote is a big deal and expects volatility sooner rather than later. That said, short positions in GBP are around 40% smaller than they were at the time of the last meaningful vote and we suspect GBP/USD may struggle to break above the 1.33 area over the coming weeks

What’s priced this week?

It’s a big week for Brexit, and UK parliament looks set for a series of votes on what it really wants from Brexit. Will it approve May’s deal tomorrow, confirm it doesn’t want a 'no-deal' Brexit on Wednesday and formally back an Article 50 delay on Thursday? Or will the EU’s final answer not emerge until the EU Council meeting on 21- 22 March? Please see James Smith’s latest thoughts on the process.

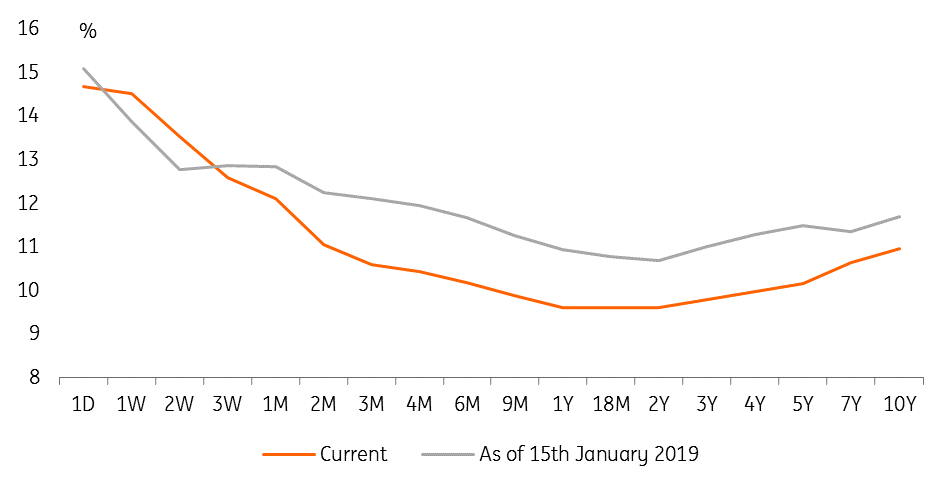

Despite various event paths, participants in the FX options market think we’ve now reached crunch-time. The term structure of the GBP/USD volatility curve is now steeply inverted and shows a market prepared to pay higher prices for implied volatility (insurance in the FX market) for the next two-three week period than any timeframe much longer.

The expectations in the FX options market can also be viewed in terms of GBP/USD pricing, where over the next two days a move over 140 USD pips, i.e. 1.3190 or 1.2940 away from the current spot price of 1.3050, would be required to deliver a larger move than is currently priced.

The market is prepared to pay more for short term GBP volatility

How does current positioning compare to the last meaningful vote?

On 15 January, prime minister Theresa May lost the last meaningful vote on a withdrawal deal by a massive margin of 230 votes. GBP/USD stayed supported after that vote, rallying from around 1.29 to 1.33 by the end of February.

Heading into that January vote, speculators were reasonably short GBP. Net short GBP positions represented close to 30% of the Open Interest (total open contracts) on the futures exchange in Chicago. Since then, short GBP positions have been cut around 40%, reducing some of the pressure for a possible short squeeze.

There are of course many paths which GBP could take, but for the time being we’re happy with the levels we outlined in our 26 February article, Delaying Brexit. And we tend to think it's too early for the 9-12 month Article 50 delay to emerge, such that 1.33 (consistent with our short delay scenario) may be the best levels for GBP/USD over coming weeks.

Speculators have reduced their GBP short positions

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more