Gas and coal imports from Russia key to China’s economic recovery

Since the start of the Russia-Ukraine war, China has started to import more coal, crude petroleum oil and natural gas from Russia. This is not only a result of international politics; China also needs stable energy imports for its economic recovery

Where does China want to be?

China, the world’s biggest emitter of carbon dioxide in 2020, pledged in September 2020 at the 75th session of the United Nations General Assembly to strive for peak CO2 emissions by 2030 and work towards carbon neutrality by 2060.

What it's been doing to get there:

China has been updating the details on how it aims to achieve net-zero carbon emissions by 2060:

-

Limited emissions will be implemented for new pollutants by 2025, according to the Action Plan for the Treatment of New Pollutants.

-

Pledges to stop financing new coal plants overseas in March 2022.

-

The State Council issued the Responding to Climate Change: China's Policies and Actions in October 2021 confirming the targets of peak carbon dioxide emissions before 2030 and achieving carbon neutrality before 2060, and further sets targets to:

-

Lower its carbon intensity by more than 65% (previously 60-65%) by 2030 from the 2005 level.

-

Increase the share of non-fossil fuels in primary energy consumption to around 25% (up from around 20%) by 2030.

-

Increase the forest stock volume by six billion cubic meters (up from 4.5 billion) by 2030 from the 2005 level.

-

Bring its total installed capacity of wind and solar power to more than 1.2 billion kW by 2030, which is additional to previous announcements. Investments in solar power were USD4.3 billion (CNY29 billion) from January to April 2022, up by 204% from the same period in 2021.

-

Raise the target for new energy vehicle share from 20% to 25% by 2025.

-

But, as stated in the Climate Action Tracker, these policies are not enough to bring the temperature down to 1.5 degrees Celsius above pre-industrial levels. More green policies are expected from China. The China Council for the Promotion of International Trade (CCPIT) estimated that to achieve net zero carbon emission by 2060, China needs to invest $21.3tr.

So far, China has put policy objectives into action with the following:

-

Issued $57bn (CNY382 billion) green bonds in the first half of 2022, an increase of 202% year-on-year.

-

Added another $14.9bn (CNY100bn) loan to support the clean and efficient mining, processing and utilisation of coal-powered energy by China’s central bank, the People's Bank of China.

-

Increased sales of electric vehicles by 122.5% year-on-year to 2.3 million in the first half of 2022.

What’s happened since the Ukraine war

Since the start of the Russian-Ukrainian conflict, China has increased its imports of coal, crude oil and natural gas from Russia.

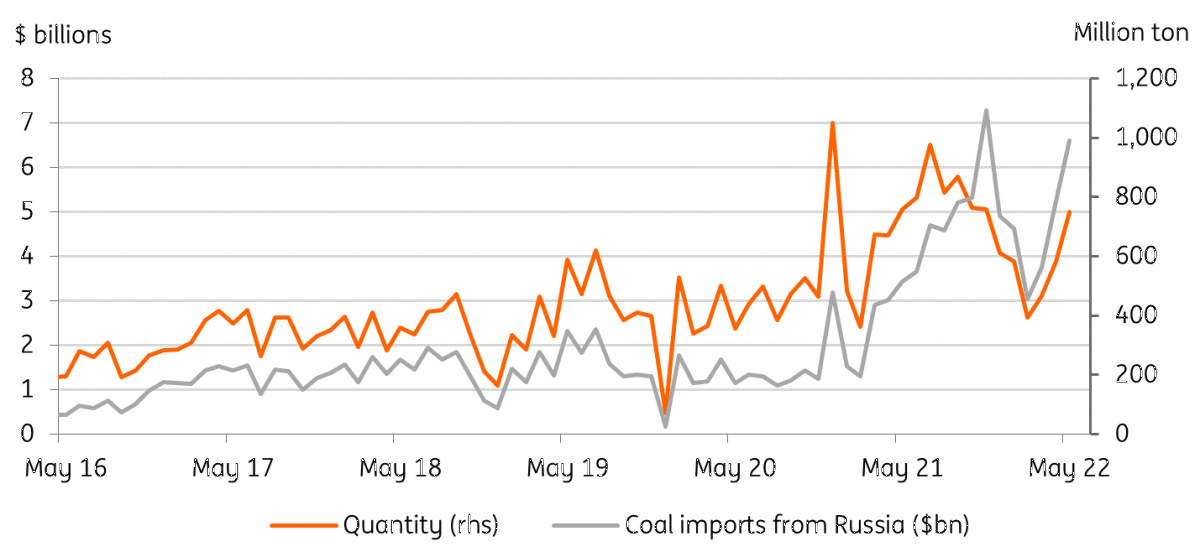

Although one-third of China’s coal imports come from Russia, Russian coal accounts for less than 1% of total China coal supply, which includes a big portion of domestic supply.

We believe that China will at least maintain this level of coal imports from Russia in 2022, as it looks to have an adequate power supply standby for economic recovery this year.

In addition, China is going to cut import tariffs for coal to zero from 1 May 2022 to 31 March 2023, which could lead to more imports of coal from Russia.

These two measures are in line with the compromise approach of moving slowly from coal to renewable energy so that the power rationing seen in 2021 will not reoccur.

China coal imports from Russia as % of total coal imports

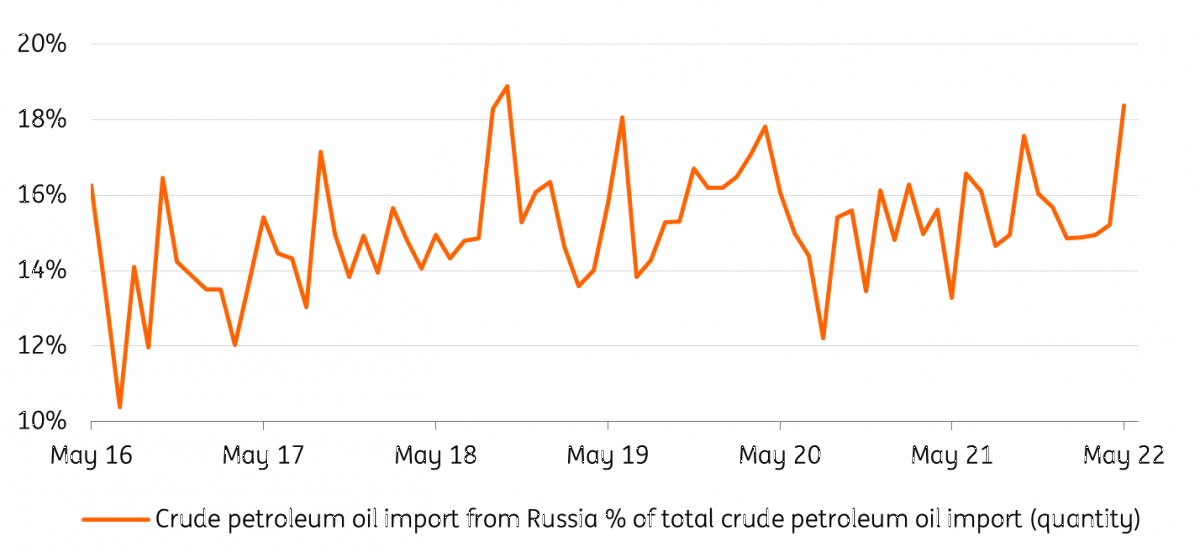

According to Chinese customs data, crude oil imports from Russia rose to more than 18% of total crude oil imports in May from 15% in April. This increase has already exceeded the previous high of 17.6% in October 2021.

China imports of crude petroleum oil from Russia

This comes as Russia signs an agreement with China to supply 100 million tonnes of oil over 10 years – which extends the existing agreement – worth $80bn.

We expect Russia's contribution to China’s crude oil imports will increase to more than 20% in 2022. This increase started in May as China imported 28% (month-on-month) more Russian crude petroleum, with the monthly import value growing at a slower pace at 20% MoM. This indicates that China bought Russian oil at a cheaper price in May. Imports from Russia should have added to strategic reserves, like imports from other economies, with total crude petroleum oil imports edging up 2.93% MoM in May. For China, Russian oil has so far not replaced oil imports from other economies.

China crude petroleum oil imports from Russia as percentage of total crude petroleum oil imports

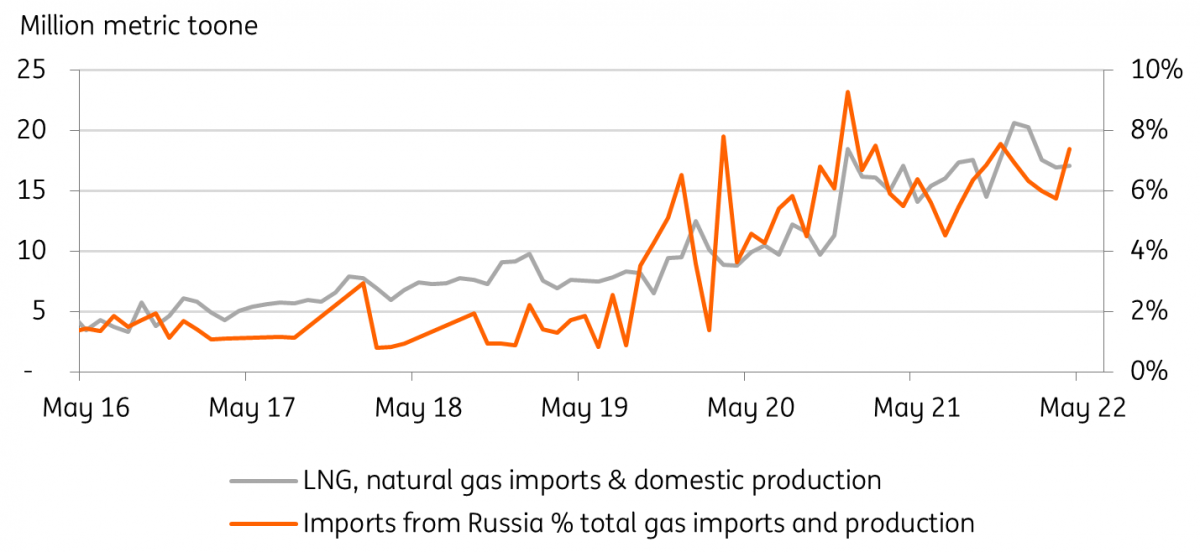

In 2021, China overtook Japan to become the world's largest importer of liquefied natural gas (LNG). Russia is the third-largest supplier of LNG to China, contributing more than 9% of China's LNG and natural gas import value in May 2022, from 12% in April, above the 5% average in 2021.

There will be even more imports of natural gas from Russia in the coming years. In February 2022, China agreed to buy 10 billion cubic meters of LNG from Russia via pipeline for 30 years. In the previous deal, Russia supplied 38 billion cubic metres of gas via pipeline until 2025, according to Reuters.

China LNG and natural gas imports from Russia

However, this does not necessarily mean that China will import less LNG from Australia and the US, which are the number one and two suppliers of LNG to China. LNG is less polluting. When China's economic growth stabilises as lockdown measures ease, the policy-driven stimulus will fade, and by that time, coal power sources will gradually be replaced by LNG and renewable energies. China's demand for LNG and natural gas will continue to rise.

Fast track to reducing carbon emissions didn’t work

China experimented with the pace of reducing carbon emissions, which could provide a valuable lesson to other economies that there is no fast track for reducing CO2. In 2021, some cities cut back on coal production significantly to achieve a reduction in carbon emitted from coal power. The result was electricity shortages. That incident was not caused by a lack of coal supply but rather a bid to cut carbon emissions, which ended up in power rationing.

This highlights power security as a risk when China reduces carbon emissions after 2030. To mitigate this risk, the government increased more than 350 Mt per year of coal mining capacity in the second half of last year. Although China has pledged to stop building coal-fired plants abroad, it increased coal power within China with more than 15 GW approved so far in the first half of 2022.

In 2022, domestic coal production saw a jump in February, while coal imports were also on the rise. The government wants to ensure that electricity supplies are sufficient to support the economy's recovery after the economic damage caused by Covid lockdowns.

It seems that the progress towards meeting its carbon emission commitments is being compromised despite announcing that it will “control coal consumption rigorously” in its 14th five-year plan from 2021 to 2025. But China believes that building a clean coal power plant is a transition phase between traditional coal-powered electricity and electricity from solar and wind.

Rather than just giving up coal power, the government announced in May 2022 that it aims to move seamlessly from coal to renewable energy by upgrading 600 GW of coal power plants to increase the standby time and enable them to ensure power supplies when wind and solar are insufficient due to unfavourable weather conditions.

China coal imports from Russia

Summary

In short, since the start of the Russia-Ukraine war, China has started to import more coal, crude petroleum oil and natural gas from Russia. This is not only a result of international politics; China also needs stable energy imports for its economic recovery. The failure to speed up CO2 reduction in 2021 has resulted in even more reliance on coal fire power to ensure the stability of the power supply. Lockdowns during March-May have cut carbon emissions, and therefore China may be able to achieve flat CO2 emissions in 2022. China is building more green infrastructure, which on the one hand helps to support economic growth, and on the other, helps it to stick to its progress of peak carbon emissions by 2030.

Download

Download article

1 August 2022

How the Ukraine war has affected Asia’s race to net zero This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).