FX Daily: 50bp Fed hike speculation to support the dollar

The fierce hawkish re-pricing of Fed tightening expectations - with markets now moving to price in 100bp in the next two meetings - is set to offer a positive undercurrent to the dollar, mostly to the detriment of low-yielders. USD/JPY may touch 125 soon. Elsewhere, Bailey's speech and the UK mini Budget can support GBP, while SEK's rally could pause soon

USD: Upside risks prevail

With global equities in the green and oil prices halting their rebound, markets went searching for risk once again yesterday in the FX market, with high-beta currencies erasing all of Monday’s losses. The dollar weakened on improved sentiment, but we still believe it can count on the supportive undercurrent offered by rising hawkish bets on Fed tightening. The futures market is fully pricing in 75bp of tightening in the next two meetings, which implies at least one 50bp increase. Indeed, expectations about half-percentage increases have been boosted by recent comments by Chair Jerome Powell and other FOMC members (like James Bullard) and we are seeing markets moving to price in two back-to-back 50bp hikes in May and June (an option that is around 35% embedded into money market pricing).

Another – and even more relevant – question for the dollar is where markets find comfort with their expectations on the Fed’s terminal rate, which are currently around 2.75%, but may soon reach 3.00%. We think this is an environment that should favour the dollar, net of risk-sentiment swings, especially against low-yielders (exposed to higher yields) and European currencies (exposed to lingering uncertainty in Ukraine).

USD/JPY continued its rally yesterday in line with yet another sell-off in bonds. After easily breaking above 120, we think a move to 125 in the near term is likely given the combination of upbeat risk sentiment and rising hawkish bets on the Fed.

Fed speakers will remain in focus today amid a lack of market-moving data drivers. Powell will speak again and may shed more light on his apparent openness to 50bp hikes. He will be followed by remarks from Mary Daly and the arch-hawk Bullard.

EUR: Not much impact from ECB speakers

A number of European Central Bank speakers yesterday – including President Christine Lagarde – failed to yield any market-moving headlines, and likely cemented the notion that the ECB is set to remain a bystander for the next couple of meetings while the Fed presses on with more aggressive tightening. Policy divergence and growth divergence (the latter exacerbated by the war in Ukraine) are, in our view, putting a cap on any recovery in EUR/USD around the 1.1100 area. We still see a move to 1.0900 in the next few days as more likely.

Today we’ll hear from Bundesbank President Joachim Nagel, who will take part in the BIS conference with Powell and Bank of England Governor Andrew Bailey. Nagel’s stance has so far been quite clear in supporting a rate hike this year, although we may get more indications on the expected timing for the start of the tightening cycle.

Elsewhere in Europe, the National Bank of Hungary raised the base rate by 100bp to 4.40% at its March meeting. Along with the move in the base rate, the central bank raised the whole corridor by 100bp as well. The most important question remaining is what the NBH does with the effective rate. In our view, the central bank will hike the one-week deposit rate by 50bp on Thursday. We expect EUR/HUF to trade below 370 this week.

GBP: Focus on Bailey and Sunak

The pound was little moved this morning – following a big rally yesterday – as CPI figures in the UK showed an above-consensus acceleration in inflation. The headline rate reached 6.2% vs the expected 6.0%, and the core advanced to 5.2% in February.

Let’s see how these latest figures impact today’s speech by the BoE's Bailey at the BIS conference. Also on the calendar today is the announcement of the so-called “mini-Budget” by Chancellor Rishi Sunak. The focus will be on any cut in fuel duty, increases in national insurance thresholds, and more generous corporate tax breaks to encourage investment.

The combination of above-consensus inflation, some potential hawkish comments by Bailey and a pro-growth announcement by Sunak could support the view that the BoE will have more room for monetary tightening, ultimately helping the pound today. We expect a decisive break in EUR/GBP below 0.8300. After that, the next big level to watch is the 0.8200 7 March low.

SEK: End of the run?

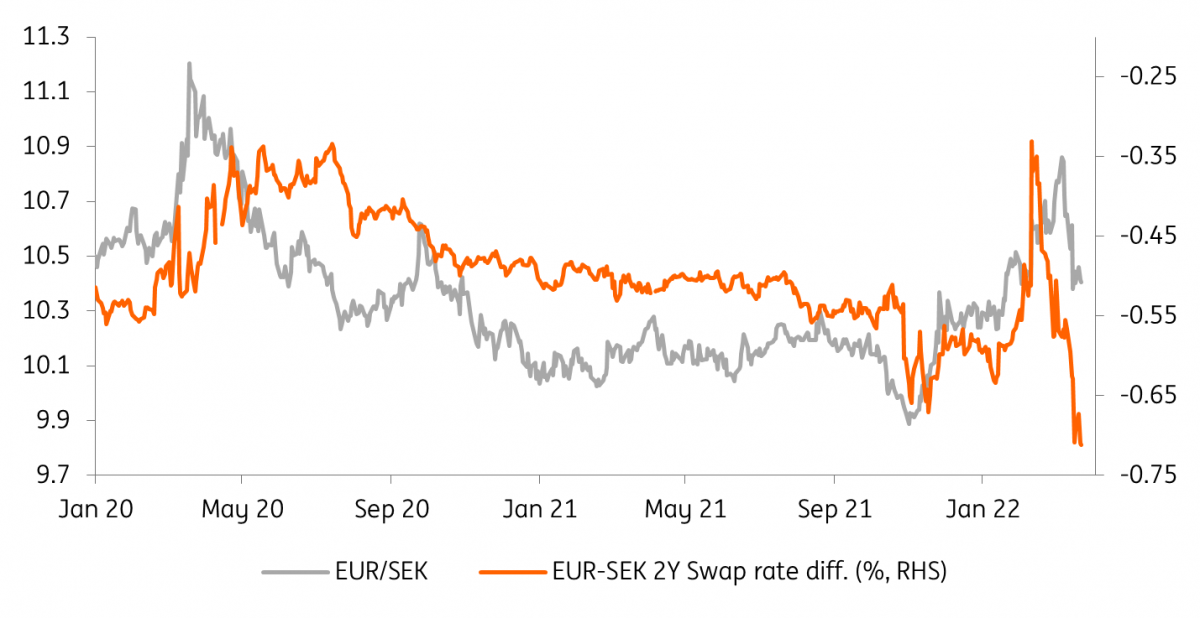

Since the start of the Russia-Ukraine tensions, the Swedish krona has emerged as a benchmark for market sentiment around the broader impact of the war. Gains in EUR/SEK over February and March signal that markets have priced a good deal of geopolitical risk out of the krona. At the same time, the recent SEK moves have also been driven by a fierce hawkish re-pricing of Riksbank’s rate expectations, which – as shown below – have made the EUR-SEK two-year rate differential swing significantly more in favour of the krona.

While markets appear quite comfortable for now with their optimistic stance on an eventual military de-escalation in Ukraine, their hawkish pricing for multiple hikes in 2022 by the Riksbank may fail to be met by a similar hawkish tone from the Riksbank. Last week, markets over-read Governor Ingves announcement that he now expects a hike before 2024, and today they’ll watch closely what Deputy Governor Breman has to say in his panel about inflation. In a still quite volatile environment for the pair, we think the risks are skewed to the upside for EUR/SEK as some hawkish expectations on Riksbank tightening may have to be scaled back in the coming weeks.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more