Four key things to watch out for at COP26

The long-awaited climate meeting, COP26, will start in Glasgow in the UK on 31 October. It will be crucial for those world leaders attending to align countries' emission reduction strategies with the global goals of the Paris Climate Agreement. Here are the four key things to look out for

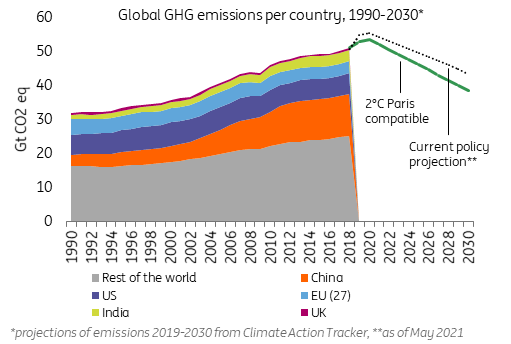

As the world recovers from Covid-19, the carbon clock has not stopped ticking. Climate models warn that current climate mitigation efforts set us on track to exceed +2° of global warming in less than 25 years, and in 7 years if the threshold is lowered to 1.5°C. It all translates to very high physical risk according to the latest IPCC report.

Will governments align their emission reduction policies with carbon neutrality?

Under the 2015 Paris agreement, countries committed to a trajectory consistent with carbon neutrality by around 2050, which implies holding global temperature rises to “well below” 2°C above pre-industrial levels while “pursuing efforts” to stay within a 1.5°C reach by 2100. But the original commitments made on cutting emissions at Paris, called the Nationally Determined Contribution (NDCs), were inadequate to hold the world within the Paris temperature targets.

Therefore, the agreement contains a ratchet mechanism by which countries would have to submit updated NDCs every five years. It is precisely the measurement of this commitment, country by country, that will be at the heart of the COP26 summit, which will meet in Scotland from October 31 to 12 November. The meeting is long-awaited as has been postponed by a year due to the Covid-19 pandemic.

The current plans of the parties due to meet at the Glasgow conference put the planet on a 2.7°C of warming trajectory by the end of the century according to the latest UNFCCC report, far from the Paris Agreement. According to the same report, if implemented, the updated NDCs (including those that have been newly submitted by the US, the EU, the UK and more than 100 others) are still inadequate. They would still result in a 16% increase in emissions by 2030 compared to 2010, whilst they would need to decline by about 45% during this period in order to keep a chance of not exceeding 1.5°C of warming.

Current carbon mitigation policies are not compatible with the 2°C Paris Agreement

So, the number one thing to watch for at COP26 is to what extent countries strengthen their carbon mitigation policies.

Will governments green their Covid-19 recovery plans at last?

Although global energy-related CO2 emissions fell by a record of 5.8% in 2020 due to the various lockdowns in the US, the EU, China and India, they are expected to skyrocket again this year as the recovery is carbon-intensive, as was the recovery from the global financial crises in 2010. The IEA already expects emissions to rebound by nearly 5% in 2021.

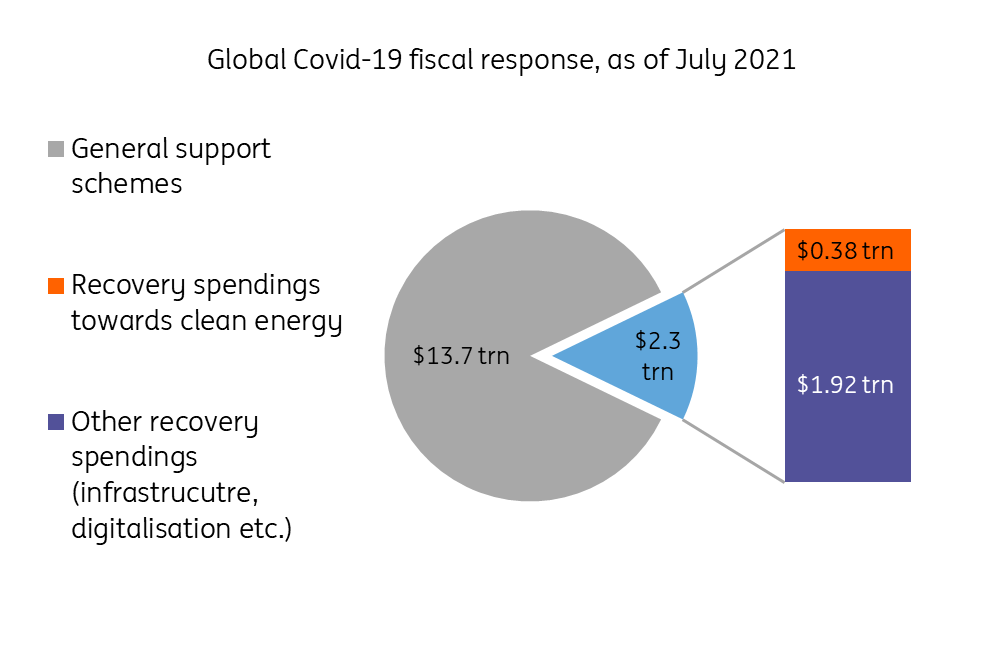

Covid-19 related discretionary fiscal spending for G20 members is of unprecedented scale. It currently amounts to around $16 trillion (fiscal support schemes for households and companies and recovery plans altogether). But so far, the opening window to use recovery measures to accelerate a low carbon transition has largely been missed for G20 countries, with spending predominantly neutral or negative on carbon emissions, despite the EU Recovery and resilience plan and Joe Biden’s plan to “Build Back Better” and greener.

Only a very small part of Covid-19 support is aimed at greening the economy

A second point to watch for will be whether renewed carbon mitigation engagements are to be followed by a greening of global recovery plans.

Will China and India present credible commitments to phase out coal?

Despite efforts ahead of the COP26 to promote a global phasing out of coal power, an agreement still seems out of reach. Coal is still the world's largest source of electricity generation (35% of the global electricity mix). It is the largest cause of greenhouse gasses, responsible for 39% of CO2 emissions.

Therefore, seven countries (notably France, the UK, Germany and Chile) have already committed to phasing out coal and a few others (Denmark and Costa Rica) are even pushing for a diplomatic initiative to get out of all fossil fuels (coal, oil and gas) altogether.

But the future of coal is in the hands of China and, to a lesser extent, India. China is not only the world’s biggest emitter of GHG, greenhouse gasses, and it is the largest consumer of coal too. Almost 50% of China’s CO2 emissions from fossil-fuel combustion are the result of power generation, of which virtually all are coal-fired power plants (i.e. 97%).

China has not yet submitted its updated NDC, but has announced a target of carbon neutrality by 2060 and expects CO2 emissions to peak by 2030. President Xi Jinping's recently announced China would stop funding new coal energy plants overseas but the future of coal and carbon emissions is about domestic policies. On the domestic side, China's exploding energy demand is prompting Beijing to boost coal production in Inner Mongolia and imports from Australia, on the back of power shortages and surging energy prices.

A recent study from Global Energy Monitor pointed out that coal-fired power plants under development in China amounted to 247 GW, which is nearly six times Germany’s entire coal-fired capacity (42.5 GW) that it wants to phase out by 2038. However, China is not the only question mark. Some of the major fossil fuel producers such as Saudi Arabia, Russia and Australia are also refusing to strengthen their NDCs ahead of COP26.

Greening China and India’s power sector makes a difference

So, a third decisive issue to watch for at COP26 is to what extent countries make credible claims to reduce the use of coal.

Will governments implement carbon markets and increase climate finance?

Raising these ambitions is largely dependent on climate finance. Developed countries promised to mobilise $100bn a year by 2020 for the developing countries to help them cope with the effects of climate change. But that target has not yet been met, still falling short of $20bn in 2019 according to an OECD study.

Another key topic that will be under the spotlight at the COP26 is article 6 of the Paris Agreement, which outlines ways that countries can achieve their mitigation goals in several ways, particularly through industry-wide emission trading schemes, such as the EU ETS carbon market and through voluntary carbon markets (VCM). If done right, both have the potential to reduce the financial cost to meet the Paris Agreement emission pledge whilst quickening the pace of the energy transition.

The carbon markets' mechanism is fairly simple. It relies on a “cap and trade” principle: each participant is attributed some “rights to emit” and participants with lower emissions can trade their excess credits to emitters that exceed their carbon budget. The overall cap guarantees that greenhouse gas emissions do not exceed the maximum level and the cap is lowered every year by a reduction factor.

Carbon markets sparked global attention in 2021 as carbon prices spiked within the EU carbon market. Furthermore, China officially launched its national carbon market, set to be the world biggest. Globally, carbon markets cover about 16% of global GHG emissions. But the path to implementing carbon markets is complex. In practice, carbon markets are yet to achieve their goal, as less than 5% of global emissions covered by carbon pricing initiatives are priced at a level consistent with achieving the goals of the Paris Agreement.

The path to implementing carbon markets is complex

And the same goes on for Voluntary Carbon Markets (VCM): nice and shiny on the paper but thorny in practice. The idea with VCM is that they would allow countries to offset domestic emissions through emission reduction measures abroad. In this way, if it is cheaper for a country like France to cut a tonne of CO2 in India rather than within its own territory the French government could finance a renewable energy project in India that would decrease emissions there, but that would count for the French emission reduction target. Such a mechanism would enable access to climate finance for poorer countries and cheaper cuts of emissions for richer countries.

All that requires transparency and the carbon accounting standards which come with it. Indeed, there could be a double-counting of emission reductions by both countries, which would give the impression that carbon emissions are falling faster than they actually are. Such offsetting projects need to comply with ESG (environment, social and corporate governance) guidelines too to enable additional benefits in terms of biodiversity protection, public-health improvements or job creation for local communities. Brazil, for example, wants tree planting excluded, while the Democratic Republic of Congo would like to see it added. The issue with VCM is so complex that negotiations had already failed to achieve a full agreement at the COP24 in Katowice (Poland) and at the COP25 in Madrid (Spain).

Climate finance for developing countries is still not enough

A fourth theme to watch out for at COP26 is to what extent negotiators make progress on implementing carbon markets and define practical guidelines for VCM.

So, there’s clearly much to discuss and binding agreements are far from assured. Remember, too, that some of the leaders of the world’s most polluting countries are unlikely to be there. Just this week, the Kremlin announced that President Vladimir Putin won’t be attending in person, although he might show up via video link. Hopes are not high that China’s President Xi will be there; Brazil’s Jair Bolsonaro isn’t flying out either.

COP26 has been described as the ‘last best chance’ of saving the planet. Weary campaigners and world leaders are well aware that we’ve heard that many times before. Let’s hope we’ll be surprised.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

21 October 2021

COP outs ahead of climate conference This bundle contains 7 Articles