FX: Dollar against the low yielders

We continue to look for the US dollar to outperform the low-yielding G10 currencies in the coming months. We expect the Federal Reserve to deliver a hike, while the European Central Bank and Bank of Japan will remain dovish/neutral. For sterling, it's all about Brexit

Further USD outperformance

Solid US economic data and a likely market-friendly resolution of the US-China trade talks should eventually translate into an additional Federal Reserve rate hike in the third quarter, in our view. With the market pricing in close to zero probability of a hike this year, any tightening should help to support the dollar against the low yielding G10 FX, where soft activity data has made tightening a low probability event. In essence, we continue to look for further USD outperformance vs the low yielding G10 FX in the months ahead.

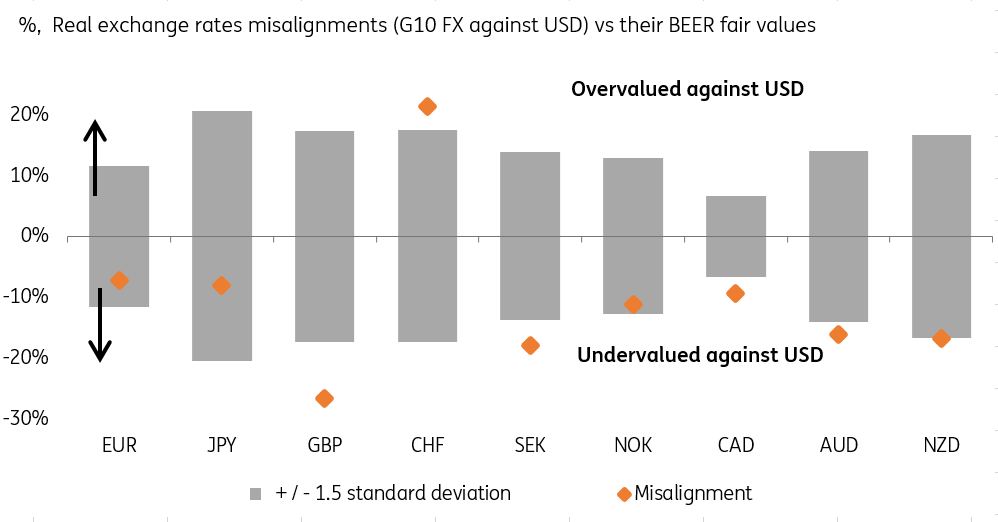

Dollar is expensive against most G10 currencies

USD is expensive but...

Here the Japanese yen, euro and Swedish krona tick the box and the latest dovish ECB meeting provides a case in point. With the case for one additional Fed hike this summer and the already non-negligible interest rate differential between the US dollar and these three currencies, going long on these low yielders against USD is not attractive because of the negative carry cost and also the lack of catalysts for the currencies to strengthen.

This is despite the fact that USD screens expensive both on a trade-weighted and bilateral basis. But the valuation alone is not a sufficiently strong reason for currencies to appreciate if there are no catalysts to close the valuation gap. As per EUR: Another punch from the ECB to the euro, the ECB won’t clearly deliver such catalysts for the euro and neither will the Riksbank or the Bank of Japan, for their respective currencies.

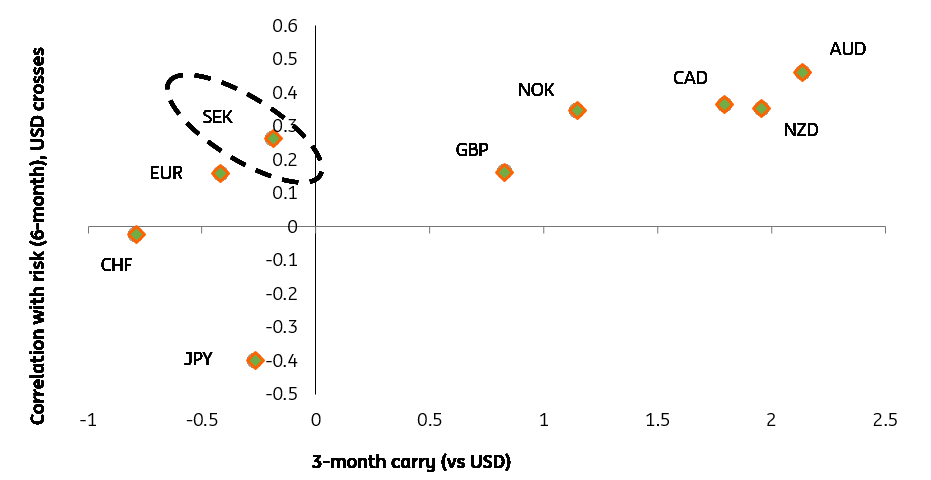

As we’ve written, (SEK: Struggling to find the silver lining), we are one of the most bearish forecasters on the Swedish krona in the market, with the currency offering a rather poor risk- reward compared to its G10 peers. As figure 11 shows, SEK exerts the lowest beta to risk among the G10 activity currencies (meaning the currency benefits less during risk-on days) and has a vastly lower yield (with the Riksbank still running negative interest rates). And now, the bar for the Riksbank to hike in 2H19 is high.

SEK offers a poor risk rewards vs G10 activity FX

Sterling stalls

The rise of sterling stalled during March, lacking any tangible progress in the EU-UK negotiations on changes to the Irish backstop. The market had already priced out the probability of a hard Brexit in February and at one point had arguably overestimated the odds of a second referendum. Next week’s set of parliamentary votes will be crucial for GBP.

Our base case is that Prime Minister Theresa May won’t get support in parliament and that lawmakers will in turn vote for an extension of Article 50. As we’ve noted in Delaying Brexit, we believe the duration of the Article 50 extension will matter for GBP price action. A short extension (i.e. three months or less) should only translate into limited GBP upside (i.e. EUR/GBP at 0.85) as economic uncertainty would prevail, the Bank of England won’t be in a position to hike and the risk of a cliff edge would be only briefly postponed.

A short Article 50 extension should only translate into limited GBP upside as the economic uncertainty would prevail

In contrast, an Article 50 extension of nine months or more would likely lead to greater GBP upside (EUR/GBP at 0.83) as a more prolonged window of stability may allow the BoE to hike.

No white flag on EM

We're still not waving the white flag on our constructive view on emerging markets FX as an expected resolution on US-China trade talks should be positive for this segment, while an eventual Fed rate hike is likely to be in part dependent on a stable global risk environment. This means that the Fed, which is watching external developments closely, is unlikely to deliver a rate hike in an environment where risk assets / EM FX sell off, suggesting that an eventual hike is not inconsistent with a constructive view on EM FX.

In the central and eastern Europe FX space, our top pick remains the Hungarian forint. The forint has been the best performing CEE currency this year, and we look for more gains this month ahead of the crucial National Bank of Hungary meeting on 26 March, when the central bank is expected to announce the start of its Bubor normalisation. This points to HUF outperformance vs the Polish zloty (where the central bank retains a neutral bias) as well as the Czech koruna (where the still heavy positioning is limiting the transmission from central bank tightening to the currency).

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

March Monthly UpdateDownload

Download article

8 March 2019

March Economic Update: In like a lion, out like a lamb? This bundle contains 9 Articles