Gold nears all-time high on likely Fed pause

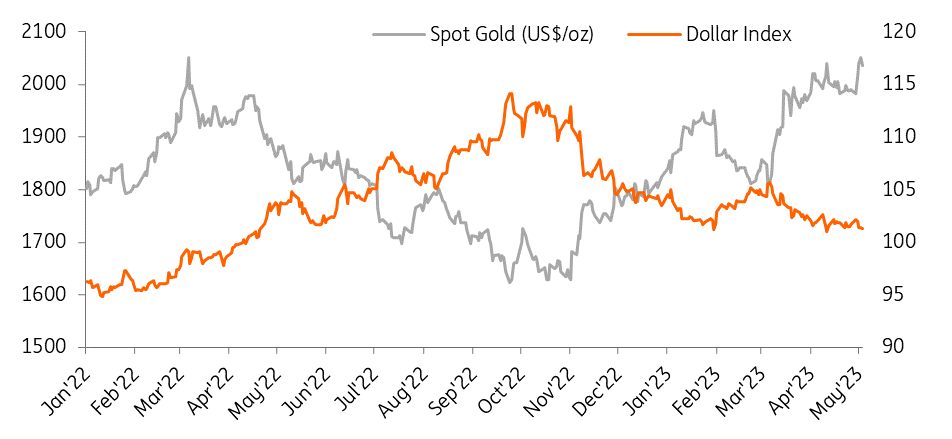

Gold is trading near an all-time high amid a decline in US bond yields and the dollar following indications from the US Federal Reserve that it might pause its rate hiking cycle. And the precious metal's momentum remains to the upside

Gold hits one-year high

Banking crisis fuels gold ETF inflows

Gold touched $2,062.99/oz on 4 May, the highest intraday level since March 2022, as renewed concerns about the US banking sector fuelled bets that the Fed may have to cut rates sooner than anticipated. The precious metal is nearing its all-time high of $2,075.47/oz made in August 2020 following Russia’s invasion of Ukraine.

Gold has rallied from around $1,630/oz in early November to above $2,000/oz with investors betting the Fed is moving closer to ending its rate hiking cycle.

The recent rally in gold prices began towards the end of the first quarter following the collapse of Silicon Valley Bank. Nervousness over the banking system, along with the weakening of the US dollar and falling Treasury yields have seen the precious metal rally more than 10% since early March.

Concerns over the US banking crisis fuelled gold ETF inflows in March. Global gold ETFs, led by European funds, saw US$1.9bn (+32t, +0.9%) of net inflows in March, putting a stop to a nine-month losing streak, data from the World Gold Council showed.

Overall, global gold ETF total assets under management (AUM) rose by 10%, aided by both inflows and the gold price appreciation, to US$220bn by the end of March. Gold holdings increased by 32 tonnes to 3,444 tonnes. And that positive trend has continued into April.

However, March inflows were not enough to reverse negative flows in January and February, resulting in a net outflow of US$1.5bn during the first quarter of 2023.

Looking forward, we believe financial stability concerns following the failure of some large US regional banks and fading interest rate headwinds will provide a positive tailwind for gold demand.

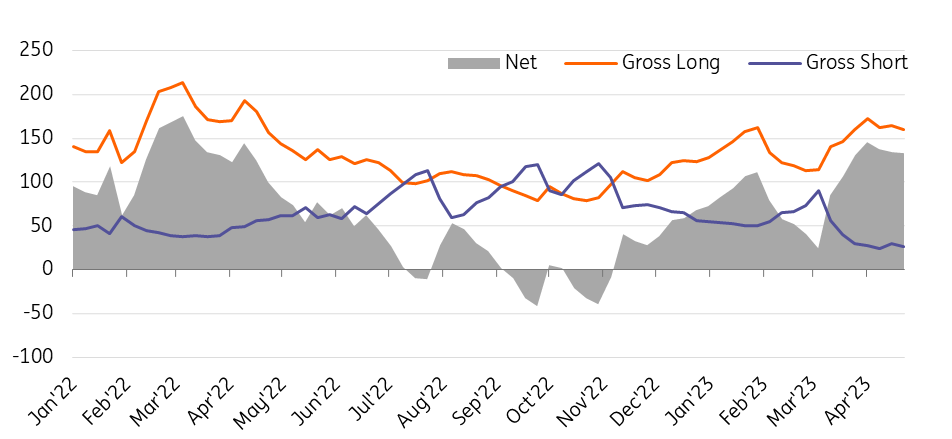

Net long positioning strengthens

Net long positioning has remained in positive territory so far in 2023, reflecting healthy appetite for gold.

Speculators had already increased their positioning towards the back end of last year and the start of this year - on the expectation that the Fed is not too far from the peak Fed funds rate.

March saw a sizable rebound in COMEX gold futures’ net longs, as the gold price showed strength. Total net longs amounted to 622 tonnes by the end of the month, surpassing the 2022 average of 527 tonnes.

Speculators boost gold longs

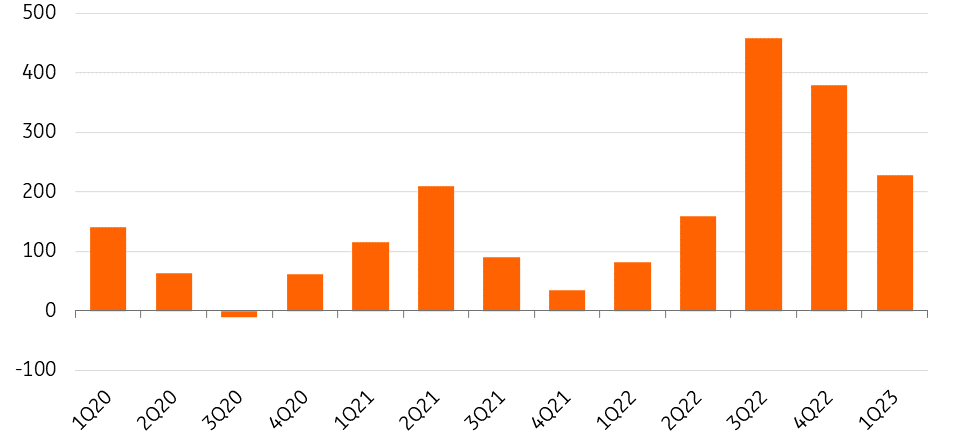

Central banks continue to boost gold reserves

Gold purchases by central banks maintained momentum in the first quarter. Central bank demand hit 228 tonnes in 1Q, 34% higher than the previous 1Q record set in 2013, according to a report from the World Gold Council.

This follows the record annual demand of 1,078 tonnes in 2022. Last year, central banks bought almost 1,136 tonnes of gold. Turkey and China were the largest known buyers, adding 148 tonnes and 62 tonnes, respectively.

Although the 1Q figure this year was lower than the figures seen in the previous two quarters and down 40% from the preceding three months, this is the strongest first quarter on record, with buying reported by both emerging and developed market banks.

Four central banks accounted for the majority of reported purchasing during 1Q:

- The Monetary Authority of Singapore (MAS) was the largest single buyer during the quarter, adding 69 tonnes, the first increase in its gold reserves since June 2021.

- The People’s Bank of China (PBoC) was the second largest buyer during the quarter, adding 58 tonnes to its gold reserves.

- Turkey was again a big buyer of gold during the quarter - official reserves rose by 30 tonnes.

We expect central banks to remain buyers, not only due to geopolitical tensions but also due to the economic climate.

Central bank buying remains at high level

Fed’s rate path crucial to gold trajectory

Fed policy will be key for gold over the medium term. The Fed raised interest rates by 25bp this week and signalled the threshold for justifying future rate increases is now higher than it was. With lending conditions rapidly tightening in the wake of recent bank stresses, our US economist thinks this will mark the peak for interest rates with recessionary forces set to prompt interest rate cuts later this year.

The market is currently pricing the potential for rate cuts as soon as September, but our US economist James Knightley doubts that the Fed will respond quite as quickly given inflation is still likely to be around 4% by that point, double the 2% target rate.

James thinks the Fed will wait until the fourth quarter, but will end up cutting interest rates more aggressively, at least in the early stages, forecasting 50bp rate cuts at both the November and December FOMC meetings with the Fed funds rate getting down to 3% by mid-2024.

We would expect real yields to follow policy rates lower later in the year, which should prove supportive for gold prices.

We see prices moving higher over the second half of next year, given that the Fed should start cutting rates towards the end of this year.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more