GBP update: Draghi and Carney more important than politics

The EU repeal bill will dominate the British media spotlight this week, but what matters for the pound is what the ECB and the Bank of England say next

GBP weekly bias: Central banks to overshadow priced in politics

EUR/GBP: Draghi and Carney more important than politics now

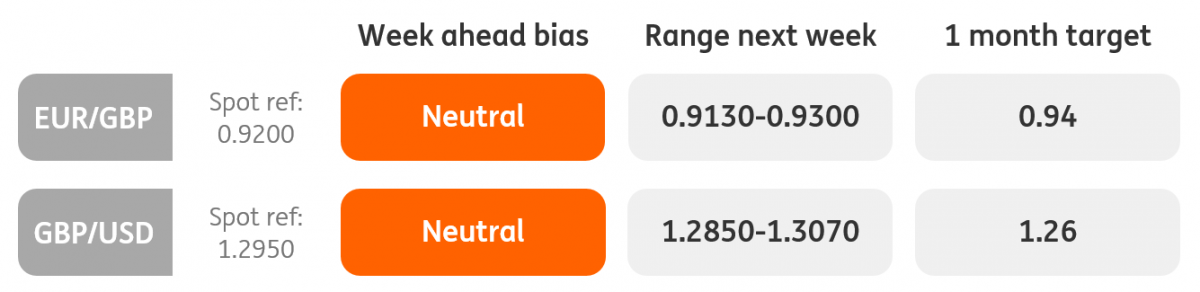

- While the story of UK politicians voting on the EU Repeal Bill is likely to dominate the media narrative, we believe GBP markets have adequately factored in the prospects of 'bad' political headlines in the near-term. Instead, the more prominent driver for EUR/GBP in early September may prove to be relative central bank currency talk. We believe that some caution by the ECB this week over an over-exuberant EUR - coupled with greater BoE concerns over GBP-induced inflation next week (see below) - could provide a de facto cap on EUR/GBP upside around the 0.92-0.93 area. We retain a neutral bias this week, noting that it would take a super dovish ECB or positive UK data surprises to see a break of the 0.9140/50 support and trigger a broader retrace towards 0.90.

- Should investors ignore any ECB verbal jawboning and push EUR/USD above 1.20, then we could easily see EUR/GBP - the market's preferred vehicle to play EUR strength - posting fresh highs above the 0.93 level. Under this alternative scenario, we would expect the 0.94150 resistance to remain in tact. Equally, we would still be inclined to view the move as a near-term EUR/GBP overshoot - rather than a trend towards parity.

GBP/USD: Cautious Fed talk amid weak US data won't spur $ optimism

- After a dismal August, GBP looks to be entering a consolidative phase ahead of the upcoming BoE policy meeting (September 14). We believe that both a softer UK economic outlook and domestic political risks are adequately priced into the currency now, and only an escalation in either would warrant further idiosyncratic GBP weakness. Services PMI (Tue), house price data (Wed) and industrial production (Fri) are the key UK data releases to note this week, though we note the more likely catalysts to break the current spell of GBP weakness are next week's key CPI and retail sales figures.

- The dollar looks to be down on its luck too, which in effect explains the stability in GBP/USD. The number of data points to save a Fed rate hike in December is decreasing by the week and unless some Fed speakers manage to convince markets otherwise, we doubt GBP/USD will find any major directional impetus this week. More noticeably, the dollar has failed to derive any benefit from the return of fiscal stimulus chatter as part of the Trump policy agenda, no doubt because the chances of Congress approving unfunded 'tax cuts' - as opposed to comprehensive 'tax reform' - look virtually zero.

Theme 1: GBP entering territory that may warrant greater BoE attention

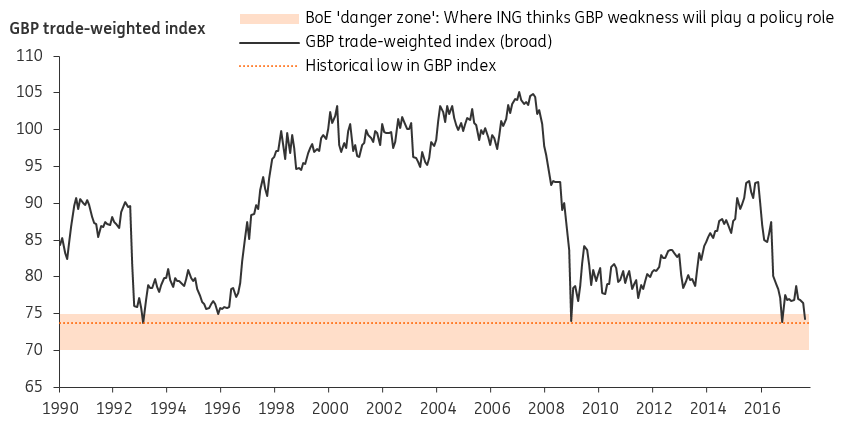

While BoE officials may state that they are not targeting a specific exchange rate level, we suspect the trade-weighted GBP index around the 74 level - and close to historic lows - is in a territory that will warrant greater attention from policymakers. We note that the BoE has conditioned their August QIR forecasts based on the GBP trade-weighted index at 77. The current broad trade-weighted index is below 75; if it pushes lower or even remains at these levels, then in isolation it will warrant an upgrade to the inflation projections in November.

We wouldn't be surprised to hear greater BoE noise over sterling weakness, primarily in terms of what this means for inflation overshooting the 2% target and whether the growth-inflation policy trade-off has altered for some MPC members. While we acknowledge that domestically generated inflationary pressures remain soft, we could start to see references to GBP weakness and imported inflation having "second-round effects" (eg, rising imported input costs potentially boosting domestic prices).

Greater "weak pound" references in the context of BoE policy talk could, in turn, provide a backstop to the current GBP-selling environment.

Theme 2: Draghi not politics holds the key to EUR/GBP this week

The House of Commons reconvenes this week after its summer recess and will vote on whether to take the EU Repeal Bill to the next stage. Naturally, this story will generate some media noise. However, apart from keeping GBP on the back foot, we suspect any further idiosyncratic currency weakness would look excessive relative to the political risks at stake. Equally, the smooth passage of the EU Repeal Bill may not actively drive GBP higher, though it will certainly offer some good news amid a backdrop of Brexit-related negative sentiment.

The bigger driver for EUR/GBP this week will be the ECB meeting and whether President Draghi has the desire - and verbal firepower - to drive the EUR lower. We doubt the ECB President will be able to achieve this - at least without explicitly stating that the central bank will delay QE tapering in light of the recent EUR strength. But certainly, a more cautious ECB chief will attempt to rein in some of the EUR optimism in financial markets.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).