France: Dismal consumption in 1Q while 2Q starts on the wrong foot

GDP growth was weaker than previously thought while private consumption growth was dismal. Despite the strong consumer confidence surveys, the second quarter has started on the wrong foot

Consumer confidence stabilised in May

French GDP growth was weaker than previously thought, at only 0.17% QoQ in 1Q18 while private consumption growth was dismal.

In May, French consumer confidence remained broadly stable in contrast to business confidence which was more affected by the strikes.

Confidence remains lower than where it was in January, but it has been stable for the last four months around 100, which is much higher than the average of the previous five years (94). The May survey brought some good news, notably in terms of employment prospects as there were more optimistic answers than pessimistic for the first time since 2007.

French consumers are also more confident in their capacity to save, which is positive except that it seems that people are more worried about savings than consuming as purchasing intentions remain low.

| 0.2% |

Domestic demand growth(QoQ) in the first quarter, below consensus |

| Lower than expected | |

But fails to translate into higher consumption

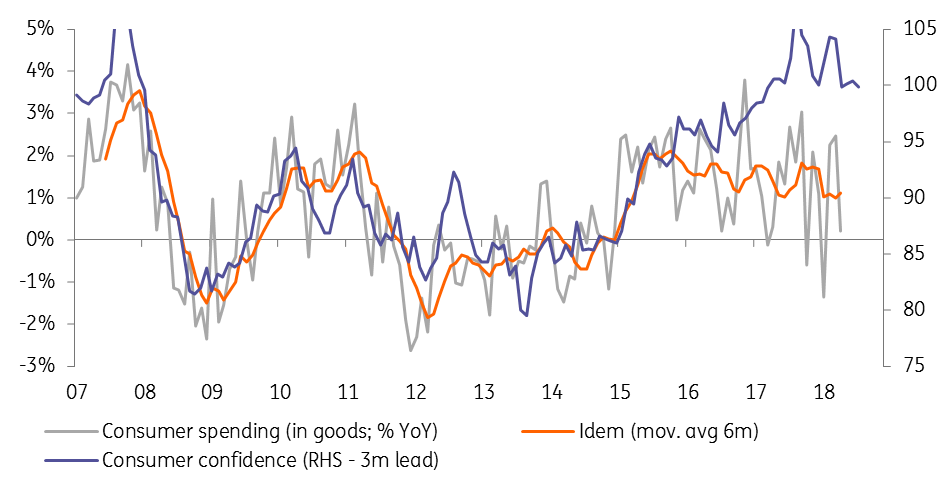

This was confirmed by consumer spending on goods in April which posted a 1.5% month on month decline. Even though this data is volatile, the moving average remains disconnected from consumer confidence since 2016, showing a rather flat trend as you can see in the figure below.

To confirm this, an update of 1Q18 GDP figures show that growth has been weaker than previously thought in the first quarter, with domestic demand growing by a dismal 0.2% QoQ. Private consumption growth was even weaker at 0.1%, which means that it will take a strong rebound in the second quarter to bring private consumption growth above 1.5% in 2018 (after 1.1% only in 2017).

We don't believe this will happen in 2Q18 as rail and air strikes are likely to have dampened Easter holidays’ expenditures and the same applies for the long weekends in May.

Consumer spending seems to have disconnected from confidence levels… for now

We remain optimistic for the second half of the year where a positive mix of fiscal measures and lower unemployment should help a much-awaited private consumption rebound and still bring GDP growth to 2.1%.

However, the current looming institutional crisis in the Eurozone could dampen confidence again and reduce 2H18 growth prospects further. The jury is still out.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).