Five reasons to stay long CAD

The Canadian dollar's rally may feel the kickback from re-escalating trade tensions, but the long-term outlook is still positive. We see high potential for the Loonie to keep outperforming its G10 peers in the coming quarters

A great first half for the loonie

At the time of writing, CAD is the best-performing currency in the G10 space since the start of the year (+4.09% vs USD to be precise).

We've recently revised our USD/CAD forecast profile lower and now expect 1.30 by the end of the year. Looking at the past six months, USD/CAD has been highly correlated with three market factors: crude oil prices, interest rate spreads and market risk sentiment. The shape of the yield curve and relative equities performance tend to show a less relevant correlation.

In the current market environment, the largest risk to an open economy like Canada and its currency are the ongoing trade tensions. The recently-agreed trade truce and the restart of negotiations for a deal between the US and China will probably keep market risk sentiment supported for some time. Although looking ahead, our trade team is reluctant to exclude a re-escalation of trade tensions, and we don't exclude the US imposing fresh tariffs on Chinese exports as early as in 3Q.

Some market attention will also be on the Canadian federal elections scheduled for October. The latest vote projections suggest the incumbent Liberal party is bound to face a defeat by Andrew Sheer’s Conservative party, but for the time being, we don't see a high market-moving potential to the elections.

We think there are at least five reasons which suggest positives will more than offset most trade-related downside risks and keep the Canadian dollar on an appreciating path.

Oil prices are likely to stay supported

Our commodities team expects the ongoing OPEC meeting – and the OPEC+ meeting tomorrow - to deliberate further supply tightening in the crude market.

Latest media reports indicate that members should all be in agreement to extend the current deal for 1.2MMbbls/d of output cuts. This would come as a positive at a time when oil prices have already found some support from US-Iran tensions and we expect WTI keep to edge above 60 $/bbl.

Nonetheless, the outlook for the regional benchmark Western Canada Select is slightly gloomier after reports that the Canadian state of Alberta is planning to increase its production limits. While this may translate into a partial re-widening of the Western Texas Intermediate and Western Canadian Select (WTI-WCS) spread, the very low correlation of the spread with USD/CAD performance tends to suggest the impact on the currency pair may be quite limited.

Inflation is strong, economy is set for a rebound

We believe a number of indicators likely back the constructive economic view expressed by the Bank of Canada in its latest statement.

-

Inflation in Canada is strong. The core measure has touched 2.3% in May - a 10-year high. The headline print also surprised to the upside at 2.4%. Both measures currently fall in the upper half of the BoC inflation-target band. Looking ahead, our economists expect inflation to stay broadly in line with the 2% median target at least until the end of 2020.

-

The labour market looks healthy: unemployment rate (5.8% in March) is close to historical lows, the participation rate has rebounded from late 2018 lows and wage growth (2.55% in May) has been quite robust.

-

Q1 subdued GDP numbers have been negatively affected by a widening trade deficit. A recovery in the deficit has already started to benefit GDP monthly reads (April YoY read at 1.5%), suggesting that the Canadian economy likely bottomed out in Q1. We currently forecast 1.5% growth in 3Q19 and 1.7% both in 4Q19 and 1Q20.

- A further boost to exports will likely come from the ratification of the USMCA trade deal, which seems to be close to being passed by the US Congress as Democrats’ oppositions have fanned.

The Fed will blink first, the BoC may not blink at all

The strong fundamentals listed above have been indeed acknowledged by Canada's central bank in its latest statement, as they reiterated an “accommodative” policy stance.

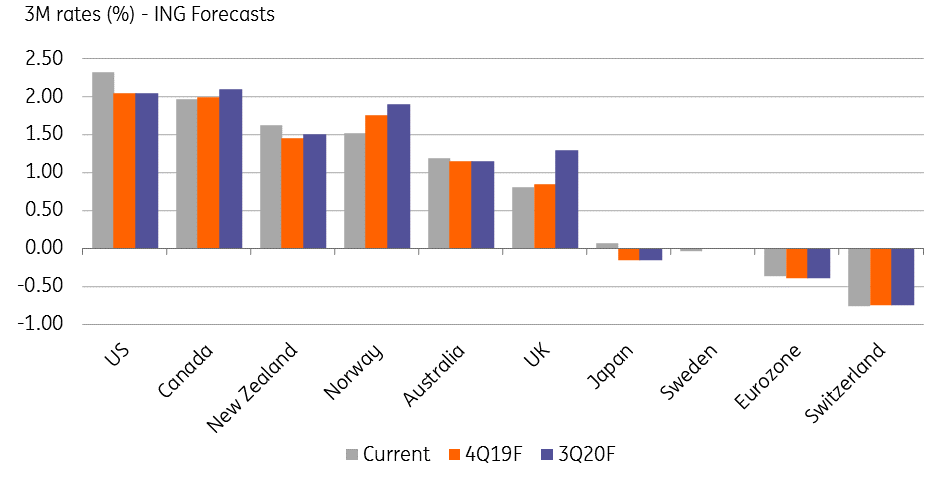

Accordingly, our economics team expects the BoC to keep rates on hold throughout 2019 and 2020. This is in contrast with markets expectations for some monetary easing ahead, with the OIS curve currently showing -25bp priced in by 2Q20. On the other side of the border, the Federal Reserve is facing increasing pressure to cut interest rates and our economists expect two rate cuts by the end of the year. Such policy divergence is likely to keep the US-Canada interest rate differential under pressure.

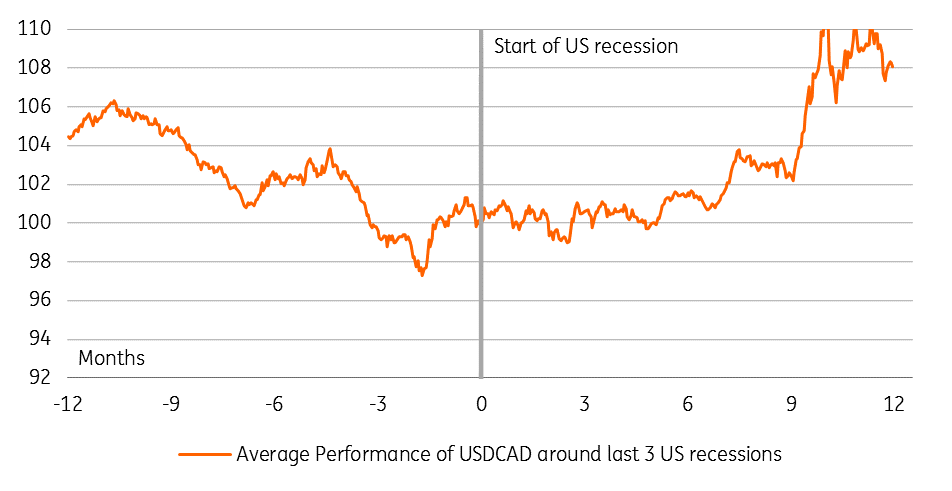

CAD has been historically strong before a US recession

From a different perspective, historical evidence from the three most recent US recessions suggests that the CAD has been amongst the best performers in the G10 space as USD weakened whilst approaching a US recession.

Looking ahead, investors may see in the loonie an interesting substitute to the US dollar to enter carry trades as the dollar rate advantage staggers. Indeed, CAD is currently the second-highest yielding currency (short-term rates) in the G10 space. According to our economists’ forecasts, Canada will have the highest 3-month yields in 3Q20. This would keep CAD supported as investors may rush to enter carry trade positions in the coming quarters before unwinding them as increased risk of a global economic downturn threatens their profitability.

CAD can still benefit from short positioning

Despite the recent bullish mood on the CAD, Commodity Futures Trading Commission (CFTC) data shows that combined net speculative position on the loonie is still in short territory (-9% of open interest). This tends to suggest that there is still some room for position-squaring-related downside risk in USD/CAD, especially when considering that positioning on USD is, on the opposite, still extensively long.

We see high potential for CAD to keep outperforming its G10 peers in the coming quarters. Nonetheless, the fall in USD/CAD may be contained around the 1.31-1.32 level until trade-tension-related downside risks dissipate. In the longer run we stick to our forecasts for 1.30 in 4Q19, 1.28 in 1Q20 and 1.26 in 2Q20.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

1 July 2019

In case you missed it: The land of lower rates This bundle contains 10 Articles