Why supply constraints are clouding the skies for airlines

Post-pandemic airline demand has proved resilient, but available capacity remains a major headache for airlines. Supply shortages, extra maintenance, aircraft production issues and delays have led to operational challenges, limiting growth and slowing sustainability progress

Global airline fleet hasn’t managed to keep up with demand and that’s not over yet

Global airline demand has outpaced fleet capacity development, which puts growth plans for airlines under strain. This is reflected in the number of parked aircrafts, which is continuously sliding. Aircraft capacity struggles are expected to drag on through 2024 and its peak season. Capacity constraints force airlines to adjust flight schedules – Ryanair, for instance, announced that it is planning to serve 200m instead of 205m passengers in 2024. This is still around 10% growth, though less than previously anticipated. The constraints also limit the ability to restore and grow intercontinental networks. Flag carriers such as Lufthansa and KLM (including Transavia) revised available seat capacity downward for the full-year 2024.

The nature of aviation understandably puts safety above everything else, and multiple supply chain issues and incidents currently limit aircraft availability. A complicating factor for airlines is the limited flexibility across the aviation sector as pilots, cabin crew and maintenance personnel are also educated for a specific type of aircraft.

Connectivity lags as airline volume recovered in a different style

Airlines across the world downsized their networks throughout the pandemic, and this hasn’t been fully restored yet. This means that current air traffic is concentrated within less routes. In Europe, the number of direct and indirect destinations at airports ended up 13 percentage points higher in 2023, but still lagged behind its 2019 figure (at 84% of this level). This put a drag on flight activity (sitting at 91.5% in 2023).

Moving forward, networks will gradually recover further as flag carriers re-introduce more long-haul destinations, but a full recovery will take more time amid current supply and demand dynamics. And of course, the geopolitical environment has also changed the map of airlines, with flights to Russia from the West suspended and flights to Israel and Iran affected by cancellations.

Unlike other sectors, supply chain shortages remain prominent in the highly regulated aerospace industry

The complex aircraft production supply chain involves highly specialised certified players. Therefore, diversification or switching suppliers in case of bottlenecks often isn't possible. On top of that, supply chain partners scaled back massively during the first phase of the pandemic, when the future was highly uncertain. The so-called bull-whip effect accelerated the downturn across the supply chain, and as a result, rescaling is now much more time consuming than it is in other sectors.

The industry also facing shortages of highly qualified skilled personnel. Both engines and other components such as seats with digital devices still have long lead-times. This means that engine makers such as CFM (GE/Safran), Pratt & Whitney and Rolls-Royce, but also parts suppliers such as RTX are struggling to keep up with demand. This limits growth potential for production of new aircrafts, but retrofitting and refurbishing programmes for older aircraft are also impacted next to regular maintanance progammes.

Deliveries of new airplanes at Boeing still way below pre-pandemic levels, while Airbus is still in recovery

Number of delivered commercial airplanes by manufacturers Airbus & Boeing

Which specific supply side hiccups will weigh on available capacity in 2024 and 2025?

- Pratt & Whitney engine checks and retrofits

In late 2023, engine manufacturer Pratt & Whitney announced extra inspections for turbofan engines installed in Airbus A320NEOs after a risk of cracks in the engine appeared. This will include a total of 600-700 aircrafts in operation each being grounded for up to ten months in batches. This will take out an expected 350 units in 2024 alone, which affects airlines operating aircrafts powered with these engines, such as Jetblue, Wizzair and Air New Zealand. In total, at least 1.5% of the global fleet capacity will be taken out of service, but for the individual airlines affected, it's going to be much more. The impact of this issue will also spill over into 2025, keeping maintenance personnel scarce and the engine company busy, limiting the ability to ramp up new production.

- Boeing production limitations

Accidents with the B737 MAX 8 aircraft in 2018 and 2019 led to a steep production decline at Boeing in 2019, which accelerated during the pandemic. The breakaway of a door panel on a Max 9 flight early 2024 created another setback and forced the US Federal Aviation Authority (FAA) to require production limitation of the B737 Max aircraft to 38 per month. Supplier issues have also kept deliveries low in the first part of 2024. On top of this, B787 quality controls are also being investigated. Consequently, upscaling production isn’t possible and instead, production almost halved again in the first quarter of 2024. For airlines such as United Airlines, Southwest and Ryanair, with significant ranges of the aircraft on order, this means that deliveries are being postponed. This disrupts flight schedules and dents growth potential in 2024, especially during the peak season. Southwest, for example, expects just 20 of the previously scheduled 46 aircraft deliveries in 2024. With production at Boeing have been subdued for four to five years, the production backlog has already hit 3.000 aircraft and continues to mount, while orderbooks have swelled.

- Boeing groundings in the US (FAA)

Another capacity factor is the immediate operational impact of incidents at Boeing. United Airlines, Southwest, Alaska Airlines are among the airlines hit by the Max 9 issue in 2024. Other incidents and concerns about quality and security procedures of 787 Dreamliner production added to the scrutiny of the aviation authority. But so far, this isn’t impacting airlines outside of the US.

Commercial aviation industry is largely dominated by Airbus and Boeing. Embraer is making regional aircraft up to 146 pax. Russia produces its own aircraft within de UAC and Chinese Comac has delivered a larger civil aircraft (C919), and large domestic orders from Air China and China Southern.

The combined backlog of Airbus and Boeing has hit a record high

Orderbook Airbus & Boeing: number of commercial airplanes, end of year

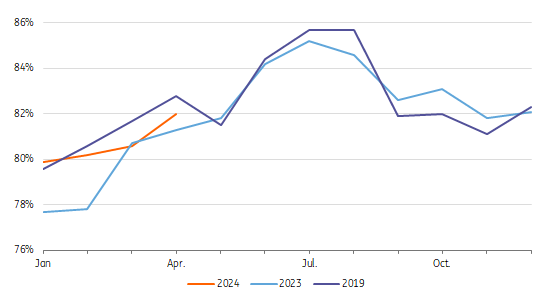

Load factors are hitting pre-pandemic levels and airlines are challenged to raise the bar

Aircraft load factors have returned to their 2019 seasonal highs and provide an indication of capacity tightness. Load factors for long haul flights are usually lower than on short haul trips. Strong passenger figures of low-cost carriers helped to raise this figure. In Europe, EasyJet’s load factor already neared 90% in the full-year 2023, and is inching closer to the 93% seen in 2019. Ryanair hit 93%, which is close to its natural max. Nevertheless, airlines are challenged to further raise the bar, especially flag carriers. But in practice, this is also a game of price dynamics. Especially in the US and Europe, where load factors are already relatively high, it will be challenging to further increase occupation rates.

Passenger load factors returned close to historical highs (2019)

Average monthly global passenger load factors (PLF) in %

Run on aircraft capacity send lease and rental rates up

Close to 60% of the global aircraft fleet is leased out and owned by companies such as Aercap, SMBC and Avolon. Airlines are currently looking look into lifetime extension and many lease terms are extended to keep flying schemes afloat. Demand for older, used aircrafts is also going up. On the back of this, used market prices and lease rates have risen significantly, especially for narrowbodies. As such, rates of the A321 have risen some 18% in early 2024 compared to a year earlier and rates for a B737 MAX 8 have also surged 19% to $400,000 a month. This direction is expected to continue in 2024. With a delay, leasing rates for widebody aircraft such as A350/B787 have also recovered.

Air fares in the EU outpace inflation amid ongoing aircraft availability constraints, taxes and sustained demand

Index ticket prices vs consumer prices (HICP) in the EU (2015 = 100), seasonally adjusted

Air fares to remain elevated amid supply constraints

Weak demand pushed air fares development below figure inflation in 2020 – but this quickly turned around in 2022 as the world emerged from the pandemic. The combination of subdued capacity and strong demand fuelled ticket prices, and higher jet fuel prices added to that.

In Europe, prices are still outpacing inflation by some 15% in early 2024. Air fares are globally under upward pressure, but higher duties also play their part (especially in Europe). This dynamic marks a different era, as increased competition of low-cost carriers previously weighed on rates for a long time.

Ticket taxes and climate policy pushes ticket prices permanently higher

In several European countries, (higher) ticket taxes and an increased application of the Emissions Trading Scheme (from 25% in 2024 to 100% in 2026 for intra-European flights) will continue to add to higher prices, with fares already moving far beyond inflation figures. The internalisation of external factors will likely continue to grow moving forward, which will lead to structurally higher fares and more real pricing.

SAF blending adds to costs and ticket prices

An increasing number of airlines secured sustainable aviation fuel (SAF) for blending, and this will continue in 2024. Frontrunning airlines target a blend ratio of 10% in 2030 and the EU, the UK and several individual countries require a minimum of 6%-10%. KLM was ahead globally with a blend rate of 1% in 2023 while the global average was just 0.2%. This has to increase rapidly to reach target levels.

SAF trades around 2.7 times the price of conventional jet fuel in March, and fuel consumption usually covers 15-25% of total costs. We don't expect that the cost of SAF will drop to jet fuel levels anytime soon, which means a targeted blend rate of 10% in 2030 being aimed for by airline coalitions Oneworld group and Clean Skies for Tomorrow eventually adds 3-4% to ticket prices.

Operational struggles challenges airlines finances, but demand still provides momentum

The world’s leading airlines roughly returned to pre-pandemic operating profits levels in 2023. And against the backdrop of capacity constraints, pricing power remains with carriers. At the same time, cost pressure remains high, with wage costs (often the largest cost fraction) likely continue rising in 2024-2025 as collective wage increases at Lufthansa suggest. Operational challenges due to delivery delays and extra maintenance – as well as more cancellations due to extreme weather, geopolitics and labour tensions – will also weigh on profitability in 2024. Nevertheless, we may see a slight uptick in operational margins.

Global CO2 emissions in aviation continue to bounce back

CO2 emissions in global aviation (in MT)

Fleet renewal delays drives emissions further up in 2024

Global GHG emissions in aviation fell steeply over the pandemic plunge, but have seen a rapid reversal since demand returned. In 2024, emissions will likely end up close to pre-pandemic levels. SAF blending has kicked off, and operational efficiency draws more attention to decarbonisation strategies – but the most important pillar for airlines, accelerated fleet renewal, is severely lagging. This slows the reduction of emissions per seat/kilometre.

The new generation A350 and B787 Dreamliner, for instance, have significantly lower fuel burn specifics than their predecessors A340 and B777. Airlines are now forced to keep older aircrafts in the skies, which impacts sustainability progress as the fuel consumption of new generation aircrafts is usually 10-25% lower.

Geopolitical tensions lead to inefficiency and extra emissions

The global skies continue to face inefficiencies due to sanctions and political tensions. Airline trips are hardly ever executed in a straight line from A to B, but avoiding various air spaces increasingly complicates things. Continued detours around the massive Russian airspace (with a fifth of Europe’s sky effectively closed) extend flight durations between Asia and Europe by up to four hours between Amsterdam and Tokyo. Tensions in the Middle East have also forced additional rerouting. Altogether, this leads to longer miles and higher emissions than seen previously.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

16 May 2024

Global aviation outlook: Air traffic soars as supply challenges linger This bundle contains 2 Articles