Global Trade: Downs and ups?

February could be the turning point in the ongoing trade war if the US and China cut a deal and if the US administration decides against hiking tariffs on cars. Unfortunately, we’re increasingly inclined to think trade tensions will get worse before they get better

The risk of fresh US tariffs being imposed on China is rising

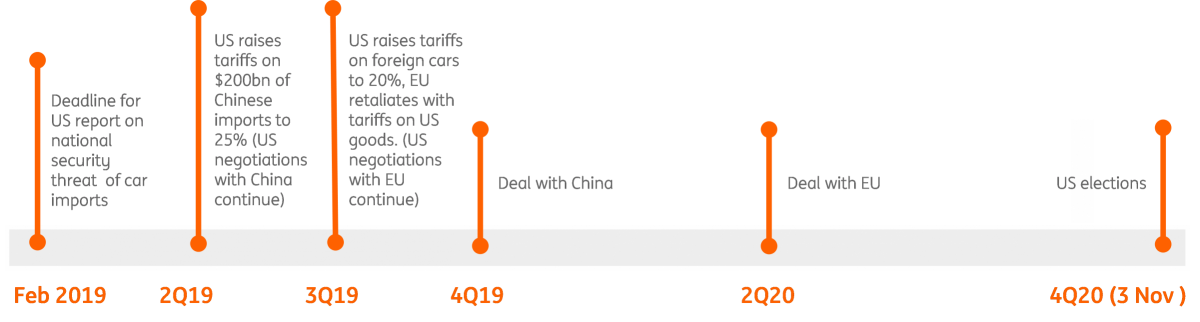

The ceasefire between the US and China meant that the scheduled 1st January 2019 implementation of an additional 15 percentage point hike of tariffs on US imports from China, worth USD 200 billion, has been on hold. It could disappear indefinitely if a trade deal is struck but in our view, the American wish list is too demanding for China to get a deal before the 1 March 2019 deadline.

Although an extension of the deadline is possible, we are inclined to think President Trump will look to increase the pressure by hiking tariffs on the USD 200 billion package to 25% in 2Q and threaten to impose further tariffs. We believe this will incentivise the Chinese to compromise just enough to make President Trump willing to compromise as well and cut a deal. After all, elections are coming up in 2020, and the US President needs to show that he has lived up to his promise of getting better terms of trade for the US. Moreover, retaliatory tariffs by China on soya beans and many other American products hurt US exports and the business of his voter base, so we expect a deal, but given the complexity of the negotiation agenda, nothing before 4Q this year.

Trade war timeline in case of no quick deal with China and a hike of US tariffs on car imports

Car tariffs back in focus as the US prepares to release national security verdict

Trump needs a deal with the EU as well. Our view that the US will not elevate car tariffs is increasingly under pressure. First, the gap between the US negotiation objectives and those of the EU has become larger since the US updated its targets. These go much further than the agenda that was set by Trump and EU President Jean-Claude Juncker last summer. Secondly, Trump is feeling increasing domestic pressure. After General Motors announced thousands of layoffs last November, the President tweeted that this wouldn’t have happened with higher import tariffs on cars.

More clarity on the next step in the conflict will come with the Commerce Department ’s report on whether the import of cars is a threat to US national security. The report is due to be published by 17 February, at the latest and the President’s response will be crucial.

If car tariffs are imposed, it will escalate the trade war because the EU has already said it will retaliate. But, similarly to the situation of China, we think Trump wants a deal, which means tariffs are directed at creating leverage in the negotiations. Although the EU is undoubtfully aware of this tactic, it doesn’t want tariffs, which will result in some willingness to compromise. But even then expect negotiations to be far from quick and easy. In case of an elevation, it will take until 2Q of 2020 before a EU-US trade deal is struck.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

8 February 2019

February Economic Update: Stick or twist? This bundle contains 9 Articles