The US Fed’s expected to prolong the party with a cut this week

The US economy is experiencing its longest expansion on record, but weaker external demand and trade tensions are risks to the outlook. A benign inflation backdrop allows the Federal Reserve room to offer support and cut rates by 25bp next week

Slowdown signals

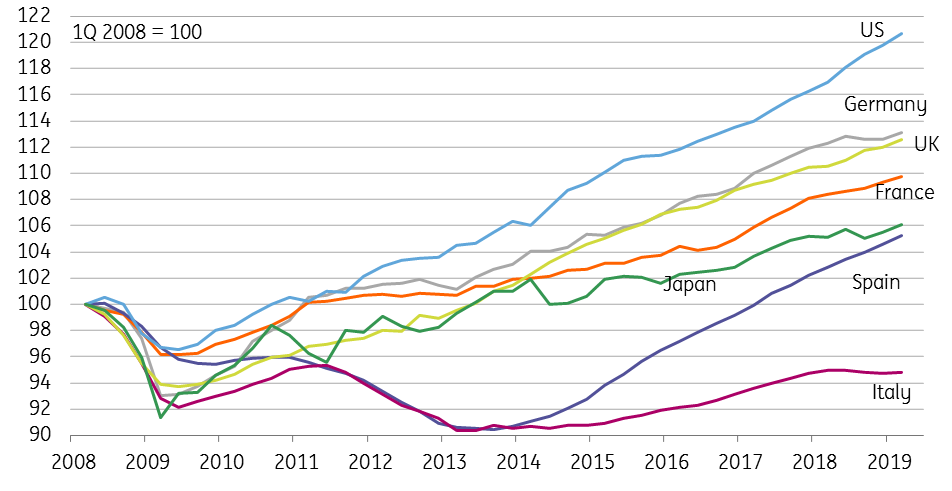

The US economy has performed solidly since the end of the financial crisis thanks to aggressive stimulus from a number of sources. The combination of a swift recapitalisation of the banking sector, interest rate cuts and quantitative easing allowed borrowing costs to fall sharply and credit to remain available. This helped to support asset prices while plunging interest rates also contributed to a weaker, more competitive dollar exchange rate. More recently, the US has experienced President Trump’s tax cuts, which have helped drive the US economy to new highs. In fact, the current expansion is the longest since the National Bureau for Economic Research's data records began back in 1854, with the US clearly outperfroming key trade partners as you can see in the chart below.

Level of real economic output versus 2008

However, a weaker global growth backdrop, as underlined by recent eurozone figures, and heightened trade tensions have started to weigh on US activity. Inventory and trade numbers have obviously been impacted, but as Fed Chair Jerome Powell noted in recent testimony, "growth in business investment seems to have slowed notably" as well.

President Trump, a vocal critic of the Federal Reserve, has demanded aggressive policy stimulus to support the US economy, but with the US consumer sector continuing to perform strongly, thanks to low unemployment and the combination of rising wages and asset prices, the Fed has been reluctant.

Prevention versus cure

That situation is now changing. After having raised interest rates in December, the language of officials has shifted significantly with Jerome Powell stating that “uncertainties around trade tensions and concerns about the strength of the global economy continue to weigh on the US economic outlook”. For now, there is a tentative truce with US-China trade talks resuming. Unfortunately, the two sides remain a long way apart on key issues so we can’t rule out the possibility that talks break up acrimoniously once again. Another round of tariff hikes would lead to a renewed bout of pessimism and contribute to more pronounced economic weakness by disrupting supply chains, putting up costs and hurting profit margins.

Such an environment would be negative for equity markets and make US businesses more reluctant to invest and hire new workers. Therefore it was interesting to hear Jerome Powell say in his latest testimony that “many FOMC participants saw that the case for a somewhat more accommodative monetary policy had strengthened”. He too appears to be backing the case by arguing “an ounce of prevention is worth more than a pound of cure”. This is a clear signal the Federal Reserve is set to ease monetary policy by cutting interest rates next week.

25bp or 50bp?

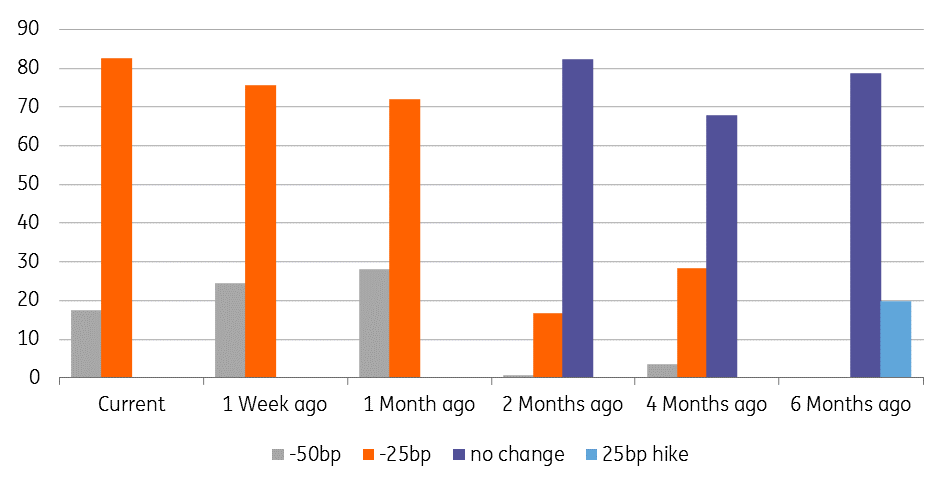

Several analysts have made the case for the Fed going early and aggressively to head off the risks to US growth with a 50bp move on 31 July. However, recent firm data has put pay to that view with the implied probability of such action drifting lower over the past couple of weeks. St Louis Fed President James Bullard, who is perceived to be one of the most dovish members of the FOMC having voted for a rate cut in June, has also downplayed that prospect. He said last Friday that “I’d like to go 25bp at the upcoming meeting”. Moreover, we have to remember that at the June FOMC meeting, the median forecast of FOMC members had no rate cuts for this year and only one for next. The newsflow hasn't deteriorated over the intervening period, so based on this we expect just a precautionary 25bp rate cut next Wednesday.

Implied probability of different scenarios for July 31st FOMC meeting

Insurance action

Our view is that we are seeing merely some insurance policy easing, similar to the Fed’s response to the 1995-96 and 1998 slowdown fears, is given credence by the Fed’s assurance that “our baseline outlook is for economic growth to remain solid, labour markets to stay strong and inflation to move back up overtime” to 2%. Indeed, the recent improvement in manufacturing surveys coupled with the very strong numbers coming from the household sector suggests economic fundamentals are broadly in decent shape.

We don't believe the Fed is seriously contemplating the 100bp of rate cuts that markets are currently expecting by the end of 2020

At this stage, we don't believe the Fed is seriously contemplating the 100bp of rate cuts that markets are currently expecting by the end of 2020. We would argue there isn't a great deal domestic interest rate cuts can do to mitigate against external threats, such as trade wars and weaker European growth, other than perhaps limit the upside for the US dollar. After all, mortgage rates have already fallen 100bp since November and debt servicing costs are historically at very low levels while external trade only accounts for around 10% of US economic activity versus more than 20% in China and 30% in Europe.

It’s all in President Trump’s hands

But also like 1995-96 and 1998, we suspect the Fed will not implement just one cut. Instead, they will likely follow up with a further 25bp interest rate cut in September. After that, it is down to the big unknown of what happens with trade policy, and that is something that is very firmly in President Trump’s hands.

Should tensions escalate, markets sell-off and economic weakness spreads then the Federal Reserve will respond with more stimulus given the benign inflation backdrop. However, our trade team takes the view that the fear of economic weakness for both sides will lead to China and the US finalising a deal later this year, even if it doesn’t necessarily achieve all of President Trump’s initial demands. After all, President Trump wants to go into next year’s election with the economy in the best shape possible. A positive boost to sentiment from a trade deal would help his re-election chances and would clearly reduce the need for any additional Fed policy easing.

Download

Download article26 July 2019

In case you missed it: Worse and worse This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more