France: No economic epiphany

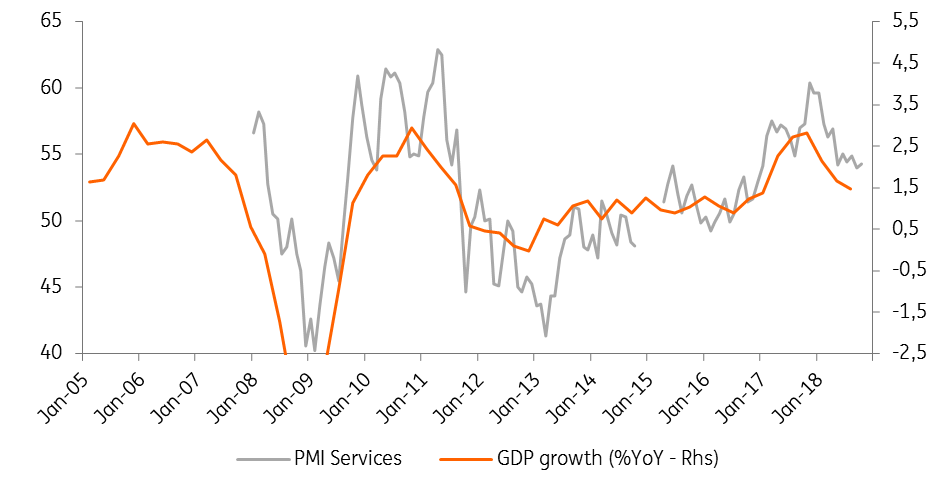

The 3Q GDP figures showed that a rebound in demand, following a weak first half of the year, will not materialise. With 0.4% quarter-on-quarter growth, the government’s 1.7% growth projection for 2018- which once looked pessimistic- will now probably be missed

| 0.5% |

Rebound in French domestic demand in 3Q, the highest in a year |

The last figures are still not as bad as they look…

After two very weak quarters of growth (each time a notch below 0.2% QoQ- half the eurozone average) induced by strikes in the service sector and weaker consumer confidence, we were among those who thought that a strong rebound was in the cards for the third quarter. Hampered by the negative impact of destocking, this didn't happen. However, we do see a rebound in domestic demand, which grew by 0.5% QoQ, the fastest pace since 3Q17 while the weak euro helped net exports, which contributed 0.2 percentage points to growth.

- Private consumption rebounded by 0.5% QoQ in 3Q18 after a 0.1% decline registered in 2Q. If oil prices are still weighing on purchasing power, a positive fiscal impulse is counterbalancing part of it, allowing purchasing power to grow in the second half of the year despite limited gains in the job market. We, therefore, expect the rebound to be repeated in 4Q18. Overall however, we believe private consumption growth will be limited to 1% this year after 1.2% in 2017. In 2019, with no fiscal headwinds and after the energy price shock has been digested, decreasing unemployment should play its role and allow for more dynamic private consumption growth of 1.5%.

- Business investment still benefited from healthy order books in 3Q18, which together with some fiscal support, led to 1.4% QoQ growth. We expect business investment to continue growing in coming quarters as capacity utilisation and foreign orders remain elevated.

- Public investments came in much weaker than expected, at 0.2% QoQ

- Household investments actually posted their first decline since 2015 at -0.2%. This is even more surprising as interest rates remain extremely low and price increases on the housing market remain soft. We still expect a positive rebound in coming quarters on that side but growth will slow down from 5.6% in 2017 to 1.6% this year.

- Exports grew by 0.7% in 3Q18, still benefiting from solid foreign order books. Private consumption was not strong enough to really boost imports, which allowed net exports to contribute a healthy 0.2 percentage points to GDP growth in the third quarter. The euro weakness should help French exporters in 2018, which is likely to see the strongest net export contribution since 2012, at 0.5 percentage points.

2018 growth should reach 1.6%, but don't be fooled: this is largely a 2017 story. The growth dynamic of 2018 is much closer to potential than what was hoped for six months ago when 2% still looked achievable.

…but they nevertheless mean an early and depressing return to potential

All in all, 2018 growth should reach 1.6%, but don't be fooled: this is largely a 2017 story. The growth dynamic of 2018 is much closer to potential than what was hoped six months ago when 2% still looked achievable. With a likely annualized QoQ average growth of 1.1% this year, the slowdown is clear, and it's come early, after only one recovery year in 2017. In 2019, if we think that domestic demand will grow faster (1.7% after 1.4% in 2018) thanks to recovering private consumption (1.5% after 1.0% in 2018), a stronger euro will weigh on net exports and limit GDP growth to 1.4%.

A pro-reform Government would certainly have benefited from a brighter outlook. This increases the sense of urgency around reforms as the outlook will become less favourable in the second half of 2019. In particular, measures to keep the public debt on a downward path, from its near 100% level currently, should be laid out before it becomes more difficult to justify in the eye of the electorate. On the same note, investment plans to increase training for the long-term unemployed should be put in place while economic growth is still having a downward effect on the unemployment rate, something that will only last until the second half of 2019. Should that opportunity be missed, it's possible that President Macron will end his Presidency in 2022 with the same unemployment rate he started with.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).