Green bonds: Momentum supported by initiatives

An overview of the market and how the oil and gas majors’ hesitant steps into renewables could turn into an offensive

The first three months of 2018 saw the issuance of c.€20bn self-labelled green bonds on the credit markets. In the last three months, the Kingdom of Belgium issued a €4.5bn green bond while the Republic of Poland and Indonesia issued €1bn respectively.

Aside from governments, oil and gas companies are trying to enter the renewable energy market too with Repsol being the only major green bond issuer. But still, we think the sector is a potential candidate.

We believe issuance for 2018 and upcoming years will remain strong, and the reason behind that is the sheer number of initiatives across the globe to promote green finance.

In March 2018, the UK government published its “Accelerating Green Finance” report which described the need for investments in clean energy and infrastructure. The document also looked at incentives for sterling issuers to issue green bonds and advocated the issuance of a UK government green bond of the same order as the French sovereign green bond (c.€10bn).

Following the initiatives of the Chinese government and organisations, Japan is ready to catch-up with its environment ministry willing to subsidise green bond costs, i.e., consultation and second opinion fees. The Japanese government would like to see Japanese green bond issuance doubling in 2018 compared with 2017. Last but not least, we want to mention the work at the European Union level with the recommendation of the establishment of an EU sustainability taxonomy, standards and labels among other things.

Green bond issuance per sector (€m)

The state of the market

The first three months of 2018 saw the issuance of c.€20bn of self-labelled green bonds on the markets with governments and SSAs providing 55% of total issuance.

The Green Finance Taskforce behind UK's “Accelerating Green Finance” report recommends a UK government large-scale green/sustainable bond issue. Such a bond would further boost green bond issuance by governments and/or governmental agencies, and we think that we will see other governments showing additional interest.

On the corporate side, issuance was supported by Enel (€1.25bn), Engie (€1bn), Iberdrola (€700m) and MidAmerican Energy (US$700m) on the Utilities side. The Norwegian SpareBank Boligkreditt issued the biggest bank green bond (€1bn) in the first quarter 2018. During this period, the EUR was by far the most used currency by issuers with 56% of total green bonds issued, followed by the US Dollar (14%).

Green bond issuances by-sector and by-currency 2017/18

The market is maturing

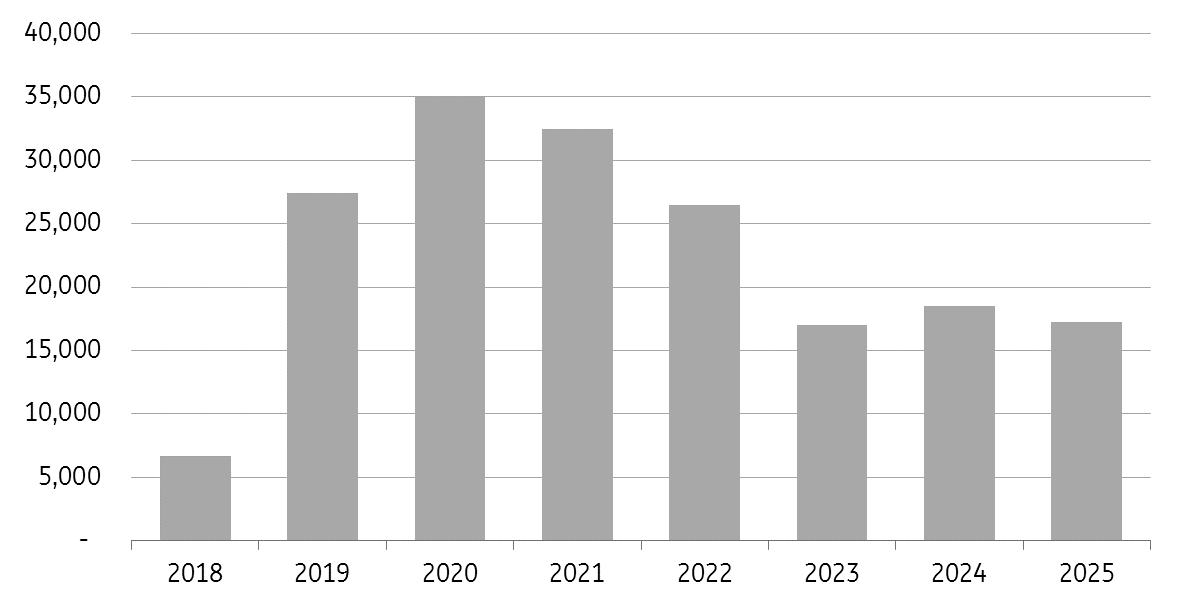

After having started slowly in the period 2008-14, the green bond market has grown stronger over the last two years. More than €255bn of green bonds are now outstanding as of March 2018. In 2018, the equivalent of €6.5bn will mature, and the redemptions are ramping up in the years after with €25.5bn in 2019 and €35bn in 2020.

However, we note that the next two years concerns a small number of green bonds issued in EUR as they represent only between 8% and 20% of the total. The redemptions of EUR green bonds will pick up in 2022-2025 with a redemption share of the total between 35% and 60%.

Green bond redemptions, all currencies included (€m)

The Innogy case

As the market mature, we think investors will be more exposed to exceptional cases. We look at the Innogy case.

On 10 March, the German utility E.ON announced the acquisition of its German peer Innogy. The agreement in principle is rather complex and consists mostly of asset swaps to RWE, Innogy’s majority shareholder and a capital increase.

After the transaction, E.ON, which will have absorbed Innogy, will transfer its renewable power generation assets to RWE. We understand that debt should stay under E.ON. In October 2017, Innogy issued a €850m green bond maturing in 2027.

Initially, the proceeds are dedicated to:

- The construction and installation of onshore and offshore wind energy, solar energy, hydropower and other renewable energies.

- The distribution of renewables generation (network activities) and development of smart meters.

- The development of clean transportation: charging stations, heating systems, smart home devices.

Looking at Innogy’s reporting on the use of its green bond proceeds, we can see that most of them are being used for renewable energy. The question that arises is what would become of Innogy’s green bond if the new E.ON does not have any renewables assets any longer in its business portfolio. Could Innogy’s green bond be transferred to RWE? In theory yes, but only if bondholders agree.

However, RWE has a different business profile and is rated one notch below Innogy at Baa3. We note as well that under the EMTN prospectus, investors have a put option to demand redemption concerning a change of control or a rating downgrade of Innogy SE. Management has not answered this question yet given that the acquisition process is only at its first steps. The case will certainly be answered one way or the other, but the company has at least two years before the full integration happens.

Oil and gas majors’ hesitant steps into renewables

Last January, we wrote a note titled “Oil & gas firms hesitant steps into renewables”. We are coming back to this subject as the last months saw rumours of acquisitions and additional details on investment programmes into renewables. Up to now, the investment plans may have looked considerable. For instance, the Saudi oil and gas major, Saudi Aramco has announced that it will spend US$5bn in the next five years and BP, Royal Dutch Shell, Statoil and Total will each invest between €1.5bn and €4.5bn.

However, these plans are spread across some years which means that capex dedicated to renewables remain rather small in comparison with the companies ‘total capital expenditure.

Saudi Aramco’s US$5bn within the next five years to develop 10GW of renewable energy capacity only represents c.1% of the group’s total investment. For the other European oil & gas majors, we estimate that they will dedicate between 1% and 5% of their global investments to green energy projects. However, groups such as Statoil and Royal Dutch Shell have already announced that their green energy plans will represent a much bigger share of their investments in the future.

The last few months have shown oil and gas majors have strong interest in entering the electricity markets. For instance, Total SA and Royal Dutch Shell have shown interest in Eneco NV, the entity operating and supplying electricity to the Dutch and British markets, after the spin-off from the Dutch Stedin network assets. Eneco NV is in the hands of Dutch regions and municipalities that are now willing to sell the company. Eneco is valued to be worth up to €4bn.

Repsol, which issued a green bond in 2017, is said to weigh the sale of its 20% stake in Gas Natural and invest directly in green energy. In January 2018, Bloomberg reported that Repsol was in talks with KKR & Co’s to acquire its renewable assets.

We believe that oil and gas majors’ ongoing projects in charging stations, renewables and the electricity power markets could make the sector a candidate for green bonds. The sector is under pressure from governments, associations, organisations and investors to reduce CO2 emissions and offer new solutions. But it worth remembering that the oil and gas industry will not be able to change its business model in a short period.

The latest initiatives show that the sector is ready to enter the renewable power markets. Some oil and gas majors have understood they need to work on their image and show they intend to gradually change their business model over time to comply with climate change mitigation objectives.

Download

Download article13 April 2018

In Case You Missed it: Trumpian uncertainties This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more