France: Yellow Fever

2018 ended with unprecedented grassroot protests throughout France, which impacted the main growth indicators. Consumer confidence was particularly hit in 4Q18. The impact of this domestic crisis will be felt across all sectors. We believe there'll be an uptick in the coming months, but see GDP growth limited to 1.3% this year

| 1.3% |

French GDP growth2019 and 2020: ING forecasts |

2018: the lost year

The second half of 2018 has been a disappointment on many economic and political fronts in France. The President’s approval rating dropped from 42% in the first half of the year to a mere 23% in December (Source: Elabe) on the back of the 'yellow vest' crisis which paralysed the country during major shopping weekends at year end, hurting growth in the worst manner (see below). The crisis interrupted the debates on crucial reforms (institutional, pensions, unemployment rights). Now that the government has put in place some measures to support the still ongoing purchasing power growth and to organise a national debate, the polls seem to be turning. The President’s approval rating slightly rebounded by 2 percentage points in January, to 25%, which is as low as François Hollande’s rating after his first 21 months in office. It is still very fragile though, and very dependent on the success of the national debate the government is currently putting in place.

This national debate could have virtues though. The formula led to success in the past; spending months on the road to listen to the French in 2016 allowed Mr Macron to establish the political programme that brought him to power. The national debate could be a way to validate the main reform needs he identified two years ago, notably for the pension system. We believe that it will be tough and that French institutions, in general, will continue to be under solid pressure but that there is no other way to regain support. Moreover, it will also be a platform for the European Parliament elections at a time when campaigning ‘as usual’ looks difficult for traditional parties given the high level of political defiance among the French. We doubt that it will be enough to avoid another victory by the far-right Rassemblement National in May’s European elections but it could help the President’s party, LREM, to have a presence on the European stage, only two years after its foundation in April 2016.

2018 will end on a humbling note

The window for reforms is closing fast though: the current economic slowdown, exacerbated by the ‘yellow vest’ crisis, will make reforms increasingly difficult in 2019. Indeed, on the economic front, the rebound that was expected in the second half of 2018 never really happened, with the fourth quarter being particularly affected by the ‘yellow vest’ crisis, while the third only showed half of the expected rebound, with GDP growing by 0.3% QoQ. Given that the first half of the year had already been slowed down by weeks of strikes that notably affected the transport sector in April and May, 2018 will end on a humbling note. The potential for a 2.0% GDP growth, which was in place at the beginning of the year, vanished and has turned into 1.5% at best. Given the weaker European economic context that is expected in 2019 and 2020, we believe GDP growth will return to potential, or 1.3% YoY, in both years. If domestic demand should recover slightly, it is indeed likely that external trade will weigh on growth (as it usually does) as the euro catches up some ground against the US dollar over the next two years and less dynamic world trade affects demand for French exports. Note that on this front, all forecasts are made under a ‘no hard Brexit’ assumption.

French consumer confidence and spending

Domestic demand starts 2019 with high anxiety

At 86.7 in December, the main consumer confidence index reached its lowest level since October 2014. The large drop in purchasing intentions that was measured in November continued in December, with intentions reaching their lowest level since June 2013. The second largest change in the survey was measured in households’ sentiment in relation their ability to save, which had been restored in the first half of 2018. Lastly, despite the fact that unemployment continued to decline in recent months, fears of unemployment – which made a two-year jump back in time in November – continued to increase in December, although the rise was limited.

The survey shows an abnormal level of anxiety among French consumers

The survey therefore shows an abnormal level of anxiety among French consumers: their sentiment about their ability to save is worse now than at any point of 2008 and 2009, while the current economic slowdown has nothing in common with what was seen at the time and despite the fact that purchasing power per household has increased by 1.4% in 2018 (Source: Bank of France) after a cumulated 3.7% between 2013 and 2017, which was admittedly weak (two times slower than real GDP).

However, this high level of anxiety will have a lasting impact on consumption long after the short-term shock of the ‘yellow vest’ crisis is over. Consumer spending was already contracting in November and purchasing intentions in December clearly show another negative month. Private consumption could, therefore, contract slightly in 4Q18, leading in 2018 to the weakest private consumption growth since 2014, at 0.9%. In 2019, private consumption should catch up on the back of lower energy prices, lower unemployment and higher purchasing power (the Bank of France expects it to rebound by 1.8% this year). However, we expect the rebound to be limited by the current level of anxiety, which we believe will feed saving behaviours rather than consumption in the coming months. We, therefore, revise our private consumption growth forecast from 1.5% to 1.1% this year while unemployment should drop to 8.5% in the course of this year. 2019 should indeed be – with 2018 - the second year posting a decline in the unemployed population (all categories included, so outside the subsidised jobs effect) since the beginning of the crisis.

The main strengths come from business investments

The main strengths we are still seeing at the moment in domestic demand come from the current level of business investments. Industrial surveys are showing that despite a decline in the economic outlook, capacity utilisation did not decline significantly in the fourth quarter while export order books remain well filled. The catching-up effect in the automobile industry should also support manufacturing in 2019: even if we do not think that car sales will recover to their summer 2018 level anytime soon as diesel car prices are durably affected by the new European norms, it does not mean that the situation cannot improve at all. Corporate investment growth should, therefore, decelerate only slightly in 2019, to 3.5%. Household investments should, on the contrary, remain subdued after a very weak second semester of 2018 despite low-interest rates. This is why we expect a deceleration in investment growth from 2.8% to 2.5% between 2018 and 2019, and to 2.2% in 2020.

Lastly, global trade growth should decelerate again in 2019 on the back of weaker economic trends in the US and China and a peak in German exports. French net exports, which benefited in 2018 from the weakness of domestic demand for imports and a relatively strong external demand despite the euro strength (outside the EUR/USD story, the effective euro exchange rate reached a peak this year), should again weigh on growth in 2019 and 2020.

Capacity utilisation remained elevated in 4Q18 (85.2%)

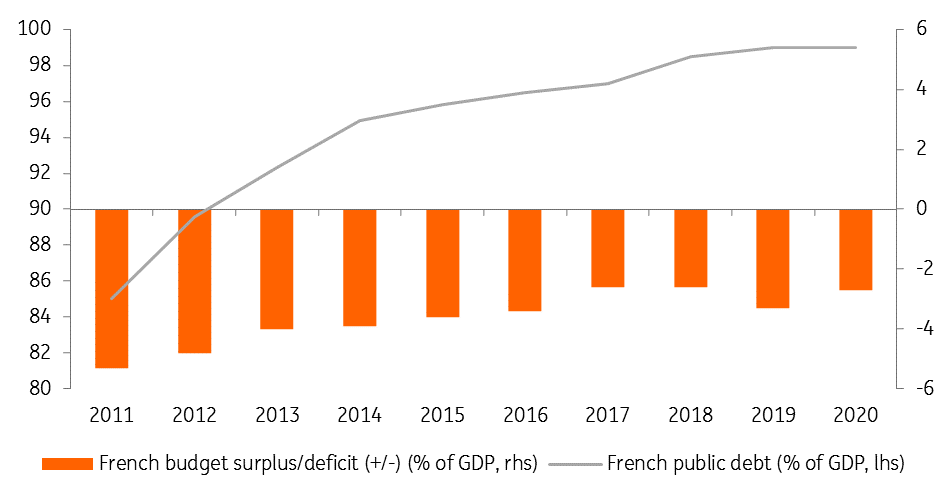

An ill-timed budget impact

Adding the effects of lower GDP growth to a higher deficit in 2019, it is unlikely that France will have a deficit below 3% in 2019. In fact, the 2019 budget was already impacted by the recovery of SNCF's debt and the transformation of tax credits for competitiveness into lower charges: it was already forecast at 2.9%, close to the limit. This should be exceeded, the deficit reaching 3.3% and the debt nearing 100%. Nevertheless, we believe that the downward trajectory will be maintained. In the coming months, the government should detail corrective measures aimed at reducing public expenditure. We, therefore, maintain a deficit forecast of less than 3% in 2020, or 2.9% instead of the previously expected 2.6%.

The rest of Europe... may not be ready to support risk sharing or tax transfers

If the shock were to be temporary, the least we can say is that it is ill-timed at the European level. Italy has indeed been forced to review its budget to avoid a new excessive deficit procedure, a procedure that France itself officially ended only last June. Both situations are, however, far from comparable since even the blip of 2019 does not put into question the trajectory of the French public debt, which should decrease in the coming years. If we think that the debate around a new Excessive Deficit Procedure for France is largely exaggerated, it remains that this makes France’s position on eurozone reforms more difficult to hold. So long as President Macron shows that France cannot be reformed, the rest of Europe, especially in the north, will not be ready to support risk sharing or tax transfers among eurozone members. The small steps that were endorsed in December by the European Council in terms of the EU budget and the Banking Union, and which acknowledged some French demands, may, therefore, be the last for a while.

French budget surplus and public debt

Download

Download article17 January 2019

ING’s Eurozone Quarterly: Tiptoeing around the ‘r’ word This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).