FX vulnerability and the liquidity factor

In the current environment, highly vulnerable risk-sensitive currencies may face a further hit due to their low liquidity characteristics. Norway's krone is a case in point while Sweden's krona and the New Zealand dollar may be at risk of giving up some of their relative resilience. In emerging markets this may mean more trouble for the overexposed rouble

G10: Watch out for Scandies illiquidity

BIS data on G10 FX turnover provides a measure of liquidity within the FX markets and shows how the US dollar (unsurprisingly) is part of 88% of the total transactions (Fig. 1), The euro and Japanese yen are also quite liquid, while the Norwegian krone, Swedish krona and New Zealand dollar rank bottom in liquidity terms.

Fig. 1 - G10 FX liquidity rank

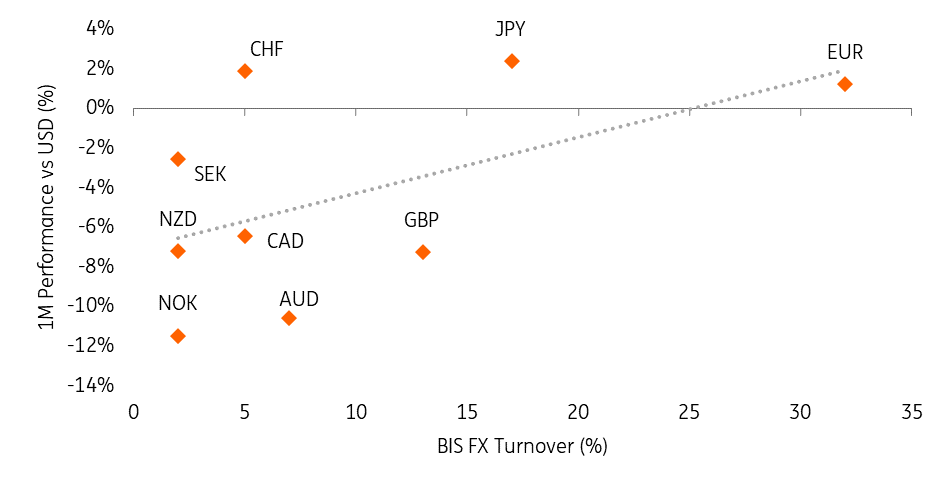

In Figure 2, turnover data is plotted against the performance of other G10 currencies versus the USD over the past 30 days. Sure, liquidity is not the only factor in play here, but we highlight how some currencies are seeing their downside being exacerbated due to their low liquidity characteristics.

NOK appears to be a perfect case in point here. The combination of rising risk aversion and dropping oil prices has proved to be a toxic combination for the currency, but the relative underperformance compared to a similarly exposed currency such as the Canadian dollar (also considering the Bank of Canada cut 100 basis points, the Norges Bank only 50bp) may well be related to NOK lower liquidity.

Fig. 2 - G10 FX liquidity and 1M performance

SEK is proving to be an outlier so far: despite being one of the least liquid currencies, it has consolidated its role as the key procyclical outperformer in these last tumultuous weeks. While we still expect it to broadly retain such role, additional liquidity squeezes may prompt SEK to partly catch up with the rest of the pro-cyclical bloc in terms of downside risk. However, most of this weakness should be channelled against the USD, EUR and JPY.

Looking at the dollar-bloc, NZD is an interesting case. Despite being the most illiquid of its peers, it has outperformed the Australian dollar. The reason stems from less dovish expectations from New Zealand's central bank for most of the past few weeks and the lower exposure to the slump in commodity prices. Similar to SEK, the risk is that drying up liquidity may prompt the NZD to catch up with some of the losses. This endorses our view that parity in AUD/NZD will hardly hold through the second quarter.

EM: RUB the most vulnerable

For the emerging markets space, we have used a market-based measure of liquidity: the average bid-ask spread over the past five years as a percentage of the average spot price (vs USD). A tighter bid-ask spread is commonly regarded as an indication of higher liquidity.

Figure 3 shows the relation with the one-month FX performance (vs USD). The slope of the trendline suggests there is some positive correlation, although more than one outlier is present.

Fig. 3 - EM FX bid-ask spreads and performance

Looking at the most vulnerable currencies, the South African rand and Russian rouble stand out due to the combination of wide bid-ask spreads and very poor performance. The relative underperformance of the RUB is mostly related to the high exposure to the slump in oil prices (WTI has recently reached $25 a barrel, the lowest since 2002), as we highlighted in “The FX winners and losers from the oil price collapse”. Furthermore, RUB – along with the Mexican peso - was one of investors' favourite long positions in EM FX prior to the sell-off, and the squaring of longs has likely exacerbated the downside moves.

Central and Eastern European FX managed to show some resilience despite relatively low liquidity thanks to the combination of low beta to global sentiment/commodity rout and positive correlation with the EUR/USD. We have recent updated our views on the CEE space in light of the latest market developments.

The Asian bloc, instead, may have benefited from the more benign liquidity conditions as it showed some relative resilience compared to the rest of G10.

The two key outliers are the Brazilian real and Mexican peso. Both currencies are highly exposed to the commodity cycle and MXN in particular had been the darling of the EM investment world over the last twelve months. This has all gone sharply into reverse on the collapse in risk assets. Today’s closing of the US border with Canada will not help the MXN outlook either.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article