Finland regains competitiveness

The Finnish economy has made notable gains in competitiveness, but an appreciation of the euro and trade uncertainty could cloud the outlook for exports. In 2018, we expect it to grow faster than its peers

Why we're comfortable with our 2.6% GDP growth outlook for Finland

In line with the rest of the Eurozone, Finnish first-quarter GDP growth is likely to be somewhat weaker than the fourth quarter. The monthly trend indicator for output jumped in January but fell slightly in February. Survey indicators for March would suggest a further moderation of activity, which means that overall GDP growth for the quarter will likely be weaker than the 0.6% seen in the fourth quarter of last year.

In line with other Eurozone economies, April data has been a mixed bag so far. The declines in business sentiment seem to have halted. The Confederation of Finnish Industries reported a bounce back for manufacturing confidence, but confidence among service sector businesses and consumers deteriorated significantly last month.

So, the outlook for the Finnish economy remains healthy regardless of a slowdown in the first quarter of the year.

Exports boosted last year's growth, but 2018 is going to see a boost driven mainly by domestic demand. Employment growth accelerated to an exceptional pace at the end of 2017, and the unemployment rate suggests this trend continues in 2018, which is likely to support domestic demand and household consumption in particular.

The outlook for exports in 2018 is positive but if the euro strength holds, it could be weaker than expected

The economy continues to be helped by ample monetary support as the ECB is widely expected to keep its rates unchanged at least until mid-2019. Asset purchases are set to end sooner, but also here we expect that the ECB will continue QE after September given the weakness in the Eurozone inflation rate and modest expectations for the coming years.

The external picture provides some uncertainty as a stronger euro starts to bite and the possibility of a trade dispute escalating over the coming months. Still, the substantial improvements in exports of 2017 were mainly to the Eurozone and Sweden, which would not see much disruption from a looming trade war. Even though the downside risks have started to become more prominent again, we remain comfortable with our outlook of 2.6% GDP growth for Finland in 2018.

The austerity package has improved labour competitiveness

From a policy perspective, economic competitiveness has been a central theme over the past years.

An ambitious agreement called the “competitiveness pact”, which is essentially a tripartite labour market agreement was signed in June 2016. This included a wage freeze for 2017 with pay cuts in the public sector, an extension of working hours without pay and a transfer of benefits contributions. This austerity package has started to benefit the competitiveness of Finnish businesses.

Finland's competitiveness improves after the crisis

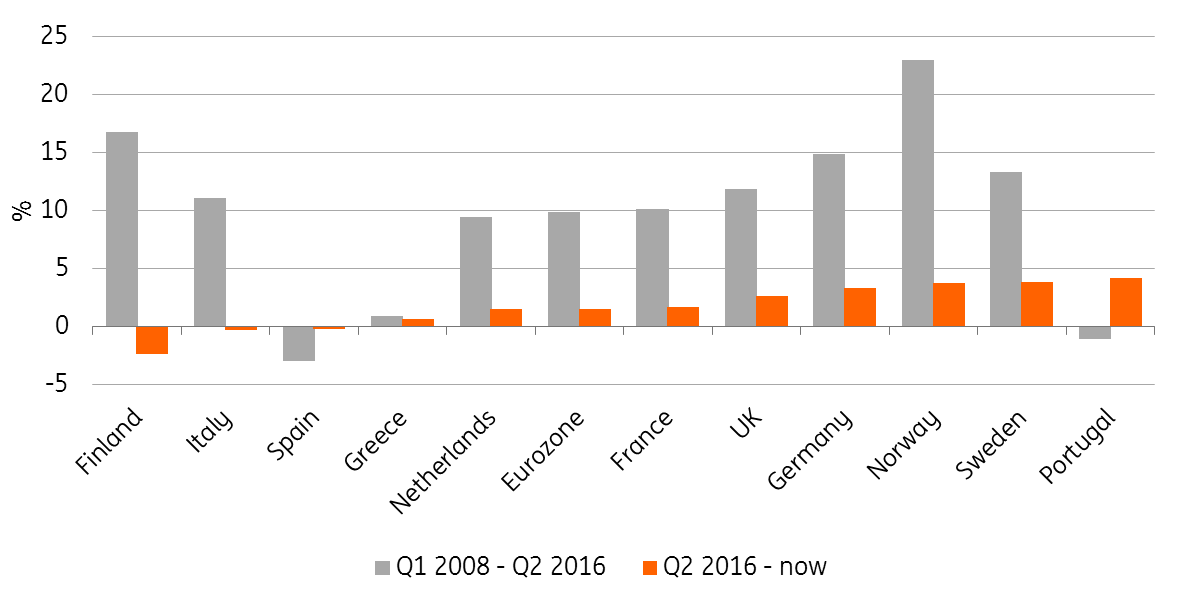

Unit labour cost growth

When looking at the broad changes in nominal unit labour costs (ULC) over the last eighteen months, Finland has outperformed its Eurozone peers and neighbours Sweden and Norway significantly.

This comes after a period of deteriorating competitiveness since the start of the crisis, in which Finland had the weakest performance of the larger Eurozone economies with an appreciation of 16% in ULC.

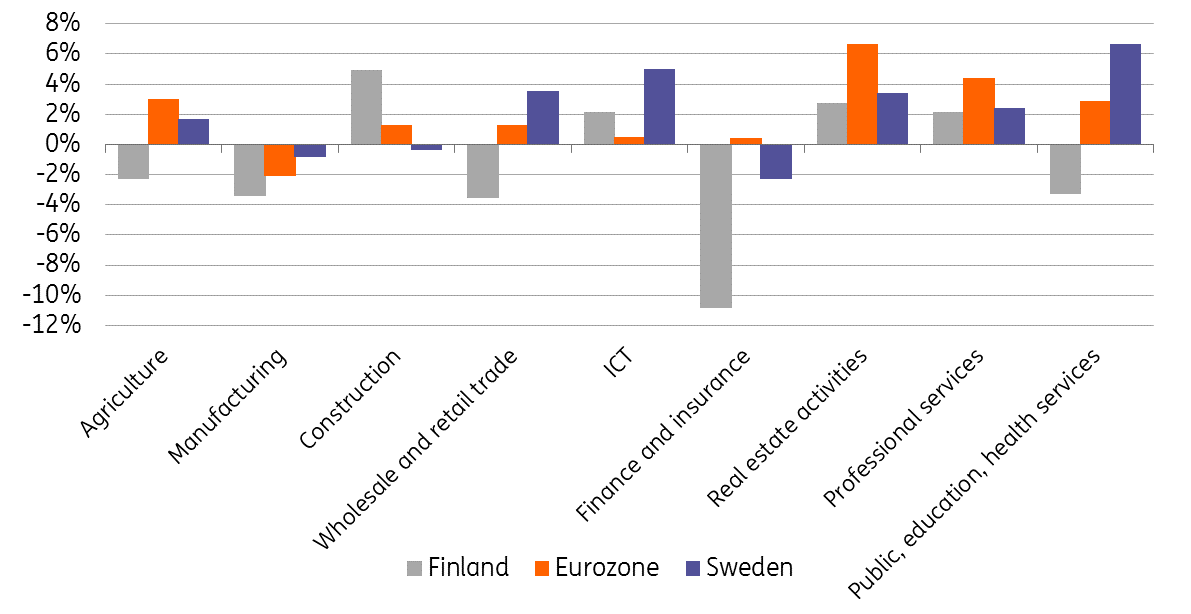

The improvements in unit labour cost are broad-based, but only five out of twelve industries have experienced increases. The sectors that have seen improvements are the ones with limited international exposure as they include construction, real estate and the arts sector. The manufacturing sector has seen significant improvements, both outright and relative compared to its major trading partners as seen below.

Most export-oriented industries have seen competitiveness gains

Therefore, the question is whether businesses have also started to notice the labour competitiveness improvement.

Survey data indicates Finnish businesses have not seen large improvements in competitiveness. A small majority of businesses note competitive gains within the EU in recent months, while this was quite a large group in the early months of 2017. The strengthening of the euro has been a negative factor for competitiveness outside of the EU, where Finnish businesses have noted a sharp deterioration over recent months. This means that ULC improvements have been cancelled out largely by the appreciation of the euro for markets outside of the EU.

The outlook for exports in 2018 is therefore moderately positive. If euro strength holds, it could be weaker than expected.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more