Higher-for-longer rates narrative takes the shine off gold

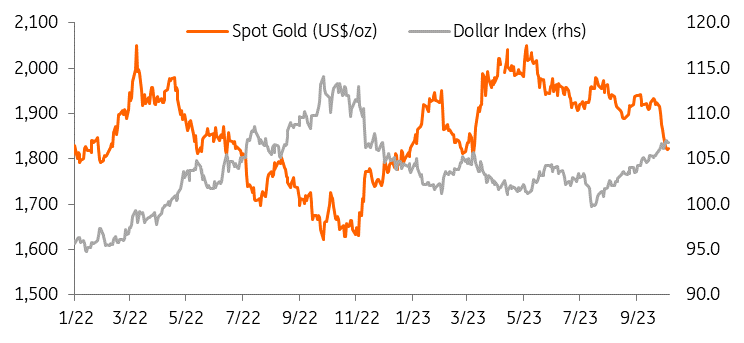

Gold plunged to its lowest level since March this week - edging closer to US$1,800/oz, as Treasury yields moved higher and the USD strengthened

Rising yields, dollar strength weigh on gold

A still hawkish Federal Reserve, strong dollar and higher yields are weighing on gold. US 10-year Treasury yields hit their highest levels since 2007 this week, whilst the USD index is at its strongest level since November 2022.

The higher-for-longer narrative has been putting significant pressure on gold, with prices slumping 4% last week, in what was the worst weekly drop since June 2021.

Both higher rates and yields are typically negative for non-interest-bearing gold.

Gold is now down more than 11% from its year-to-date highs above $2,000/oz hit in May.

This has led to a significant reduction in investment appetite reflected by the large declines in gold ETF holdings which have been sliding since May. ETFs saw outflows equivalent to eight tonnes of gold on Monday, according to data compiled by Bloomberg.

Meanwhile, hedge funds trading Comex futures cut bullish gold bets to a five-week low.

With Fed policymakers indicating they will keep policy tight for a long period and the US dollar and Treasury yields strengthening, gold is likely to face more headwinds in the fourth quarter.

Investors shun gold

China remains the largest net importer of gold, with an additional 29 tonnes purchased in August by the country’s central bank. This marked the tenth month of gold purchases in a row.

So far this year, China has imported about 900 tonnes of gold, which is the highest in five years.

China’s gold buying remains strong

There is likely to be more appetite for gold from Chinese consumers after Beijing eased gold import restrictions. Over the past few weeks, local prices jumped to a near-record premium compared to those on the international market amid a supply squeeze following China’s central bank curbs on gold imports that were introduced in August. Last month, the premium had risen to a record of over $120/oz. That premium has now narrowed, closing the gap with international prices.

The curbs on gold shipments, which reduce the need for local banks to buy dollars, are part of the measures imposed by Beijing to defend the renminbi.

Meanwhile, Turkey resumed central bank purchases in June and continued in July, totalling 28.2 tonnes following a sell-off from March to May.

China domestic gold prices plunge

Fed’s policy remains key

Fed policy will remain key to the outlook for gold prices in the months ahead with the precious metal likely to stay under pressure in the short term amid speculation that US interest rates will remain higher for longer.

The focus remains on US data with the market now awaiting Friday’s monthly jobs report to gauge the health of the economy.

The Fed continues to signal the potential for a further rate hike this year, given that inflation remains above target, the jobs market is tight and activity has proven to be surprisingly resilient.

However, our US economist believes that the Fed is done hiking rates with cuts starting from spring 2024 as challenges continue to mount. Real household disposable income is slowing, student loan repayments are due to restart, credit availability is drying up and pandemic-era accrued savings have been exhausted by many households.

In the short term, we believe the threat of further action from the Fed will continue to keep the lid on gold prices. We have revised our gold forecast lower, weighed down by higher real yields and a stronger dollar, with an average of $1,900/oz in the fourth quarter, bringing the 2023 average to $1,924/oz.

However, we expect prices to move higher again in the first quarter of 2024 to average $1,950/oz on the assumption that the Fed will start cutting rates in the first quarter of next year, the dollar weakens, safe haven demand picks up amid global economic uncertainty and central bank buying remains at high levels.

ING forecast

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more