Gold Monthly: Gold breaks new highs

Gold hit an all-time high above $2,400/oz in April after a rally underpinned by strong demand from the world’s central banks and geopolitical tensions

Gold is up 12% this year despite a stronger dollar

US Fed in focus

Gold has climbed more than 12% so far this year despite the timeline for Fed cuts being pushed back. Higher rates are typically negative for gold as it doesn’t pay interest.

The key driver of the outlook for gold prices for the past year has been Federal Reserve policy. The Fed is expected to cut rates this year but has said that it needs to see more evidence of inflation easing first. Inflation data that is due next week will offer further insights into the US economy.

Our US economist expects the first rate cut in September, followed by cuts in November and December as well.

If the Fed continues its cautious approach to easing, gold prices risk a pullback. We expect gold prices to remain volatile in the coming months as the market reacts to macro drivers, tracking geopolitical events and Fed rate policy.

Gold long positions remain high

Central banks keep buying gold

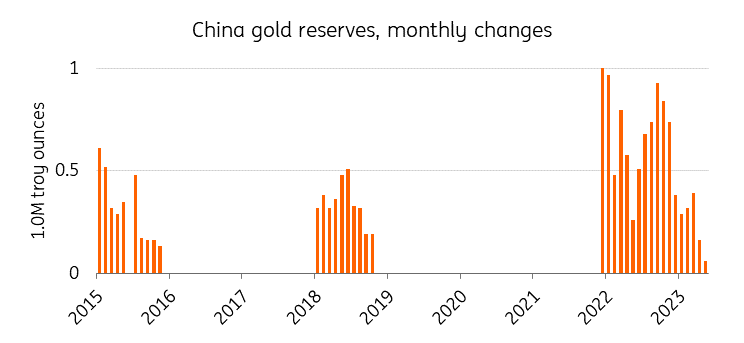

Gold demand from central banks posted its strongest start to any year on record in the first quarter. Central banks added 290 tonnes of gold to their official holdings in the first quarter of the year, with China being the biggest buyer. The People’s Bank of China added 27 tonnes to its gold reserves during the quarter.

In April, China’s central bank expanded its gold reserves for an 18th straight month adding 1.87 tonnes and taking the total holdings to 2264.3 tonnes. However, the pace of buying slowed last month amid record high gold prices.

Last year central banks bought 1,037 tonnes of gold, just shy of the all-time high of 2022. Gold tends to become more attractive in times of instability, when investors pile into safe-haven assets as a hedge against the economic climate, geopolitical tensions or inflation. Still, the record-breaking rally since mid-February might dent demand for now.

Central banks gold buying continues in 2024

Turkey, China and India lead the way in the first quarter

However, China’s appetite for gold slows down in April

ETFs continue to see outflows

Still, physically backed gold exchange-traded funds (ETF) flows are lagging.

During the Covid pandemic, ETF holdings were the driver behind gold’s surge to then-record highs. Investor holdings in gold ETFs generally rise when gold prices gain, and vice versa. Gold ETF holdings have been in decline for much of 2024, while spot gold prices have hit a record after record.

The end of April saw global gold ETF holdings fall to 3,079 tonnes, the lowest since February 2020, according to data from the World Gold Council. Although Asia and North America saw inflows, Europe continued to register outflows offsetting inflows elsewhere.

ETF holdings still in decline

Gold prices risk a pullback

We expect gold prices to come down slightly from its current levels this quarter as the Fed continues its cautious approach and with geopolitics already being factored into the current price. We see prices averaging $2,250/oz in the second quarter and an annual average of $2,218/oz in 2024. We see prices peaking in the fourth quarter, averaging $2,300/oz, on the assumption that the Fed starts cutting rates in the second half of the year and the dollar and yields weaken.

ING forecast

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more