Grim outlook for the European staffing sector in 2024

After two years of above-average volume growth for the European temporary employment sector, that growth turned to contraction last year. For 2024, we expect the freeze on hiring temp workers to continue. Sluggish economic growth and staff shortages are the main challenges for the sector this year

Slowdown in economic growth in most European economies

Economic and geopolitical uncertainties, combined with higher interest rates, are likely to soften economic growth in Europe this year. Both companies and consumers are taking it easier with investments and spending due to those higher rates and persistently high inflation. As a result, GDP growth in most European economies will contract slightly or grow only modestly in 2024.

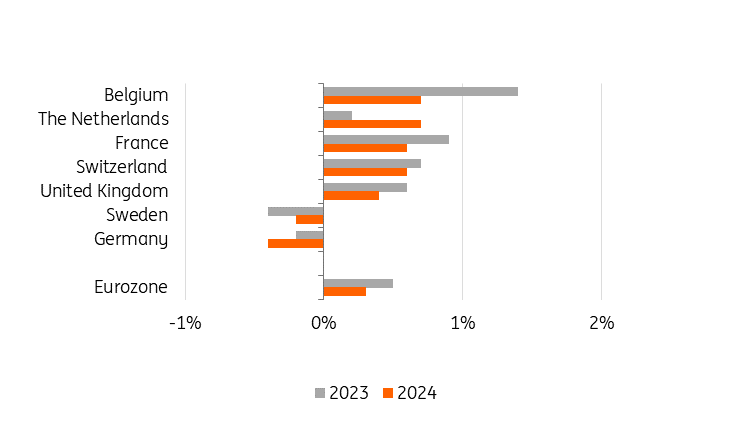

Modest economic growth in most European economies in 2024

GDP growth, year-on-year

The European labour market remains tight

Despite an economic slowdown and a cooling of the labour market, unemployment will remain relatively high in most European economies in 2024. While vacancy rates will be slightly lower in 2024, many European economies continue to struggle with a tight labour market. This is not only due to an ageing population, but also because the average number of hours worked per person is still lower than before the pandemic.

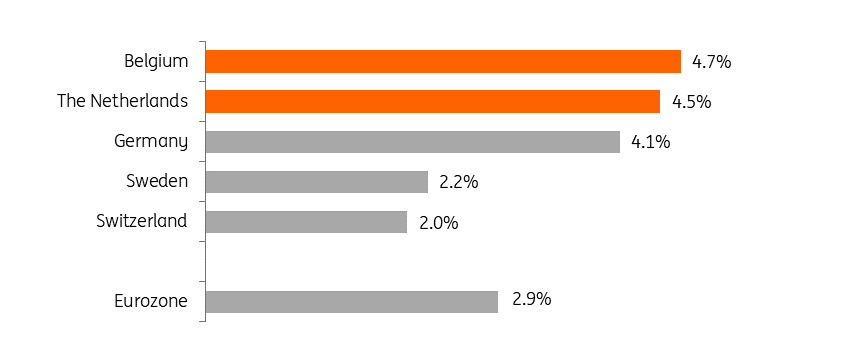

Staff shortages could slow market volume growth in the temporary employment sector, as temp agencies experience more difficulties recruiting new employees. Based on the job vacancy rate, the labour market is tightest in Belgium and the Netherlands, with 5% of unfilled vacancies in the third quarter of 2023.

The labour market is tightest in Belgium and the Netherlands

Job vacancy rate, third quarter 2023, seasonally adjusted

Strongest hiring plans in the Netherlands

While the economic environment is deteriorating, most employers still have modest hiring intentions as we begin 2024. In fact, most employers in the Netherlands, Belgium and Germany are more optimistic about their hiring plans at the start of this year than they were at the end of 2023. In France, Switzerland and Sweden, hiring plans are weaker for the first quarter of 2024 compared to the end of 2023.

Employers in the Netherlands, Belgium and Germany are more optimistic about their hiring plans in 2024

Percentage of employers planning to hire minus the percentage of employers expecting a reduction in staffing levels

Less demand for temporary workers

2024 will be another challenging year for the temporary employment sector. Economic growth forecasts for most European economies remain weak for 2024, ranging from a mild contraction in Sweden and Germany to a lingering 0.7% GDP growth in Belgium and the Netherlands. As a result, unemployment could rise slightly.

The sluggish economic outlook also has consequences for the employment services industry. Companies are reluctant to invest now that the market remains highly uncertain. This softens the demand for temporary agency workers. That's particularly true for the manufacturing sector, an important industry for temp workers, where new orders continue to decline, as does capacity utilisation. But employment prospects for temp workers are also deteriorating in the services sector. Taken together, market volumes in the employment services sector are expected to decline in most European economies next year.

Staffing sector forecast: volumes are likely to decline in most European economies

Volume output (value added) employment services industry, year-on-year, indices (2019=100)

Belgium - Shorter duration of temporary work

GDP growth in Belgium is expected to be relatively high at 0.7% in 2024, compared to other European economies. This is mainly due to automatic wage indexation, which means that income increases with the inflation rate (excluding alcohol, tobacco and fuels). Higher purchasing power stimulates consumer spending and, thus, economic growth. Nevertheless, higher hourly labour costs will negatively impact labour demand, including the demand for temporary agency workers. We, therefore, expect a decline in market volumes in the temporary employment sector in 2024.

Despite a slow economic growth, Belgium's labour market remains very solid. This is largely due to the country's tight labour market. One of the consequences of talent scarcity is that the duration of temporary work is becoming shorter because temp workers are more often hired on a permanent basis.

France - Hiring plans on hold

Economic growth is expected to slow further, from 0.9% in 2023 to 0.6% in 2024. The outlook for both the French services and manufacturing sectors remains bleak. Both sectors are facing lower demand, high inflation and greater uncertainty. In addition, the French labour market is showing the first signs of cooling down, resulting in a rise in unemployment in 2024. The deterioration of the employment climate is mainly due to the services sector. Because almost half of the temps actually work in the service sector, this will also have a negative impact on the demand for temporary agency workers and the number of hours worked. We, therefore, expect a further contraction in employment activities in 2024.

Germany - Hiring freeze over recession fears

Weaker global demand, high interest rates, energy uncertainty and persistently high inflation are hitting the German economy this year. This will have consequences for the demand for temporary agency workers. Adverse macroeconomic developments are putting pressure on the German automotive industry, an important sector for employment agencies. In addition, production is also declining substantially in other subsectors of the manufacturing industry. Another factor negatively affecting the temporary employment sector is the shortage of temp workers due to demographic developments. Overall, we expect a further decline in the volume of employment activities in 2024.

The Netherlands - Self-employment is an attractive alternative

As a result of a weakening economy, the number of temporary employment hours in the Netherlands is expected to decrease further in 2024. We anticipate a decrease in the number of temporary agency hours by approximately 5% by 2024, mainly due to continued relatively low economic growth. In manufacturing, temp workers are the first to be laid off due to a rapid decline in production and the number of orders.

A major challenge for the staffing industry in the Netherlands is the impact of stricter regulations, which make agency workers more expensive and less flexible. As a result, other forms of employment contracts become more attractive for hiring companies, such as self-employed professionals.

More self-employed people, less flexible employment in the Netherlands in 2023

Share of labour position in the labour force in the Netherlands, third quarter

Sweden - The job market is cooling down

Sweden is among the European economies expected to enter a recession in 2023, mainly due to high inflation and higher interest rates. We expect economic activity to stagnate this year. There are already signs that the job market is cooling down. As a result, consumer and business confidence remains low. The economic situation is likely to weaken demand for temp workers, especially in the construction and manufacturing sectors. Overall, we expect market volumes for the temporary employment sector to decline again in 2024.

Switzerland - Another year of negative volume growth in employment activities

Like many other European countries, the Swiss economy became more challenging in 2023 due to high inflation, higher interest rates and weakening global demand. GDP growth is expected to slow from 2.2% in 2022 to around 0.6% in 2023 and 2024. The Swiss manufacturing industry, with a relatively large weight of the cyclical chemical and pharmaceutical sectors, is shrinking. The staffing market is also negatively affected by staff shortages, making it difficult to find suitable candidates. In short, we expect another year of negative volume growth in employment activities in Switzerland in 2024.

Manufacturing and construction are the most important sectors for the Swiss staffing industry

Percentage of industries that used temporary agency work in Switzerland in 2022

The United Kingdom - Weak outlook for the employment activities sector

Economic activity in the UK is expected to grow only modestly in 2024, similar to most other European economies. The sluggish economy will lead to a decrease in the number of vacancies and an increase in the unemployment rate. However, given the ongoing staff shortages, this increase is expected to be limited. Nevertheless, we expect the demand for temporary agency workers to weaken further in 2024.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article