FX: Protectionist risk premium in the US dollar

We retain EUR/USD targets at 1.30 for end 2018 and 1.35 for end 2019

The year has started strongly for risky assets – especially equities. The theme of synchronised global growth, re-rating stories outside of the US and dollar weakness is now a familiar one. We have characterised this as a ‘benign decline’ in the dollar and it is on this which we base our year-end EUR/USD forecast of 1.30.

Emergence of protectionism and a mercantilist dollar policy

Yet over recent weeks, we have also seen the emergence of some less benign factors such as US protectionism and a mercantilist approach to dollar policy. We now expect investors to build a protectionist risk premium into the dollar, prompting us to revise our USD/JPY forecasts lower.

Let’s look at the two key developments here:

(1) President Trump agreeing to anti-dumping tariffs to protect US manufacturers of washing machines and solar panels; and

(2) Treasury Secretary Mnuchin’s comment that a weaker dollar is good for trade.

Both developments could be dismissed as ‘noise’. We would counter that:

(1) this is the first time these particular safeguard tariffs have been used since 2002; and

(2) President Draghi did not regard Mnuchin’s remarks as casual and instead publicly rebuked him for seemingly encouraging a weaker dollar for trade gain.

Clinton Administration took over a year to put the genie of a weak dollar policy back in the bottle

In particular Mnuchin’s remarks recall a very similar (and failed) dollar policy employed by the US Treasury in the early-1990s. At the time it was seeking to narrow the US trade deficit with Japan. Having encouraged a weaker dollar in 1993/early-1994 and inadvertently contributed to a Treasury market sell-off, it took well over a year for the Clinton Administration to put the genie of a weaker dollar back into the bottle – and what we now know as the US Treasury’s strong dollar policy was born in April 1995.

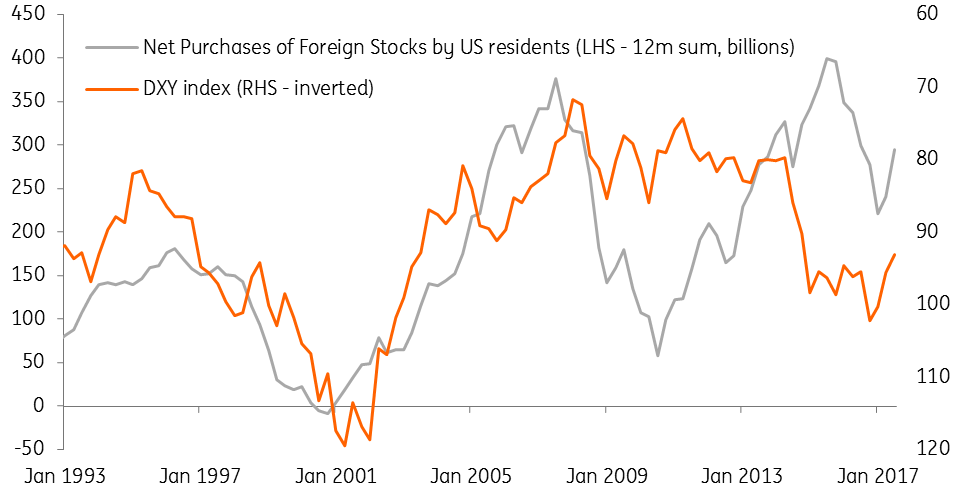

US investors put money to work, dollar weakens

Why our revised year-end target of 100 is not particularly excessive

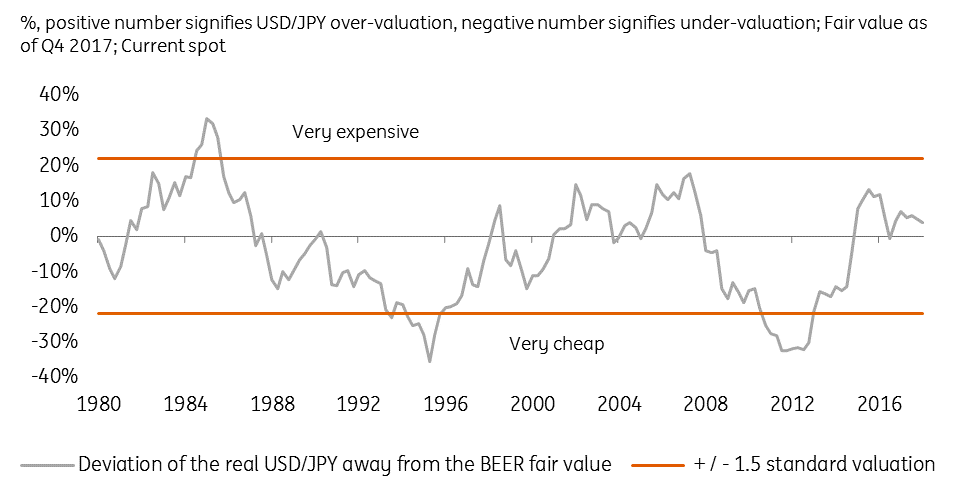

How much could the risk premium damage the dollar? Back in the early-1990s, USD/JPY traded more than 30% below ING’s fair value estimate based on medium-term fundamentals. That fair value calculation now stands at 105 – suggesting our downwardly revised year-end target of 100 is not particularly excessive. It also reflects the fact that the world economy is now in a lot better shape than the early-1990s.

USD/JPY versus term fair value estimates

Bottom line

The protectionism story aside, it still seems investors are willing to put money to work. US Exchange Traded Fund (ETF) flow data shows continued strong demand for US, Emerging Markets, European and Japanese equities (in that order). Assuming global activity remains on an upswing, we expect US investors to continue to put money to work overseas – keeping the dollar on the back foot. We retain EUR/USD targets at 1.30 for end-2018 and 1.35 for end-2019.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more