FXFX Talking

G10 FX Talking: US default stands in the path to a weaker dollar

Tighter US credit conditions make a US recession, a deeper Fed easing cycle and a weaker dollar all more likely. We continue, however, to favour the dollar bear trend really taking hold in the second half. Before then we have the small matters of a US banking crisis and a possible US Treasury default. The next couple of months could be volatile for the dollar.

Shutterstock

Main ING G10 FX forecasts

| EUR/USD | USD/JPY | GBP/USD | ||||

| 1M | 1.10 | ↑ | 132.00 | ↓ | 1.25 | → |

| 3M | 1.14 | ↑ | 128.00 | ↓ | 1.28 | ↑ |

| 6M | 1.18 | ↑ | 125.00 | ↓ | 1.31 | ↑ |

| 12M | 1.15 | ↑ | 120.00 | ↓ | 1.28 | ↑ |

| EUR/GBP | EUR/CHF | USD/CAD | ||||

| 1M | 0.88 | ↑ | 0.97 | → | 1.35 | → |

| 3M | 0.89 | ↑ | 0.96 | → | 1.32 | ↓ |

| 6M | 0.90 | ↑ | 0.97 | ↑ | 1.29 | ↓ |

| 12M | 0.90 | ↑ | 1.00 | ↑ | 1.25 | ↓ |

↑ / → / ↓ indicates our forecast for the currency pair is above/in line with/below the corresponding market forward or NDF outright

Source (all charts and tables): Refinitiv, ING forecast

EUR/USD: The bumpy path to a higher EUR/USD

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/USD

1.0877

|

Mildly Bullish | 1.10 | 1.14 | 1.18 | 1.15 |

- Based on our view that the Fed tightening cycle is over and that a credit crunch makes a US recession more likely, we believe the dollar is about to embark on a multi-quarter (if not multi-year) decline. The bulk of that dollar decline may come in 2H23 as the US disinflation story builds and the Fed front-loads easing with 100bp of cuts in 4Q23. That could see EUR/USD at 1.20 end year.

- The road to a dollar decline will not be smooth, however. The most pressing risks are the US banking crisis and the risk of a US Treasury default in the June/July window. Historically, stress in US money markets has triggered a temporary surge in the dollar.

- Any flash crash below 1.05 should be temporary, however.

Refinitiv, Macrobond, ING

USD/JPY: 137/140 should be best levels for a while

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/JPY

135.97

|

Bearish | 132.00 | 128.00 | 125.00 | 120.00 |

- USD/JPY continues to frustrate dollar bears such as ourselves. Neither has the risk environment deteriorated enough nor has US disinflation been strong enough to send USD/JPY sharply lower. However, the US credit crunch makes a recession there more likely, and we have a conviction call that USD/JPY will be trading a lot lower by the end of the year.

- In Japan, USD/JPY rallied when new BoJ Governor Kazuo Ueda’s first policy meeting saw the announcement of an 18-month policy review. However, we think there is an under-priced risk that the BoJ does start to normalise policy at its 16 June meeting.

- 137/140 may be the best levels for the next two to three years.

Refinitiv, Macrobond, ING

GBP/USD: Sterling’s correlation with risk assets declines

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

GBP/USD

1.2505

|

Neutral | 1.25 | 1.28 | 1.31 | 1.28 |

- The Bank of England’s trade-weighted sterling index has rallied nearly 9% from its lows last September – the dark days of the brief Liz Truss government. Certainly, that weakness looked like an overshoot and part of sterling’s strength looks like a function of asset managers unwinding sterling shorts. This community is now net long sterling futures contracts for the first time since 21 October.

- Based on our overall dollar view, GBP/USD should be heading higher this year. 1.33 is our target for year-end.

- Interestingly, sterling’s correlation with risk assets has fallen a lot this year – a factor probably helping sterling at the moment. Yet we see a less hawkish BoE coming through, limiting GBP gains.

Refinitiv, Macrobond, ING

EUR/JPY: Late cycle woes favour EUR/JPY downside

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/JPY

147.92

|

Mildly Bearish | 145.00 | 146.00 | 148.00 | 138.00 |

- The tail-end of a business cycle is typically a difficult time for risk assets and 2023 should prove no exception. Looming recessions in both the US and the eurozone will weigh heavily on global growth prospects and should demand some under-performance in this pro-cyclical EUR/JPY cross rate.

- As to ECB policy, our team looks for one last hike (deposit rate to 3.50% in June) before the ECB enters a prolonged pause. As above, we think the BoJ could start to normalise policy in June.

- EUR/JPY reversed sharply from its recent break above 150. Despite still wide differentials between the eurozone and Japan, we favour a break to 140 later this year and 135 next year.

Refinitiv, Macrobond, ING

EUR/GBP: Too much Bank of England tightening is priced

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/GBP

0.8699

|

Mildly Bullish | 0.88 | 0.89 | 0.90 | 0.90 |

- We have been fighting sterling strength for a while – largely on the view that the BoE would not deliver on the tightening expectations priced in by the markets. However, the BoE has delivered on these hikes after all (Bank Rate now 4.50%) and the market prices a further 40-50bp of tightening.

- We continue to think that further tightening is unlikely. Wage disinflation can allow the BoE to pause at its 22 June meeting.

- If we’re right with our BoE call, EUR/GBP should be trading towards 0.88 by the end of June. We suspect that the effects of prior tightening will start to show up, via higher mortgage refinancing costs, in 2H23 and pitch a weak UK activity story.

Refinitiv, Macrobond, ING

EUR/CHF: Swiss National Bank policy plus risk sentiment aids franc

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/CHF

0.9749

|

Neutral | 0.97 | 0.96 | 0.97 | 1.00 |

- Having been as high as 3.5% YoY last year, Swiss CPI has now dropped to 2.6%. Having seen that drop, however, SNB President, Thomas Jordan, said that interest rates were still not restrictive enough. That suggests the SNB will continue to hike and continues to seek nominal CHF appreciation – if necessary, by selling FX. Last year the SNB sold CHF22b to keep the Swiss franc strong.

- In addition, the US regional banking crisis and debt ceiling standoff make it a difficult risk environment. Expect the franc to remain in demand as a non-correlated currency with the S&P 500.

- Moves will continue to be gradual, however, as the SNB heavily controls this pair. But the bias for EUR/CHF is clearly lower.

Refinitiv, Macrobond, ING

EUR/NOK: Norges Bank support efforts may be insufficient

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/NOK

11.595

|

Mildly Bullish | 11.80 | 11.40 | 11.00 | 10.50 |

- Norway’s krone has stayed very volatile and exceptionally weak in the past month. Norges Bank is now in a fully-fledged currency-supportive mode and may hike beyond the projected 3.50% peak rate. We also expect larger cuts to the daily FX purchases in June compared to previous months.

- So, domestically, the picture should keep improving for NOK (which is already deeply undervalued), but external factors remain a bigger driver and beyond the central bank’s control.

- The recent instability in risk sentiment suggests that the near-term outlook for the relatively illiquid krone remains quite clouded. Volatility should remain high, more selloffs are a tangible risk. Still, we expect a recovery from the second half of 2023.

Refinitiv, Macrobond, ING

EUR/SEK: Riksbank dissent weighs on Swedish krona

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/SEK

11.298

|

Mildly Bullish | 11.35 | 11.15 | 11.00 | 10.70 |

- The Riksbank’s hawkish tone started to soften at the April meeting when two members verbally protested the 50bp hike, ultimately hindering the Bank’s SEK-supporting efforts.

- The Riksbank will hike again by 25bp in June or September, but that now looks quite likely to be the end of the cycle. The housing market remains a concern despite some slightly encouraging data, and we recently saw one of Sweden’s largest landlord’s (SBB) credit being downgraded to junk.

- We now expect more EUR strength later this year and have revised our EUR/SEK profile higher too. While short-term upside risks remain material in the near term, we expect a stabilisation around 11.00 in the second half of the year.

Refinitiv, Macrobond, ING

EUR/DKK: Danmarks Nationalbank in a comfortable position

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/DKK

7.448

|

Neutral | 7.45 | 7.45 | 7.46 | 7.46 |

- Danmarks Nationalbank followed the ECB with a 25bp hike in May after another month without FX intervention.

- Denmark’s inflation rate dropped quite sharply in April, from 6.7% to 5.3%, driven by lower energy and food prices. That could mean DN will be more comfortable in re-widening the EUR-DKK rate differential if needed with a smaller hike than the ECB, should fresh pressure on EUR/DKK emerge.

- Indeed, May has seen EUR/DKK touch the 7.4450 level, a two-month low, before rebounding. DN can revamp FX intervention if needed, but the rate differential should allow a gradual convergence to 7.4550/7.4600 around the turn of the year.

Refinitiv, Macrobond, ING

USD/CAD: Loonie has the best risk-adjusted carry in G10

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/CAD

1.3509

|

Neutral | 1.35 | 1.32 | 1.29 | 1.25 |

- With other central banks' tightening cycles coming to an end, the Bank of Canada’s long pause is no longer out of the ordinary. Instead, it has granted more stability to the loonie, which now has the best volatility-adjusted 3-month carry in the G10. We expect 50bp of cuts in 4Q23 by the BoC, but 40bp are already priced in.

- Short-term headwinds for CAD remain non-negligible though, starting from the US banking troubles (Canada is quite exposed), oil’s uncertain performance and risk instability.

- In line with our call for USD accelerating its decline in the second half of the year and oil prices to be supported, we think USD/CAD can move sustainably below 1.30 by the end of 2023.

Refinitiv, Macrobond, ING

AUD/USD: Room to recover beyond the short-term

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

AUD/USD

0.6686

|

Mildly Bullish | 0.68 | 0.70 | 0.72 | 0.74 |

- The Reserve Bank of Australia has alternated between dovish and hawkish surprises lately, and we admit calling the next move is a very hard task. Our base case is one last 25bp hike to bring rates to 4.10%, but much will depend on wage, employment, and inflation data.

- Markets are seeing very little chance of another hike by the summer, so we think there is some mis-pricing in the AUD curve. At the same time, the implications for AUD are not huge, given that external factors remain firmly in the driver’s seat.

- China’s growth story is still a decent underlying narrative, but iron ore prices have dropped lately and risk sentiment has been unsupportive. AUD/USD upside in the medium-term should largely follow the broad USD decline: we target 0.73 in 4Q23.

Refinitiv, Macrobond, ING

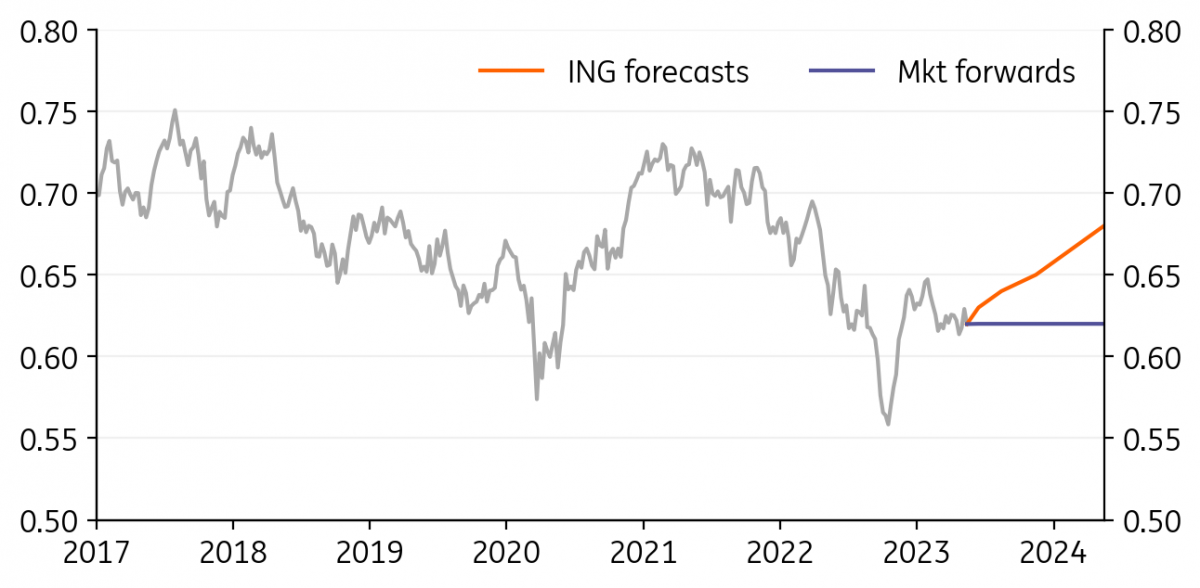

NZD/USD: Watch for RBNZ cuts later this year

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

NZD/USD

0.6217

|

Mildly Bullish | 0.63 | 0.64 | 0.65 | 0.68 |

- It looks like the Reserve Bank of New Zealand may eventually hit the 5.50% projected rate that some – including us - had judged too high. A May hike, even if not guaranteed given yet more evidence of a faster-than-projected drop in inflation, would be the last one in any case.

- Our longer-term view is unchanged: we think the RBNZ overestimated inflation and domestic strains (like in the housing market) will force rate cuts before the end of this year.

- Markets price in one 25bp rate cut in November at the moment, but we don’t exclude that could be as large as 50bp, or that cuts may start in October. This poses risks to the NZD outlook despite an improvement in external factors.

Refinitiv, Macrobond, ING

Download

Download articleThis article is part of the following bundle

15 May 2023

FX Talking: The rocky path to a weaker dollar This bundle contains {bundle_entries}{/bundle_entries} articles

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more