G10 FX Week Ahead: Everybody be FX fighting

The poker games between central bankers and FX markets resume this week - with policymakers in Europe and Japan playing down their strong domestic economic hands and bluffing about the potential for forthcoming policy tightening in an attempt to curb recent currency strength. The only problem is that markets have got pretty good at reading these dovish bluffs

Theme of the week: Everybody be FX fighting

EUR & ECB Preview: The name of the game for markets will be reading President Draghi's dovish bluff at this week's ECB meeting (Thu). Sure, our economists see it as too early to be committing to any explicit end to QE purchases, though we don't feel the EUR needs to necessarily sell-off on this; it would presume that investors have been positioning for an ECB policy shift as early as this week – and we don't feel that this has been the case. While the central bank is likely to toe the party line of a strong EUR being a ‘source of uncertainty’, President Draghi may struggle to find evidence suggesting that the recent move higher in the EUR has been anything but justified by fundamentals (albeit weaker fundamentals else-where as well).

Indeed, a range of models that we monitor tend to support this stance:

(1) EUR/USD close to 1.23 still remains undervalued based on our short-term financial model;

(2) EUR/USD below 1.25 means that the ECB’s macro ‘pain threshold’ has not been breached – and the central bank will find it difficult to credibly cite recent currency strength as a drag on the real economy (just yet); and

(3) the OECD PPP estimate – a medium-term anchor point for EUR/USD – is around 1.32-1.33 (still some 8-9% away from current levels).

As such, attempts by President Draghi to talk down the EUR this week may prove ineffective – with markets in recent years getting better at spotting dovish central bank bluffs. We remain inclined to fade any post-ECB meeting move lower in EUR/USD, with the 1.2140/50 area providing support. Any move below here is a good buying opportunity; the ECB cannot change the positive fundamental EUR backdrop.

JPY & BoJ Preview: The Bank of Japan meeting this week (Tue) may command more attention than usual – not least given recent speculation that the central bank may be looking to signal a hawkish policy shift. We think that it is way too soon for any explicit change to the current policy regime, although one could easily interpret the central bank’s more upbeat outlook on the economy as a small step towards the unconventional monetary policy exit door. Given that the macro story no longer makes the JPY a go-to short, it’s all about managing expectations for Governor Kuroda this week. We wouldn’t be surprised to see a skilful display of dovish showboating in the post-meeting presser – including some pre-emptive concerns over ‘disorderly’ FX moves. This suggests USD/JPY may be supported above 110 for now – but real money buyers of yen may be looking to swoop in.

Bottom line: Policymakers in Europe and Japan will look to play down their strong domestic economic hands and bluff about the potential for forthcoming policy tightening in an attempt to curb recent currency strength. The only problem is that markets have got pretty good at reading these dovish bluffs. It's worth remembering that central bank meetings themselves do not change macro fundamentals.

Majors: EUR, JPY & GBP

EUR: Reading Draghi's dovish bluff

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| EUR/USD | 1.2225 | Neutral | 1.2050 - 1.2350 | 1.2300 |

- The US government shutdown will dominate the domestic narrative this week, with the question now turning to how long any impasse between the President and the Democrats will continue. A swift resolution is proving somewhat difficult given the current ‘blame game’ taking place on Capitol Hill; the looming November midterm elections mean that both sides of Congress may be first looking to save face with a deeply polarised US electorate. A Senate vote is scheduled for 1200 ET today – though it is largely expected to fail. The political woes working against the US dollar have become too difficult to fight – and with the more economically damaging debt ceiling issue still to come in late February/early March – the US dollar may be waiting a while for any political reprieve. 4Q US GDP (Fri) and Fed talk may be a sideshow for markets.

- The ECB meeting will be the focal point for markets this week. ECB officials have been playing ‘good cop, bad cop’ for EUR bulls – with Governing Council member, Villeroy citing FX moves as a source of uncertainty, while Weidmann noted that expectations for a mid-2019 ECB deposit rate hike are realistic. While the latter holds the key to further EUR upside, Villeroy’s cautious take is probably the consensus within the ECB for now. Sure, our economists see it as too early to be committing to an explicit end to QE purchases, though we don't feel the EUR needs to necessarily sell-off on this; it would presume that investors have been positioning for an ECB policy shift as early as this week – and we don't feel that this has been the case. Ahead of this, we have German ZEW and EZ confidence data (Tue), PMI releases (Wed) and German IFO survey data (Thu). Worth also noting that the EUR saw off the German political event risk over the weekend; the SPD narrowly voted to begin coalition talks with Chancellor Merkel - which may be seen as a small step towards a resolution.

JPY: Kuroda's skillful dovish showboating

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| USD/JPY | 110.80 | Neutral | 109.50 - 112.10 | 111.00 |

- The BoJ policy meeting this week (Tue) is likely to command a slightly higher degree of attention than usual given the recent speculation around a potential hawkish policy shift. While we think it is still way too premature for this, there has been a positive Japanese economic story unfolding over the past few quarters - and the lack of observed JPY weakness may in part be down to this. Certainly, in the context of positive activity surprises and stubbornly low inflation, Japan is looking like less of an economic outlier these days – and the local macro story doesn’t make the JPY an obvious sell anymore.

- But while the BoJ may sound slightly more constructive on the economic outlook, they will be highly wary of initiating any disorderly tightening of domestic financial conditions. Raising the yield curve target – and allowing for the JGB yield curve to steepen a bit more – is not an unrealistic scenario in 2H18. But it also requires seeing (a) other major central banks normalising policy and (b) the global risk environment staying positive; these two factors would help to avoid a sharp appreciation in the yen. We wouldn't be surprised if the BoJ sends a gentle reminder that in a yield curve control (YCC) world, the focus is on price (yield target) – not quantity and that one should refrain from extrapolating policy signals from any changes to the amount of monthly bond purchases. Later in the week, we also have Japanese CPI data (Thu); headline CPI for national figure may see a 1% handle for the first time since early 2015 - albeit due to oil price effects.

GBP: Searching for a positive catalyst

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| GBP/USD | 1.3860 | Neutral | 1.3720 - 1.4000 | 1.4000 |

- The pound is touching distance away from our long-held conviction call of 1.40 against the US dollar in 1Q18 – but even we're slightly surprised by the speed at which we have got there. We do think there is more upside potential for GBP in 2018 – but for the next wave of appreciation to kick in, we'll require a positive GBP-specific catalyst. We continue to cite 2 non-mutually exclusive potential sources: (1) positive UK data surprises and (2) actual Brexit progress in the form of a 'gentlemen's agreement' over a transition deal. On the former, this week's UK jobs report (Wed) will give us some further clarity on wage inflation; any positive surprises here would give BoE hawks some confidence that underlying price pressures are moving in the right direction. The first release of 4Q UK GDP (Fri) is expected to show 0.4% QoQ growth - again BoE sentiment will be sensitive to any surprises here.

- With markets barely pricing in one BoE rate hike in 2018 - and only 50bps of tightening in over a 2-year horizon - we still see the potential for a steeper UK rate curve to lift GBP higher. Timing this is key: in the absence of any supportive data, positive Brexit headlines will help to steepen the curve. This, however, seems like a February story - with PM May not expected to outline the UK's position on a future trade deal with the EU until the middle of next month.

Dollar bloc: AUD, NZD, & CAD

AUD: Iron ore deficiency could start to kick in

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| AUD/USD | 0.8000 | Mildly bearish | 0.7800 - 0.8100 | 0.7800 |

- Despite a healthy Australian jobs report, positive Chinese GDP surprise and soft US dollar environment – AUD/USD has failed to make much headway above the 0.80 level. We’re not overly surprised given that investors are likely to view this as the RBA’s threshold for increased currency jawboning – especially while local inflation remains benign. The next major catalyst to test this will be the 4Q CPI data (31 Jan) - until then, we expect external factors to continue determining AUD's near-term direction.

- On that note, a channel of recent AUD support – rising iron ore prices – looks set to revert; our commodities team see the rally up to US$75/t as overdone now and expect a return to US$55/t by 2Q18. An added headwind is the spectre of US steel tariffs – President Trump now has the Commerce Department’s Section 232 report and has 90 days to decide on recommended policy actions (the aluminium report will be released on Monday). Given that this could occur anytime, the unpredictability may act as a limiting factor for AUD bulls in the absence of any other major catalysts.

NZD: 4Q NZ CPI to set the RBNZ policy tone

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| NZD/USD | 0.7280 | Mildly bearish | 0.7100 - 0.7350 | 0.7200 |

- New Zealand 4Q CPI data (Wed) will be the first major domestic data release of the year - and is likely to set the tone for RBNZ policy sentiment (at least in the short-run). Market consensus is for headline inflation to remain at 1.9% YoY (0.4% QoQ) - which would still technically be below the 2% midpoint of the RBNZ's 1-3% target range. Even in the case of a positive CPI surprise, the general expectation is that the RBNZ will have some tolerance for inflation to head towards the higher-end of the target range - not least given the structurally low price dynamics that have plagued the DM world in recent years.

- Add to this some uncertainty over what a shift to a dual mandate actually means for the RBNZ's policy reaction function - and it's unlikely that markets will be any rush to bring forward their expectations for the first rate hike in New Zealand this week. But we do see upside risks - given that there is only currently a 70% probability of a 2018 hike priced into the NZD OIS curve. That seems a bit low to us - and we expect a positive re-pricing at some point over the coming months - potentially in the build-up to the March RBNZ meeting. Domestic data, however, will do the heavy-lifting here. Look for NZD/USD to face strong resistance around the 0.7350-0.7400 area in the absence of any further USD weakness.

CAD: All hands on the NAFTA deck

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| USD/CAD | 1.2420 | Neutral | 1.2350 - 1.2520 | 1.2400 |

- With the Bank of Canada hiking rates as broadly expected, the focus for CAD now shifts to two external factors: (1) US trade policy and NAFTA negotiations and (2) oil prices. The fifth - and potentially penultimate - round of NAFTA talks will dominate the agenda; while our base case is that a break-up will be avoided, noise around NAFTA may act as limiting factor for CAD. But any actual fallout from negative NAFTA noise may be fairly muted - CAD (and now MXN) is showing some resilience despite some anti-NAFTA sentiment from President Trump. This suggests that markets are looking to trade the facts - rather than buy into any Trump-fuelled rumours.

- The week ahead also sees trade (Mon), retail sales (Thu) and CPI (Fri) data releases. The BoC see inflation now broadly stabilising below the 2% target over the coming months - but upside surprises do risk the potential for another 1H18 rate hike (likely May). For now, we expect a 'NAFTA premium' to keep the CAD curve fairly flat - with markets instead see a 2H18 hike as more likely. USD/CAD looks to have found support at the 1.24 level - a significant breach of this seems unlikely in the absence of any further positive CAD developments.

EUR crosses: CHF, SEK & NOK

CHF: Watch for Trump Davos anti-trade risk

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| EUR/CHF | 1.1740 | Mildly bearish | 1.1680 - 1.1830 | 1.1800 |

- Switzerland will be a hot topic in the latter part of next week - but only because world leaders and renowned economists will descend upon Davos to attend the World Economic Forum. In fact, for the Swiss franc, a quiet week in the domestic calendar means that the key driver for EUR/CHF will be the ECB policy meeting. A fairly non-committal President Draghi could see limited risks for EUR/CHF to move above 1.18.

- There is a trivial risk that heightened anti-trade talk from President Trump keeps risk sentiment sidelined; in this scenario, the safe-haven CHF could find some support.

SEK: Another week of range-bound trading

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| EUR/SEK | 9.8350 | Neutral | 9.7750 - 9.8880 | 9.6000 |

- We don’t expect the potential dovish tilt to the ECB meeting (Thu) to have a negative impact on EUR/SEK as the cross has been relatively immune to the ECB QE outlook re-pricing.

- On the Swedish domestic data side, the focus turns to the Swedish inflation expectations (Wed), the Jan Economic Tendency Survey (Thu) and Dec retail sales (Fri). We don’t expect the data to effect SEK either, suggesting a rather neutral outlook for EUR/SEK this week.

NOK: Norges Bank staying put

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| EUR/NOK | 9.6140 | Neutral | 9.5480 - 9.7000 | 9.6000 |

- We look for the NB to remain on hold this week, in line with market expectations. As no economic and interest rate projections are published during the January NB meeting, there is a little scope of the NB statement (without new interest rate projections) to effect NOK.

- Oil price seems to be stabilising and not persistently breaking above 70 $/bbl, meaning the NOK upside seems limited this week.

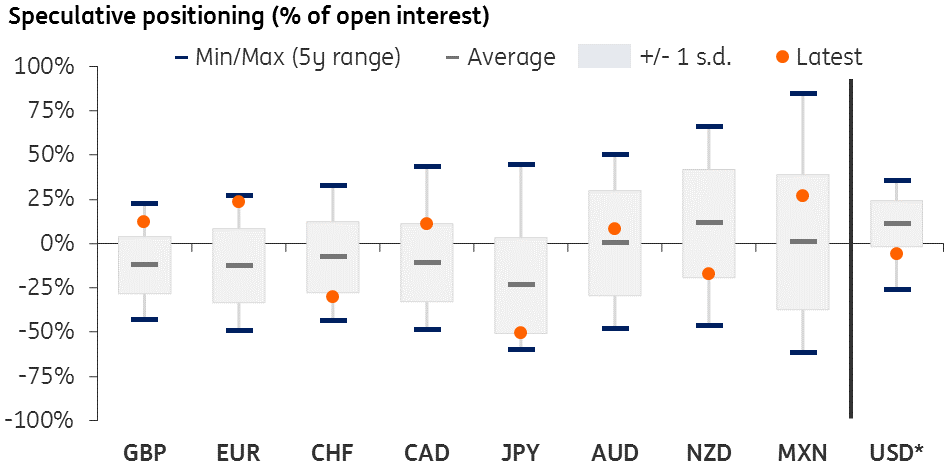

FX Positioning: EUR longs close to highs

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).