Flexibility, resilience and regulation support the European trailer market

The European trailer market is usually sensitive to the economic cycle, but this time is slightly different. Headwinds slow new order intake, but backlogs secure double-digit recovery for registrations in 2022. The need for flexibility in a volatile world supports the trailer market. And new regulation adds to that

European semi-trailer fleet has grown continuously in recent years

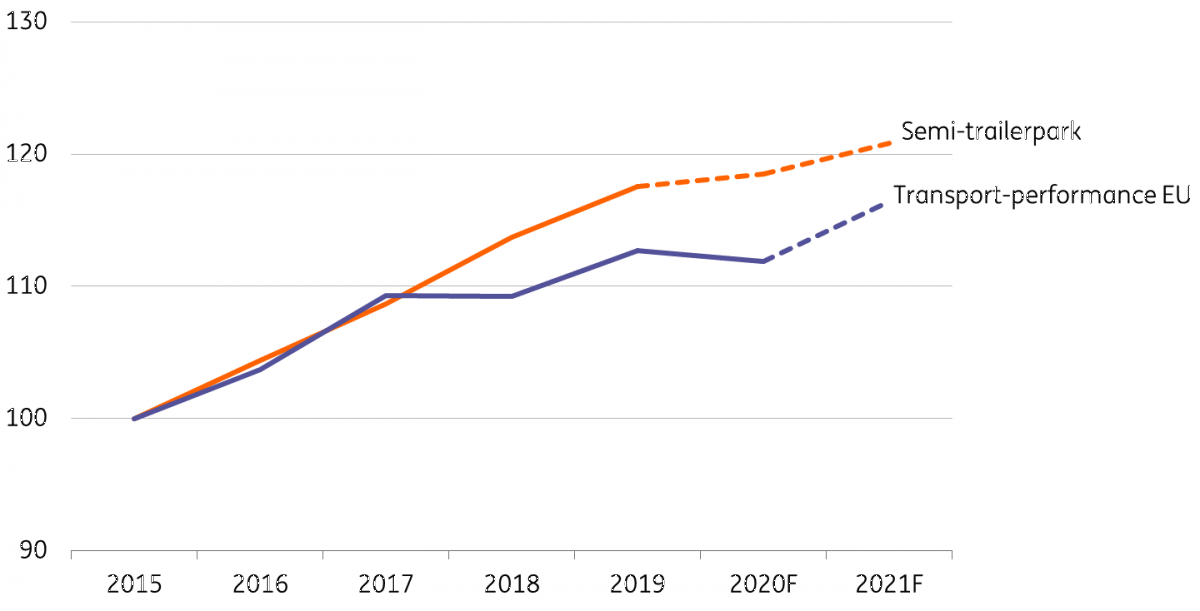

The European semi-trailer fleet has expanded only slightly in the past two years, but continues to grow and is now estimated at around three million. In contrast to the truck fleet, the trailer fleet has outpaced road transport activity over the last four years. New trailer inflow has also increasingly shifted from drawbars to the more flexible semi-trailers. The replacements of trailers can be postponed more easily than trucks, as new emission standards are making less of a difference and extra capacity entails few extra costs for fleet owners. Fleet owners increasingly choose to keep trailers in their fleets and also refurbish them more often if necessary.

European semi-trailer park expanded more than transport demand

Development of trailerpark vs. transport performance in ton/km (EU), index (2015 = 100)

But no excess capacity due to the increased need for flexibility

Despite the relatively strong growth of the semi-trailer fleet, there’s little evidence of large excess capacity. Rental companies also still reported high occupancy rates in the first half of 2022. A primary explanation is the higher volatility of road transport flows. Including timing preferences, this requires a higher extent of flexibility and spare capacity to meet peaks.

Offering flexible logistics solutions is an important reason why logistics service providers like DSV only operate trailer capacity, and this also explains the increased role of rental companies like TIP and PNO as capacity and flexibility providers. Trailer units are increasingly used as temporary storage objects in the logistics process. The driver shortage is an extra reason to leave more trailer units at docks to save on waiting times for drivers. The surge in e-commerce also pushed up transport and storage demand. For example, Amazon has started to build up its own European trailer fleet.

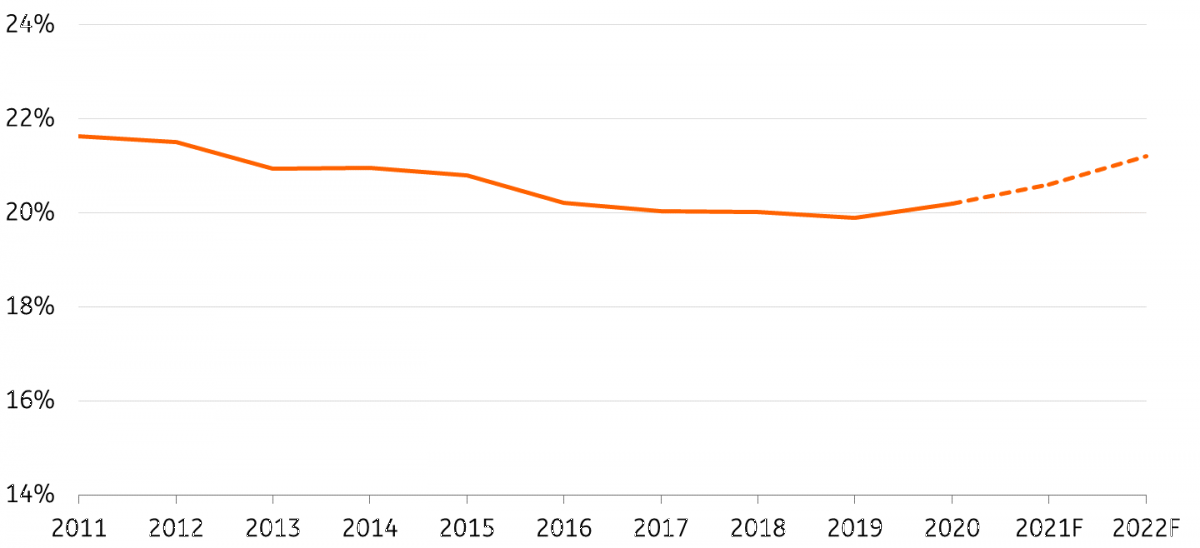

Empty vehicle kilometers in European road haulage on the rise again

Share of empty road freight transport vehicle km's in the EU-27

Inefficiency pushes usage, with a lack of trailers not capacity space

After years of gradual improvement, efficiency in European road transport has deteriorated in recent years, showing up in higher ‘empty running’. This explains why trailer capacity is still being felt as ‘tight’, while total capacity space should suffice. Uncertainty and unpredictability in current supply chains are one factor, and growing e-commerce volumes lead to smaller shipments and increased time pressure. On top of this, new regulation leads to higher trailer utilisation:

- Brexit: longer waiting times due to extra custom checks for attained or unattained shipments (of agricultural products) to and from the UK lead to longer turnaround times. Often journeys take one day longer.

- The European mobility package (which came into force in February 2022) is a new set of rules for the EU road transport sector. This requires the operator to ‘return home vehicle’ once every eight weeks, next to 'return home driver' which should occur once every four weeks. Return home vehicle in practice also holds for trailers registered in foreign European countries (for instance in the Netherlands for fiscal, insurance, and inspection purposes). Given the disbalance of freight traffic between East and West, this is expected to lead to more empty running, despite efforts to find a workaround.

The better utilisation of data in planning, cooperation, and the use of freight platforms offer opportunities to organise freight transport more efficiently, but in the meantime, inefficiencies benefit the trailer market.

Soaring commodity prices have pushed up prices for trailer manufacturers

Given their usage for chassis and bodies, high steel and aluminium prices have a big impact on trailer manufacturers. Due to the war in Ukraine, wood products – used in flooring – have become more expensive as well. New curtain siders have become some 25%-30% more expensive to order compared to pre-pandemic levels, and increases for other configurations are at similar levels. Like truck manufacturers, trailer builders struggle to manage price risks in the ordering process.

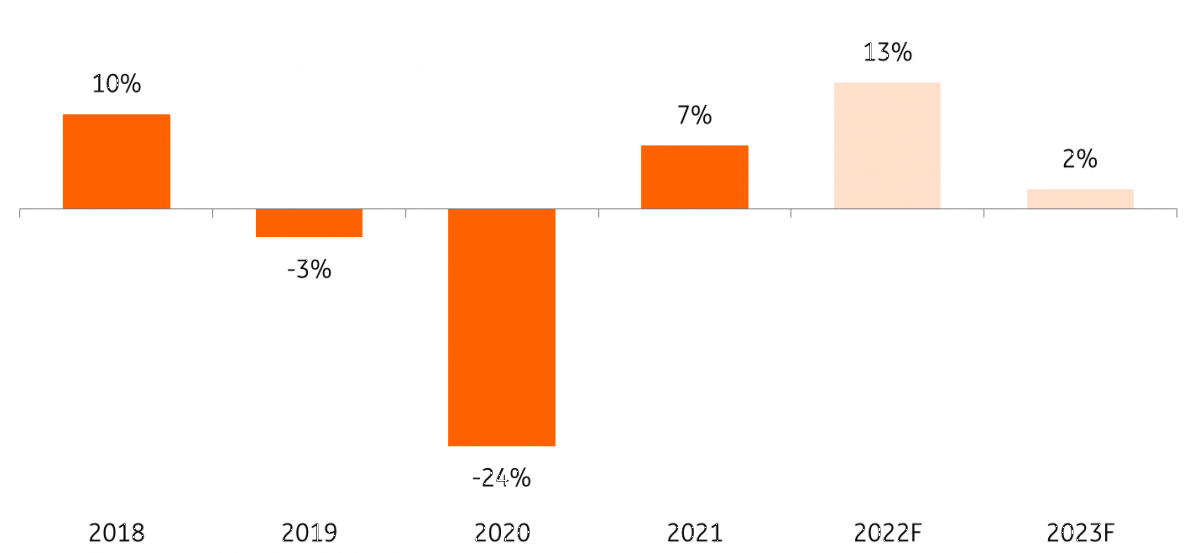

Curbed production slowed new trailer registration

Western European trailer registrations dropped some 25% in 2020 and recovered only moderately in 2021 to 90% of their pre-pandemic level. Although trailers are less electrified and digitalised than trucks, chips are still used in axis, lightning, cooling systems, and telematics, to name a few. Aside from this, manufacturers also faced shortages of components like EBS-modulators (brakes) and landing legs. This ended up in lead times running up to a year and thousands of semi-finished trailers parked at green fields outside the production sites of Krone and Schmitz. The release of Russian (and Ukrainian) production slots led to some acceleration in deliveries to other clients, but not much.

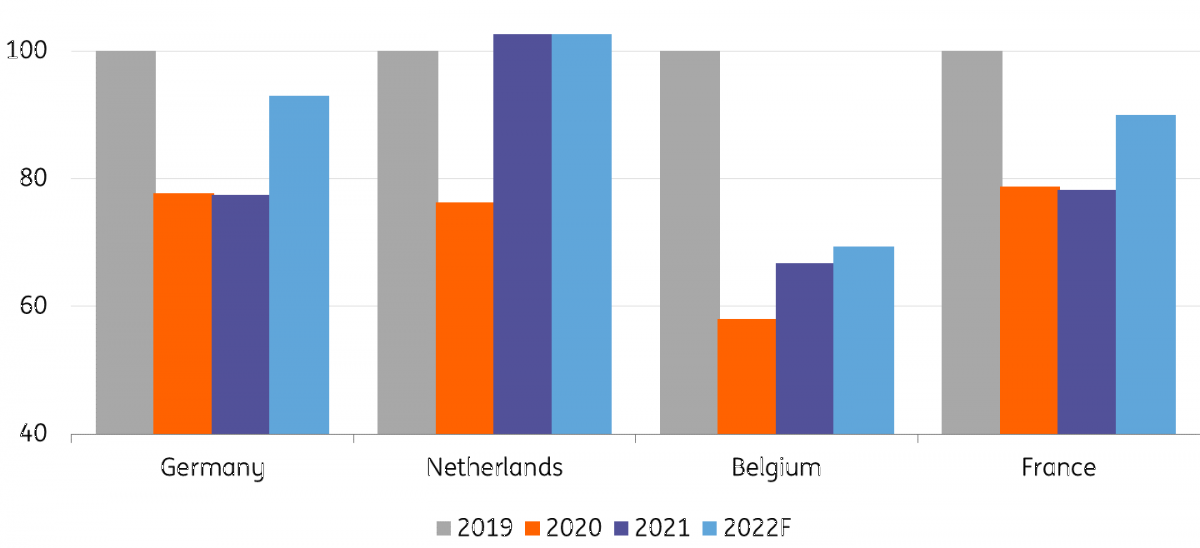

Trailer registrations still far from pre-pandemic levels in most countries

Development of new semi-trailer registrations (2019 = 100)

Germany and France lead the recovery in trailer registrations in 2022

The Netherlands was the only western European market where trailer registrations fully recovered in 2021, pushed by large deliveries. In Belgium, however, registrations still ended up a third below their previous level. In the first half of 2022, the largest western European markets showed significant recovery and France is also expected to see a rebound.

Stronger but no complete recovery for trailer registrations in 2022

Western European* registrations of semi-trailers y.o.y

Trailer registrations expected to show a continued recovery into 2023

Despite high utilisation rates and the continued investing of large fleet owners (like TIP for DHL), general order intake for new trailers is expected to slow down in the second half of 2022. Weaker transport volume perspectives and higher asset prices are the main causes. However, with existing order books taking us into 2023 we expect that new registrations in northwest Europe will show a recovery of more than 10% in 2022. This is based on the assumption that supply chain and production conditions will improve and at least part of the parked trailers can be finished and delivered. Depending on the uncertain economic reality going further into 2023, registrations could show a slight increase. Even in a scenario of a recession, the current market without large numbers of trailers build to stock is very different from the situation in 2009 when registrations faced a severe downturn.

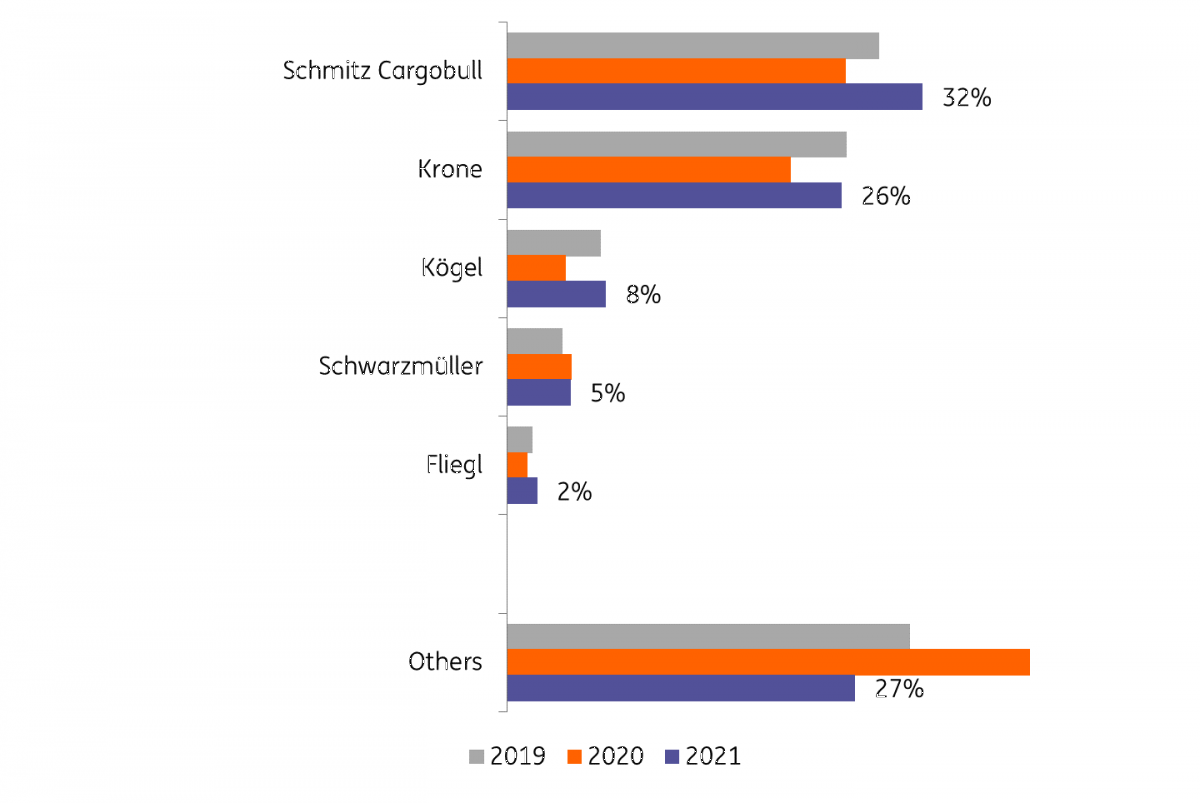

Schmitz, Krone and Kögel managed to increase deliveries and market share again in Europe's largest market

Market shares in new semi-trailer registrations in Germany

Market leaders Schmitz and Krone benefit from larger trailer output

Two-thirds of Europe’s largest semi-trailer market in Germany is covered by Schmitz, Krone and Kögel. Schmitz leads the market with a share of almost a third, followed by Krone (just over a quarter). Both gained market share in 2021, probably because they strongly rely on the production volume of more standardised trailers like curtain siders, box trailers and coolers. Manufacturers were able to gradually ramp up production figures and a.o. rental companies receiving a series of ordered standardised new trailers.

Schmitz and Krone also dominate the European markets. In some other countries like the Netherlands and Belgium, the positions of the two rivals are reversed. After a process of consolidation over the previous decade, the market shares of the dominant players seem to have reached their limits for now. This leaves a large part of the trailer market still fragmented with hundreds of smaller players offering a range of specialties like dry and liquid bulk trailers, low loaders (heavy-duty transport), and tailor-made products.

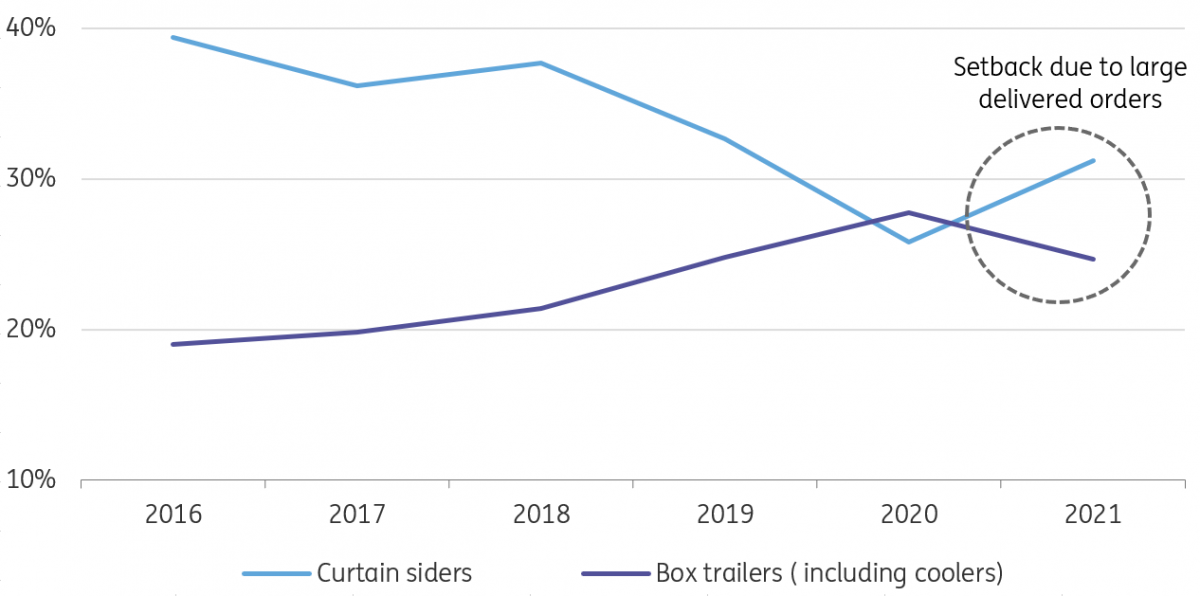

Structural shift in new trailer registrations to box trailers

Share of main semi trailer configurations in total registrations in Europe's largest market Germany

Shift from curtain siders to box trailers holds despite more expensive configuration

When looking at different types of trailers, there has been a recent shift in trailer registrations from curtain siders to box trailers for security reasons. The rise of e-commerce has also had an impact here. In 2021, the share of box trailers slid somewhat again whereas the curtain siders were revived. This is probably related to the delivery of large rental orders operating large numbers of these vehicles. In 2022, some pressure could remain on steel heavy box trailers because of high commodity prices. Fleet owners may have decided to refurbish trailers and postpone the replacement of these trailers. Nevertheless, we expect the share of box trailers to stay at higher levels than previously.

Download

Download article

1 July 2022

Extraordinary times for the European truck and trailer market This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more